Introduction

Image: www.chegg.com

The energy sector is a cornerstone of modern society, providing the fuel for our transportation, heating, and electricity needs. Natural gas, as a clean-burning and versatile energy source, plays a crucial role in meeting these demands. Trading in natural gas futures, options, and swaps has emerged as a sophisticated financial instrument that allows market participants to mitigate risk, enhance returns, and gain exposure to the price movements of this vital commodity. This article delves into the intricacies of natural gas trading, providing a comprehensive guide to its multifaceted aspects.

Exploring the Fundamentals of Natural Gas Trading

Natural gas futures are standardized contracts traded on futures exchanges that obligate the buyer to purchase and the seller to deliver a specific quantity of natural gas at a predetermined price on a specified future date. Options, on the other hand, provide the right but not the obligation to buy or sell natural gas at a set price until a certain time. Swaps, in contrast, are customizable agreements between two parties where they exchange cash flows based on the difference between an agreed-upon price and the market price of natural gas.

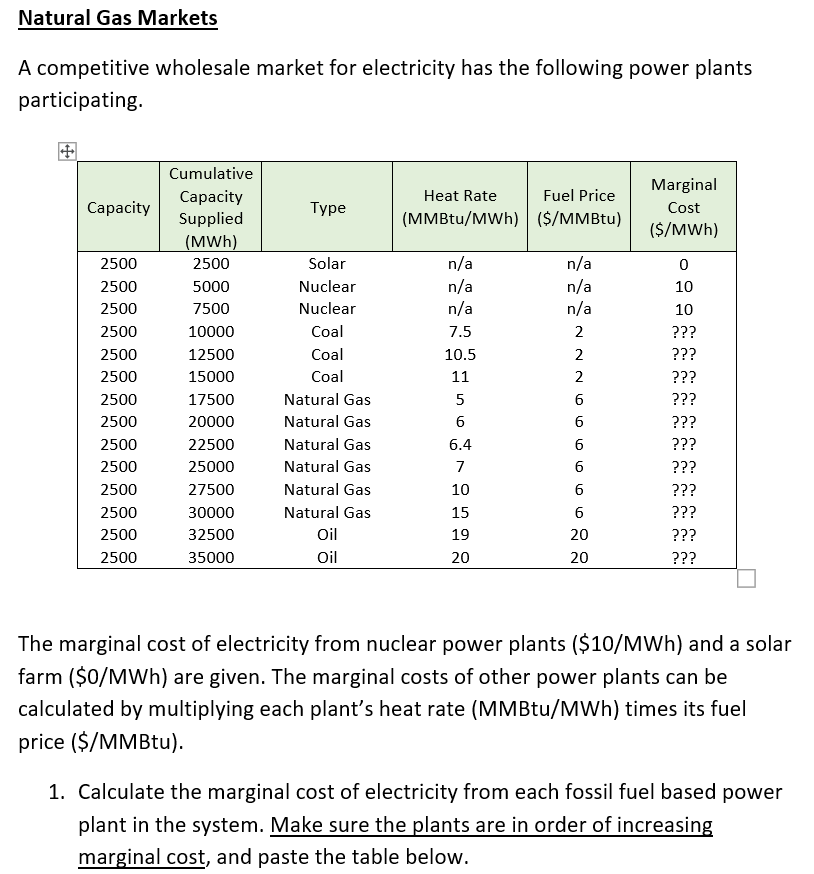

Understanding the roles of producers, distributors, and consumers in the natural gas supply chain is essential in grasping the dynamics of this market. Producers extract and process natural gas, while distributors transport it through pipelines to various end-users, including industrial consumers, power plants, and residential households.

Market Dynamics and Risk Management

The natural gas market is subject to a range of factors that influence price fluctuations, including weather patterns, geopolitical events, and economic conditions. Traders must navigate these complexities by utilizing sophisticated risk management strategies. Futures and options contracts provide built-in hedging mechanisms, allowing market participants to safeguard against unfavorable price movements.

The Benefits of Trading Natural Gas Futures, Options, and Swaps

Trading natural gas derivatives offers an array of benefits for various market participants. Speculators seek to profit from price fluctuations, while producers and distributors use futures and options to manage price risk. Traders can also leverage the tax advantages associated with trading natural gas futures.

Practical Applications and Real-World Examples

To illustrate the practical applications of natural gas trading, let’s consider a scenario where a utility company anticipates increased consumer demand during an impending winter. To mitigate the risk of price increases, the company enters into a futures contract to purchase natural gas at a fixed price in the months leading up to the peak demand period. Conversely, a producer facing the prospect of oversupply can utilize options to lock in a favorable price for future sales.

Expert Insights and Actionable Tips

Seasoned veterans of the natural gas trading arena offer valuable insights to enhance your strategy. They emphasize the importance of understanding the underlying market fundamentals, staying abreast of industry developments, and managing risk prudently. Additionally, they advise traders to tailor their trading approach to their individual risk appetite and market expertise.

Conclusion

Trading natural gas futures, options, and swaps is a dynamic and challenging endeavor that offers both potential rewards and risks. By gaining a thorough understanding of the market fundamentals, mastering risk management techniques, and leveraging expert insights, participants can navigate the complexities of this sophisticated financial instrument and unlock its potential to mitigate risk, maximize returns, and participate in the ever-evolving energy landscape.

Image: www.chegg.com

Trading Natural Gas Cash Futures Options And Swaps Pdf