A High-Velocity Approach to Profiting from Market Inefficiencies

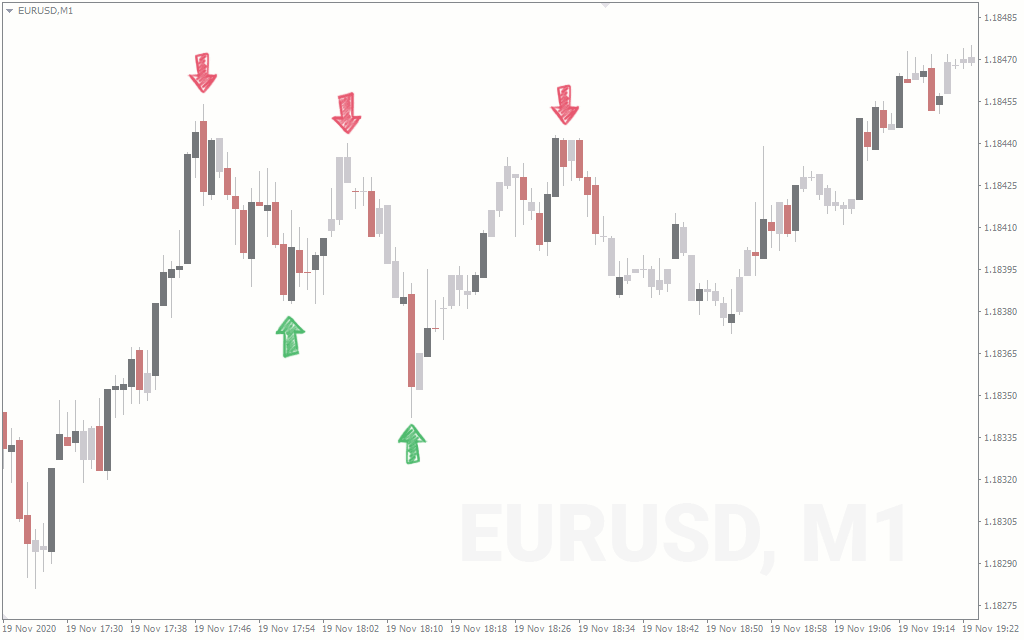

Scalping is a dynamic trading strategy commonly employed in option trading, aimed at exploiting fleeting market inefficiencies for quick and often substantial profits. This fast-paced approach involves executing a series of short-term trades within minutes or even seconds, aiming to capitalize on price fluctuations before they reverse.

Image: www.youtube.com

Scalping bears a unique allure in the complex and ever-shifting world of option trading. Its core appeal lies in its potential for frequent profits and requires a high degree of technical skill, real-time market analysis, and a disciplined trading mindset to navigate its inherent risks and challenges.

Anatomy of a Scalping Strategy

Understanding the anatomy of a successful scalping strategy is akin to deciphering a roadmap to navigating the labyrinthine markets. At its core, scalpers leverage a combination of technical analysis and real-time market data, employing strategies like trend following, support and resistance identification, breakout trading, and volatility measurement.

Scalpers operate within short time frames, often holding positions for mere minutes or just seconds before exiting. This rapid trading cadence requires lightning-fast execution capabilities, demanding a seamless connection to real-time market feeds. To succeed, scalpers astutely monitor market behavior, actively adjusting their trading strategies based on evolving conditions.

Risk Management in Scalping

Managing risk remains paramount in the high-velocity realm of scalping. While the potential for profits may beckon seductively, recognizing the inherent risks is non-negotiable. The market has a mind of its own, and even seasoned scalpers can face sudden price reversals that challenge their positions.

To mitigate these risks, scalpers employ strict position-sizing guidelines, ensuring that a single losing trade does not jeopardize the overall health of their trading portfolio. Additionally, stop-loss orders should be considered an indispensable tool, strategically placed to limit potential losses and preserve capital.

Disciplined Mindset and Execution

A disciplined mindset and unwavering adherence to trading rules serve as the cornerstone of a successful scalping journey. The thrill of rapid-fire trades can be exhilarating, yet it must not compromise sound judgment or cloud one’s trading plan.

Scalping is a demanding endeavor, requiring focus, patience, and the ability to withstand psychological pressures. Traders must remain calm under pressure, adeptly making critical decisions in the face of rapidly changing market conditions.

Image: fxssi.com

Technological Advancements in Scalping

In recent years, technological advancements have revolutionized the scalping landscape. The proliferation of high-speed trading platforms, sophisticated trading algorithms, and vast data analysis tools has empowered scalpers with an unprecedented level of precision and efficiency.

These tools allow scalpers to analyze vast amounts of market data in real-time, pinpointing potential trading opportunities and executing trades with remarkable speed. However, it remains crucial not to let the allure of technology overshadow the importance of sound trading principles.

What Is Scalping In Option Trading

Conclusion

Scalping in option trading presents a tantalizing path to profitability, yet it demands a profound understanding of the markets, lightning-fast execution capabilities, and an unwavering commitment to risk management. This high-velocity trading strategy, while alluring, is not suited for the faint of heart or those seeking quick riches without the commensurate effort.

For those with the necessary aptitude, the discipline, and a robust grasp of technical analysis, scalping can unlock a world of opportunity. It is a challenging yet rewarding endeavor that can yield tangible profits for those who master its intricacies. As with any endeavor worth pursuing, patience, perseverance, and a commitment to continuous learning can ascend traders towards the peak of scalping success.