Introduction:

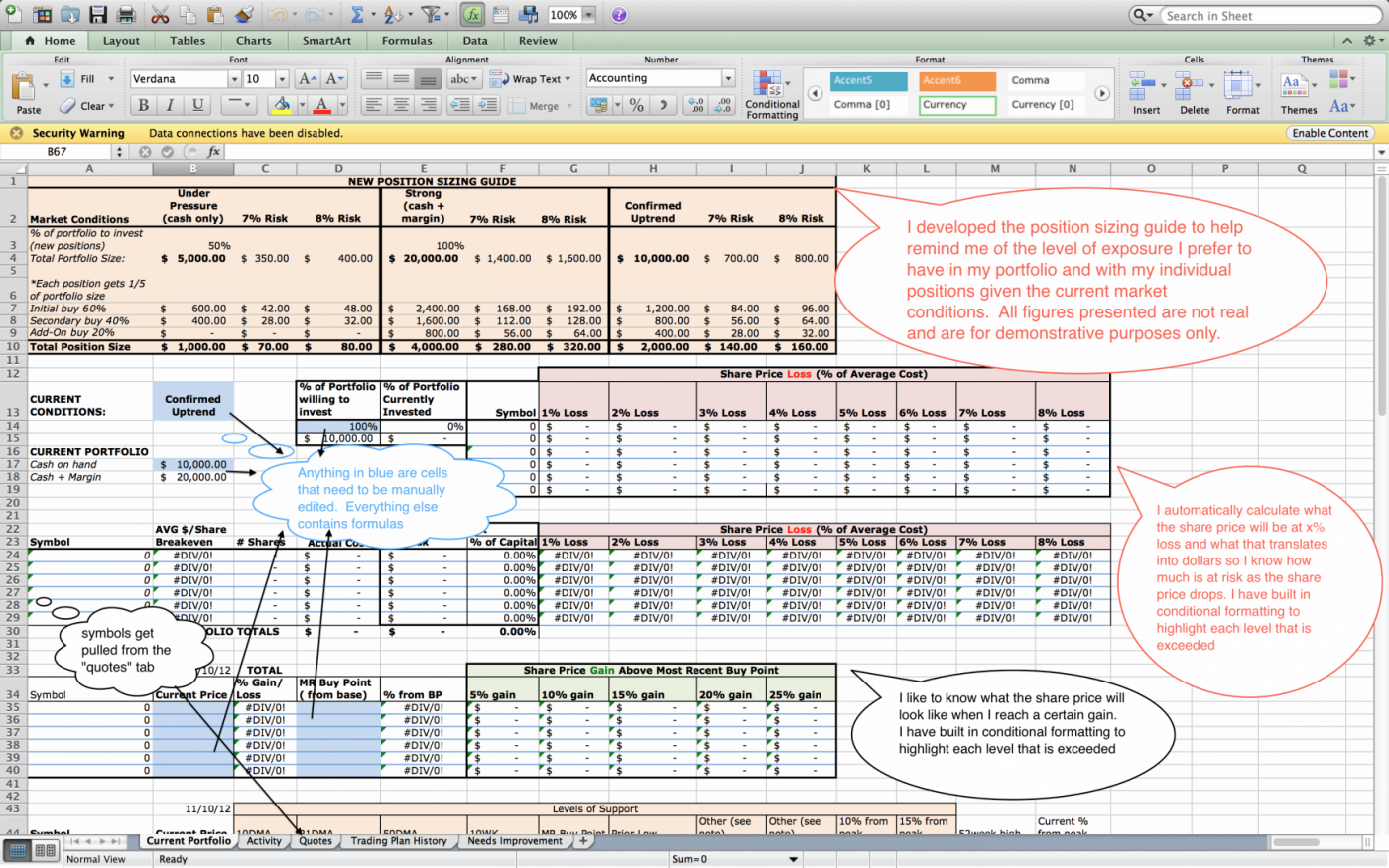

Image: db-excel.com

Options trading involves complex strategies and myriad variables, making it imperative for traders to diligently track their trades. A meticulously designed options trading log spreadsheet template can serve as an invaluable tool to streamline this process and enhance your trading performance. This article delves into the significance and intricacies of using an options trading log spreadsheet template, providing a comprehensive guide to maximize its potential.

