Trading Natural Gas Cash Futures, Options and Swaps: An Exhaustive PDF Guide

SEO Title: Unlock the Power of Natural Gas Trading with this Comprehensive PDF

Trending Headline: Become a Natural Gas Trading Guru with our Exclusive PDF Toolkit

Introduction

In the global energy landscape, natural gas has emerged as a crucial commodity, powering industries, generating electricity, and heating homes. Navigating the complexities of natural gas trading requires a thorough understanding of various instruments, including cash futures, options, and swaps. This comprehensive PDF guide will delve into these concepts, providing traders with a roadmap to enhance their trading strategies.

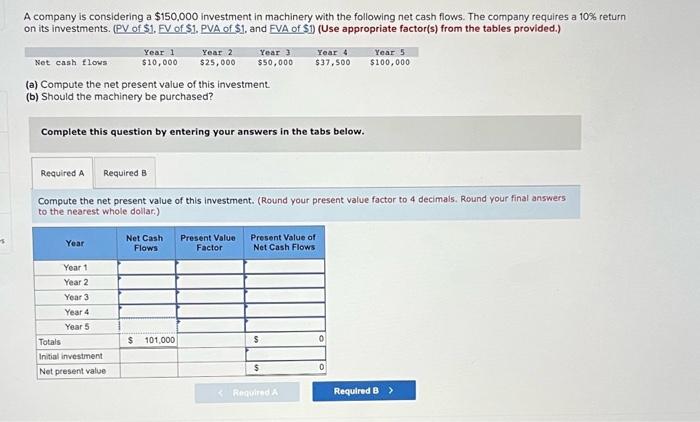

Image: www.chegg.com

Understanding Natural Gas Futures

Natural gas futures are standardized contracts that obligate the seller to deliver a specified quantity of natural gas at a predetermined price on a future date. These contracts trade on exchanges such as the New York Mercantile Exchange (NYMEX). Futures provide a way for buyers and sellers to lock in future prices, mitigating price risk.

Cash Futures vs. Physically Delivered Futures

Cash futures are futures contracts that settle in cash, rather than requiring physical delivery of the underlying gas. Physically delivered futures, on the other hand, require the actual exchange of gas. Cash futures offer greater flexibility and lower transaction costs, making them the preferred choice for many traders.

Trading Natural Gas Options

Natural gas options are contracts that give the buyer the right, but not the obligation, to buy or sell a specified quantity of natural gas at a set price on or before a certain date. There are two main types of options: calls and puts. Calls give the buyer the right to buy, while puts give the buyer the right to sell.

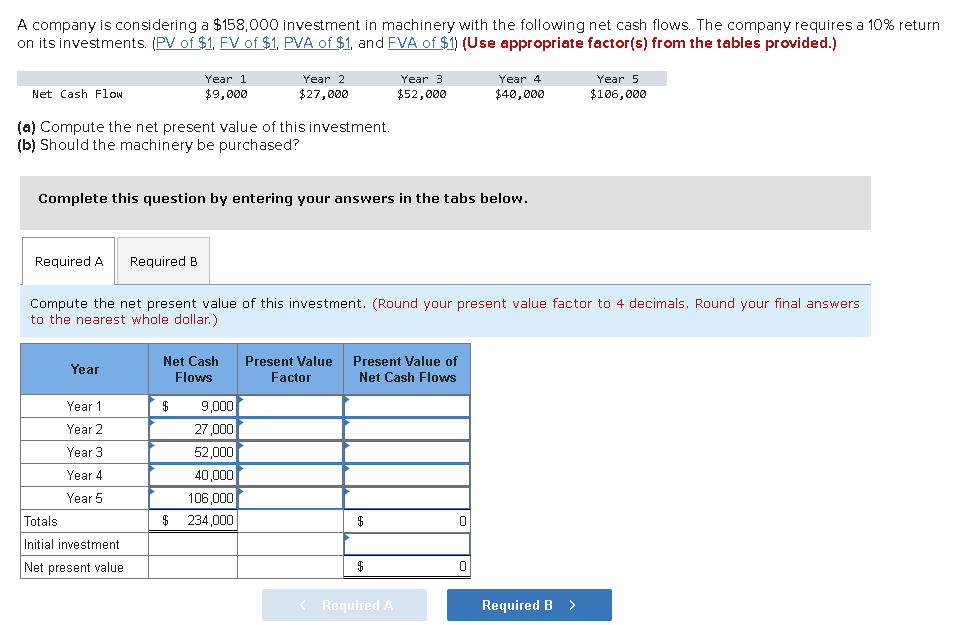

Image: www.chegg.com

Understanding Natural Gas Swaps

Natural gas swaps are over-the-counter (OTC) derivatives that allow parties to exchange future cash flows based on a specified quantity of gas. Swaps provide a flexible tool for managing risk and optimizing portfolio returns. There are various types of swaps, including basis swaps, calendar swaps, and price swaps.

Real-World Applications

Natural gas futures, options, and swaps play a vital role in the natural gas industry. They allow producers, consumers, and traders to manage price risk, secure supplies, and optimize their positions. These instruments are essential for creating a liquid and efficient market.

Recent Trends and Developments

Recent years have witnessed advancements in natural gas trading technology. Electronic trading platforms have streamlined the execution process, improving efficiency and reducing costs. Additionally, the emergence of natural gas exchange-traded funds (ETFs) has made it easier for investors to gain exposure to the market.

Trading Natural Gas Cash Futures Options And Swaps Pdf Download

![Read [PDF] Trading Natural Gas: Cash Futures Options & Swaps](https://www.yumpu.com/en/image/facebook/64232755.jpg)

Image: www.yumpu.com

Conclusion

This comprehensive PDF guide has provided an in-depth overview of natural gas cash futures, options, and swaps. By leveraging these instruments effectively, traders can enhance their trading strategies, mitigate risks, and capture opportunities in the dynamic natural gas market. This guide will empower readers with the knowledge and tools necessary to navigate the complexities of natural gas trading.