Imagine a world where you can leverage the power of the stock market to amplify your financial potential. Options trading, particularly exchange traded options, offers this very opportunity. In this article, we embark on a journey to unravel the intricacies of this exciting financial instrument, empowering you with the knowledge and strategies to navigate the markets with confidence.

Image: www.qarya.org

Understanding Options: A Gateway to Financial Opportunity

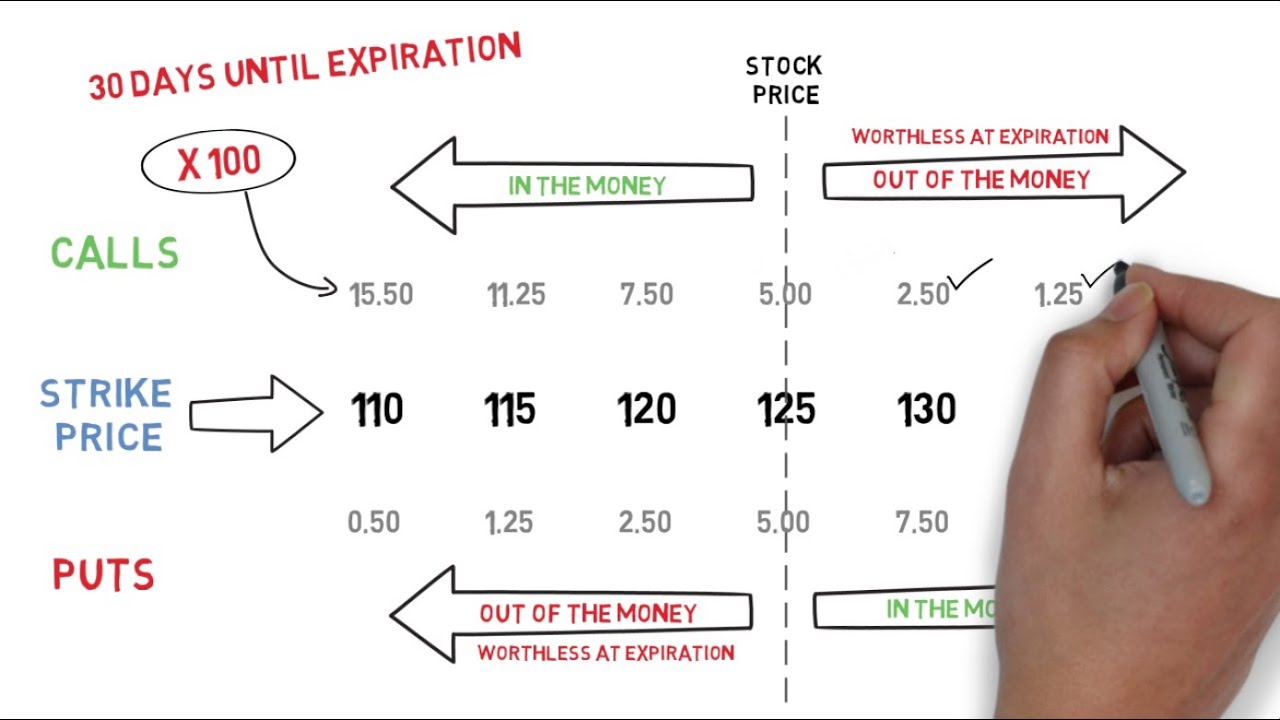

Options trading involves contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or index, at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility allows traders to tailor their strategies to specific market scenarios, hedging against risks or pursuing profit opportunities.

Exchange Traded Options: A Marketplace for Precision

Exchange traded options, unlike their over-the-counter counterparts, are standardized contracts traded on designated exchanges, ensuring transparency and liquidity. Traders have access to a vast marketplace of options with varying strike prices and expiration dates, enabling them to finely tune their trades to suit their risk tolerance and investment goals.

Diving into the Mechanics: Empowering Informed Decisions

The value of an option contract is determined by several key factors: the underlying asset’s price, the strike price, the time to expiration, and market volatility. Understanding how these variables interact is crucial for making informed trading decisions. By analyzing historical data and relying on sound technical and fundamental analysis, traders can assess the likelihood of the underlying asset moving in their desired direction and position themselves accordingly.

Image: www.youtube.com

Getting Started: Strategies for Success

For beginners, the most basic options trading strategy is buying (or selling) call (or put) options outright. This simple approach allows traders to speculate on the upward (or downward) movement of the underlying asset. As the underlying asset’s price moves favorably, the call (put) option increases in value, providing the potential for profit. However, it’s important to note that if the asset’s price moves against the trader’s prediction, they could face significant losses.

Expert Insights: Navigating the Market with Confidence

Seasoned options traders often employ more advanced strategies to enhance their risk management and profit-taking potential. These include covered calls, cash-secured puts, straddles, and strangles. By leveraging the wisdom of experts, traders can refine their trading techniques and increase their chances of success in the dynamic market environment.

Options Trading Exchange Traded Options

Image: www.warriortrading.com

Call to Action: Embracing the Power of Options

Options trading exchange traded options provides a powerful tool for investors and traders seeking to enhance their financial outcomes. By grasping the fundamental concepts, understanding the mechanics, and implementing proven strategies, you can unlock the world of options trading and harness its potential to amplify your financial success. Dive into the markets with confidence, explore the vast array of options available, and seize the opportunities that lie before you.