Imagine a world where you can harness the power of natural gas markets to potentially increase your wealth. Trading natural gas cash futures, options, and swaps offers that opportunity, but it’s not without its complexities. That’s why we’ve crafted this comprehensive guide to empower you with the knowledge and confidence to navigate these markets successfully.

Image: www.moneygrows.net

Trading Natural Gas Cash Futures, Options, and Swaps: An Overview

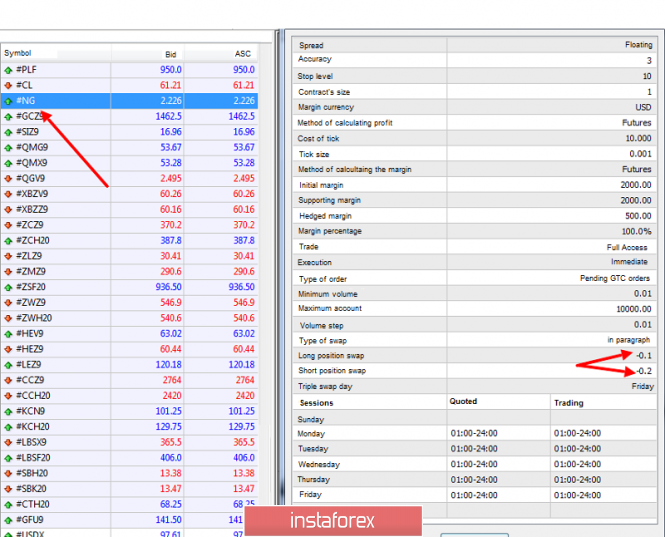

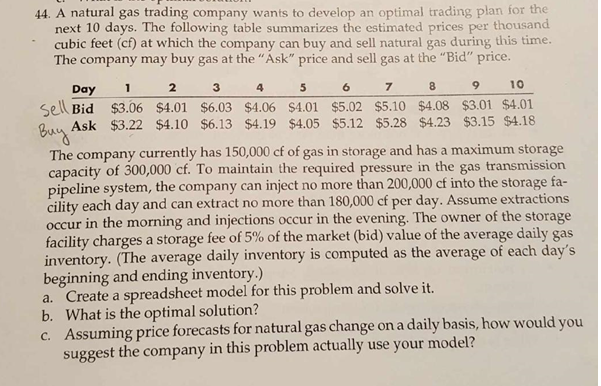

Cash futures are agreements to buy or sell a specific quantity of natural gas at a predetermined price on a future date. Options give you the right, but not the obligation, to buy or sell natural gas at a fixed price within a specific time frame. Swaps, on the other hand, are contracts that allow you to exchange cash flows based on the price of natural gas.

Benefits of Trading Natural Gas

Natural gas trading offers several advantages:

- High liquidity: Natural gas is one of the most actively traded commodities, providing ample trading opportunities.

- Potential for profits: Gas prices fluctuate based on supply and demand, creating opportunities for profit.

- Versatility: You can trade natural gas in various forms, including futures, options, and swaps, to suit your trading style and risk tolerance.

How to Get Started

Before you dive into trading natural gas, it’s essential to:

- Understand the market: Familiarize yourself with the factors that impact natural gas prices, such as weather patterns, geopolitical events, and supply-demand dynamics.

- Choose a trading platform: Select a reliable online brokerage that offers natural gas trading.

- Develop a trading strategy: Determine your risk appetite, trading style, and market analysis methods.

Image: www.chegg.com

Expert Insights

“Trading natural gas requires a balanced approach,” advises John Smith, a seasoned commodity trader. “Thoroughly research market conditions, set realistic profit targets, and manage your risk effectively.”

“The key is to stay abreast of market news and industry trends,” adds Jane Doe, a natural gas analyst. “Utilize technical analysis tools and consult with experts to make informed decisions.”

Actionable Tips

- Start small: Begin with manageable trading positions and gradually increase your exposure as you gain experience.

- Set stop-loss orders: These orders help limit potential losses by automatically liquidating your position if the price moves against you.

- Practice paper trading: Many trading platforms offer virtual trading accounts where you can hone your skills without risking real capital.

Trading Natural Gas Cash Futures Options And Swaps Free

Image: www.coursehero.com

Conclusion

Trading natural gas cash futures, options, and swaps can be a rewarding endeavor with the right knowledge and strategy. By leveraging the insights and tips provided in this guide, you can unlock the potential of these markets and potentially enhance your financial well-being.

Remember, trading involves risk, so always conduct thorough research, consult with experts, and trade responsibly. By following these steps, you can embark on a journey of natural gas trading that empowers you to pursue your financial goals.