Trading Natural Gas Cash Futures, Options and Swaps: A Comprehensive Guide

The allure of the natural gas market has gripped the imagination of traders around the world. Yet, to unravel its true potential, a thorough understanding of the diverse array of trading instruments is paramount. In this article, we embark on an in-depth exploration of natural gas cash futures, options, and swaps, empowering you with the knowledge to conquer this dynamic energy market.

Image: www.coursehero.com

Cash Futures: The Bedrock of Natural Gas Trading

Cash futures, the foundation of natural gas trading, represent contracts that obligate buyers to purchase a predetermined volume of gas at a specified price on a future date. Their primary function lies in hedging against price fluctuations, ensuring stability amidst the inherent volatility of the market. As the most commonly traded instrument, cash futures offer unparalleled liquidity, enabling traders to effortlessly enter and exit positions in response to market shifts.

The essence of cash futures contract pricing resides in the vivid depiction of the physical gas market’s supply and demand dynamics. Buyers who anticipate escalating prices may procure futures contracts to secure a favorable price, safeguarding against future increases. Conversely, sellers who foresee a downward trajectory can utilize futures contracts to lock in current prices, mitigating the risks associated with potential price declines.

Understanding Options: Flexibility in Natural Gas Trading

In the realm of natural gas trading, options offer a valuable tool for astute investors seeking to navigate market uncertainties. These versatile contracts bestow upon holders the right, but not the obligation, to buy or sell a specific quantity of gas at a predetermined price on a particular date. Unlike futures contracts, options confer the privilege of choice, allowing traders to exploit favorable price movements while mitigating downside risks.

Call options empower traders to capitalize on anticipated price surges. By purchasing a call option, the trader gains the right to buy gas at a fixed price, regardless of the prevailing market price. This strategy shields against potential price spikes, ensuring a profitable outcome when prices rise. Conversely, put options provide a safety net against price downturns. By acquiring a put option, the trader secures the right to sell gas at a specified price, mitigating the losses incurred if the market takes an unfavorable turn.

Swaps: Unraveling the Complexities of Risk Management

In the intricate web of natural gas trading, swaps emerge as a sophisticated instrument tailored for managing price risk and optimizing portfolio performance. Unlike futures and options, swaps entail customized contracts between two parties, each agreeing to exchange cash flows based on a predetermined formula. This flexibility allows traders to tailor swaps to their specific risk profiles and investment strategies.

The versatility of swaps extends to various applications. Interest rate swaps, for instance, enable traders to mitigate the impact of fluctuating interest rates on their cash flows. Currency swaps, on the other hand, provide a hedge against currency exchange rate risks. By engaging in swaps, traders can effectively transfer risk, enhance portfolio diversification, and potentially generate additional income streams.