Understanding Options Trading Log Spreadsheets:

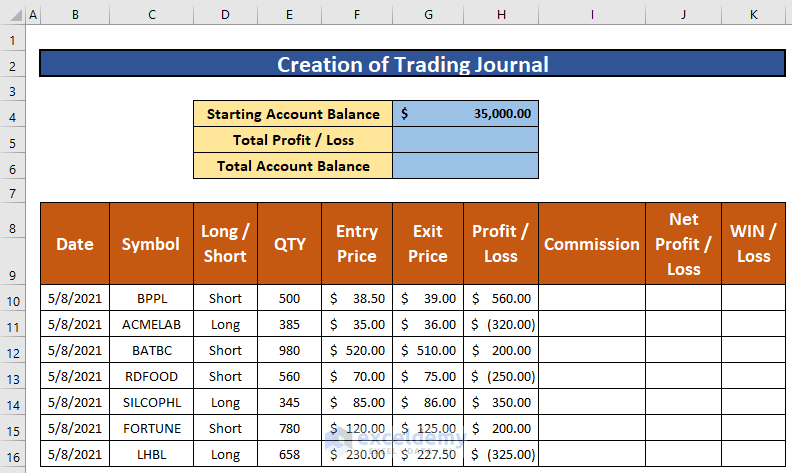

An options trading log spreadsheet is a customizable template that allows traders to meticulously record and evaluate every detail of their trades. It typically encompasses columns for key information such as the underlying asset, option type, expiration date, strike price, premium paid, and profit/loss. By capturing this crucial data, traders can gain valuable insights into their trading strategies and identify areas for improvement.

Benefits of Using an Options Trading Log Spreadsheet:

- Organized Record-Keeping: A spreadsheet consolidates all your trades in one central location, ensuring that crucial information is accessible and well-organized.

- Real-Time Monitoring: The ability to constantly track your trades empowers you to make informed decisions based on up-to-date performance data.

- Enhanced Accountability: Meticulously recording every transaction increases accountability and reduces the likelihood of careless trading mistakes.

- Pattern Recognition: By analyzing historical data, you can identify recurring patterns and trends in your trading behavior, ultimately leading to more informed choices.

- Tax Reporting: A well-maintained log is indispensable during tax season, providing a comprehensive record of capital gains and losses for accurate reporting.

Creating and Using an Options Trading Log Spreadsheet:

Creating an options trading log spreadsheet is relatively straightforward, but customized adjustments may be necessary to align with your specific trading strategies. The following steps provide a general guide:

- Select a Spreadsheet Software: Choose a spreadsheet software that meets your needs, such as Microsoft Excel or Google Sheets.

- Set Up the Basic Structure: Start by creating columns for essential details like trade date, underlying asset, option type, and strike price.

- Customize for Metrics: Add additional columns to capture metrics that align with your trading strategies, such as premium paid, profit/loss, and notes.

- Populate the Log: Diligently input data for each trade immediately after execution to maintain an accurate and up-to-date record.

- Regular Review: Schedule periodic reviews to analyze your performance, identify patterns, and refine your trading approach.

Conclusion:

Utilizing an options trading log spreadsheet template can revolutionize your trading experience. By providing a consolidated platform for tracking and monitoring your trades, it empowers you with valuable insights that can enhance your decision-making and optimize your performance. Embrace the benefits of this indispensable tool to stay organized, make informed choices, and elevate your options trading journey.

Image: www.pinterest.com

Options Trading Log Spreadsheet Template

Image: peacecommission.kdsg.gov.ng