Introduction

In a world where financial markets are constantly evolving, alternative investment strategies are gaining traction as investors seek to diversify their portfolios and generate potentially lucrative returns. Among these, oil trading has emerged as a popular option, promising high rewards but also carrying significant risks. Enter Option Genius, a platform that offers a unique twist on oil trading through its “blank check” approach. But amidst the hype and promise, it’s crucial to delve into the complexities of Option Genius and carefully evaluate its offerings to make an informed decision. This comprehensive review delves into the intricacies of Option Genius, examining its strengths, potential drawbacks, and ultimately providing an unbiased assessment of its credibility.

Image: imgflip.com

Understanding Option Genius and Blank Check Oil Trading

Option Genius operates on a unique model that defies conventional oil trading practices. The platform essentially allows investors to purchase a “blank check” that grants them the option to buy or sell oil at a specified price within a predetermined timeframe. Unlike traditional oil futures contracts, which are binding agreements to buy or sell a specific quantity of oil at a set price, Option Genius’s blank checks offer greater flexibility and potential for profit in volatile markets.

By leveraging its advanced algorithms, Option Genius analyzes market data and identifies optimal trading opportunities. The platform claims to provide investors with high-probability trades with the potential for significant returns. However, it’s crucial to recognize that oil trading, like any financial investment, carries inherent risks. The volatility of oil prices can lead to substantial losses if the market moves against the investor’s position.

Weighing the Pros and Cons

To make a well-informed decision about whether Option Genius is the right choice for your investment strategy, it’s essential to weigh its potential advantages and drawbacks.

Pros:

- Flexibility: Option Genius’s blank checks offer greater flexibility compared to traditional futures contracts, allowing investors to capitalize on market fluctuations without being tied to a specific purchase or sale obligation.

- Potential for High Returns: The platform claims to provide high-probability trades with the potential for substantial profits, especially during periods of market volatility.

- Advanced Analysis: Option Genius employs advanced algorithms to analyze market data and identify trading opportunities, potentially increasing the likelihood of successful trades.

Cons:

- High Risk: Oil trading carries inherent risks, and losses can be substantial if the market moves against the investor’s position.

- Fees and Commissions: Investors should be aware of the platform’s fees and commissions, which can impact overall profitability.

- Limited Transparency: The opaque nature of Option Genius’s trading algorithm and the lack of disclosure regarding underlying strategies may raise concerns for some investors.

Expert Insights and Independent Reviews

To provide a balanced assessment, let’s turn to expert insights and independent reviews of Option Genius. Some industry analysts have lauded the platform for its innovative approach to oil trading and the potential for high returns. However, others have expressed concerns regarding the platform’s limited transparency and the risks associated with leveraged trading.

Independent reviews offer a mixed bag. While some users have reported positive experiences and substantial profits, others have faced losses and questioned the efficacy of the platform’s trading strategies. It’s important to note that individual experiences may vary and should not be taken as a guarantee of future results.

Image: motoraspects.com

Is Option Genius Trustworthy?

Establishing the trustworthiness of any investment platform is paramount. While Option Genius claims to be a reputable and transparent company, further research reveals mixed feedback. Some users have reported positive experiences and a responsive customer support team, while others have raised concerns about the platform’s reliability and the handling of disputes.

It’s essential to exercise due diligence by thoroughly researching Option Genius, reading independent reviews, and understanding the potential risks before committing any funds. It’s also advisable to consult with a financial advisor to assess the suitability of Option Genius for your specific investment goals and risk tolerance.

Option Genius Blank Check Oil Trading Reviews

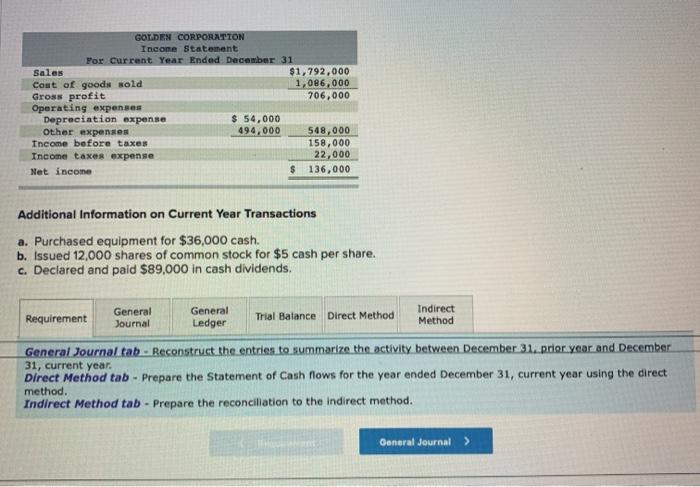

Image: www.chegg.com

Conclusion

Option Genius presents a unique approach to oil trading, potentially offering flexibility, high returns, and sophisticated market analysis. However, it’s imperative to recognize the inherent risks associated with oil trading and the platform’s limited transparency. While some users have reported success, others have raised concerns riguardo the平台’s reliability.

Ultimately, the decision of whether or not to invest with Option Genius is a personal one. Investors should carefully evaluate the platform’s offerings, weigh the pros and cons, and conduct thorough due diligence. Consulting with a financial advisor can provide valuable insights and help you make an informed decision that aligns with your investment goals and risk tolerance.

As with any investment, it’s vital to proceed with caution, diversify your portfolio, and never invest more than you can afford to lose. The allure of potential profits should never overshadow the importance of responsible investing and managing risk effectively.