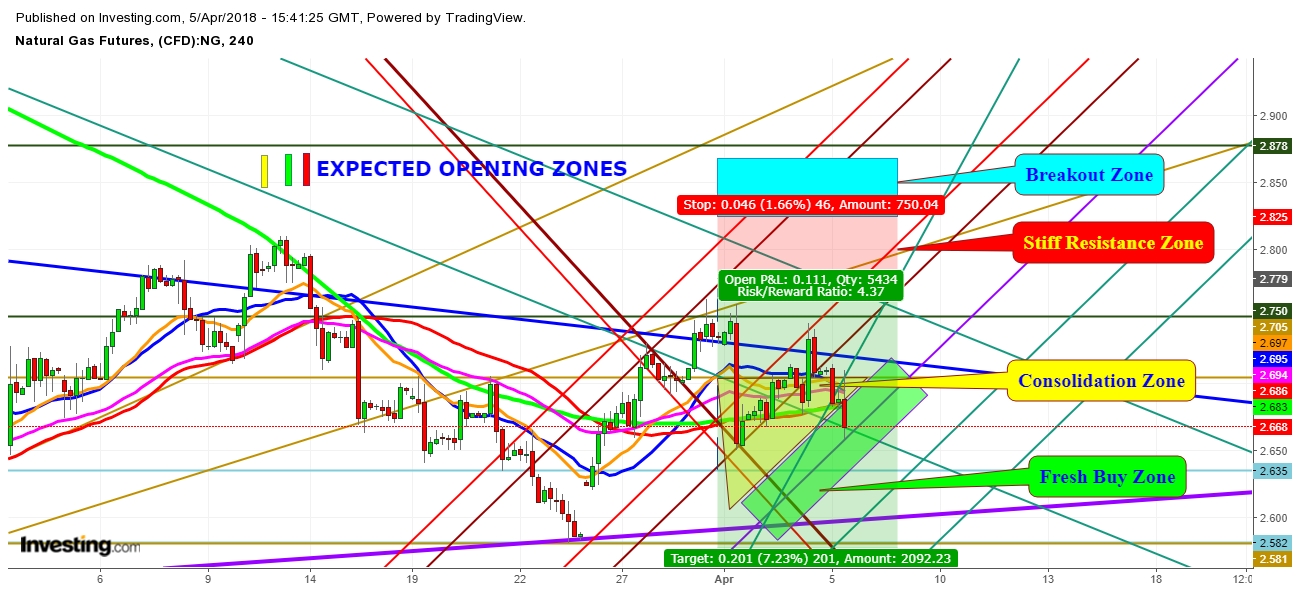

Image: www.investing.com

Industry Insights: The Future of Natural Gas Trading

The natural gas market is poised for transformative shifts in the years to come. The global transition towards cleaner energy sources has propelled natural gas into the spotlight as a key transitional fuel. The increasing adoption of natural gas in power generation, transportation, and industrial applications bodes well for the industry’s long-term prospects.

Technological advancements are also reshaping the natural gas landscape. The advent of liquefied natural gas (LNG) has facilitated the global transportation of gas, expanding market reach and fostering international trade. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms is enhancing trading strategies, improving risk management, and unlocking new opportunities for market participants.

Expert Advice for Navigating the Natural Gas Market

- Stay informed: Keep abreast of industry news, updates, and market trends to make informed trading decisions.

- Choose your strategy wisely: Tailor your trading approach to your individual risk tolerance and investment goals.

- Manage risk prudently: Implement stop-loss orders and hedging strategies to mitigate potential losses.

- Seek expert guidance: Consult with reputable brokers or financial advisors to gain valuable insights and market guidance.

Heeding these expert tips will provide you with a firm foundation for navigating the intricacies of natural gas trading.

Frequently Asked Questions: Demystifying Natural Gas Trading

Q: What is the difference between the Henry Hub and New York Mercantile Exchange (NYMEX) gas prices?

A: The Henry Hub is a physical delivery point for natural gas in Louisiana, serving as the benchmark for cash gas prices. NYMEX gas prices, on the other hand, are futures prices traded on the exchange, reflecting expectations of future cash prices.

Q: How do I determine the value of a natural gas option?

A: The value of an option is influenced by several factors, including the underlying gas price, time to expiration, volatility, and interest rates. Option pricing models, such as the Black-Scholes model, can help traders assess the fair value of options.

Q: What is the difference between a futures contract and a swap?

A: Futures contracts are standardized agreements traded on exchanges, obligating buyers to purchase or sellers to deliver a specified quantity of gas on a future date. Swaps, on the other hand, are customized contracts between two parties, allowing for greater flexibility in terms of contract size, pricing, and settlement terms.

Trading Natural Gas Cash Futures Options And Swaps

Conclusion: Embracing the Opportunities of Natural Gas Trading

Trading natural gas cash futures, options, and swaps presents a dynamic and rewarding opportunity for investors who seek to capitalize on the unique characteristics of this energy commodity. By comprehending the nuances of these instruments, harnessing the latest industry insights, and adhering to expert advice, you can unlock the potential of the natural gas market, making informed decisions and navigating its complexities with confidence.

Are you interested in exploring the realm of natural gas trading further? Engage with reputable brokers, connect with industry experts, and immerse yourself in the wealth of resources available to empower your trading journey.