Introduction

Image: fabalabse.com

Are you ready to delve into the exciting world of options trading and unlock its immense potential? Look no further than our comprehensive “Trading Options Workbook PDF.” This ultimate resource will equip you with a thorough understanding of options strategies, enabling you to make informed trades and maximize your returns. Whether you’re a beginner just starting out or an experienced trader seeking to enhance your skills, this workbook is your indispensable guide to the world of options.

Decoding the Basics of Options Trading

Let’s begin by understanding the fundamentals of options trading. Options are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a certain date (expiration date). This flexibility offers traders a wide range of opportunities to hedge risk, speculate on price movements, or generate income.

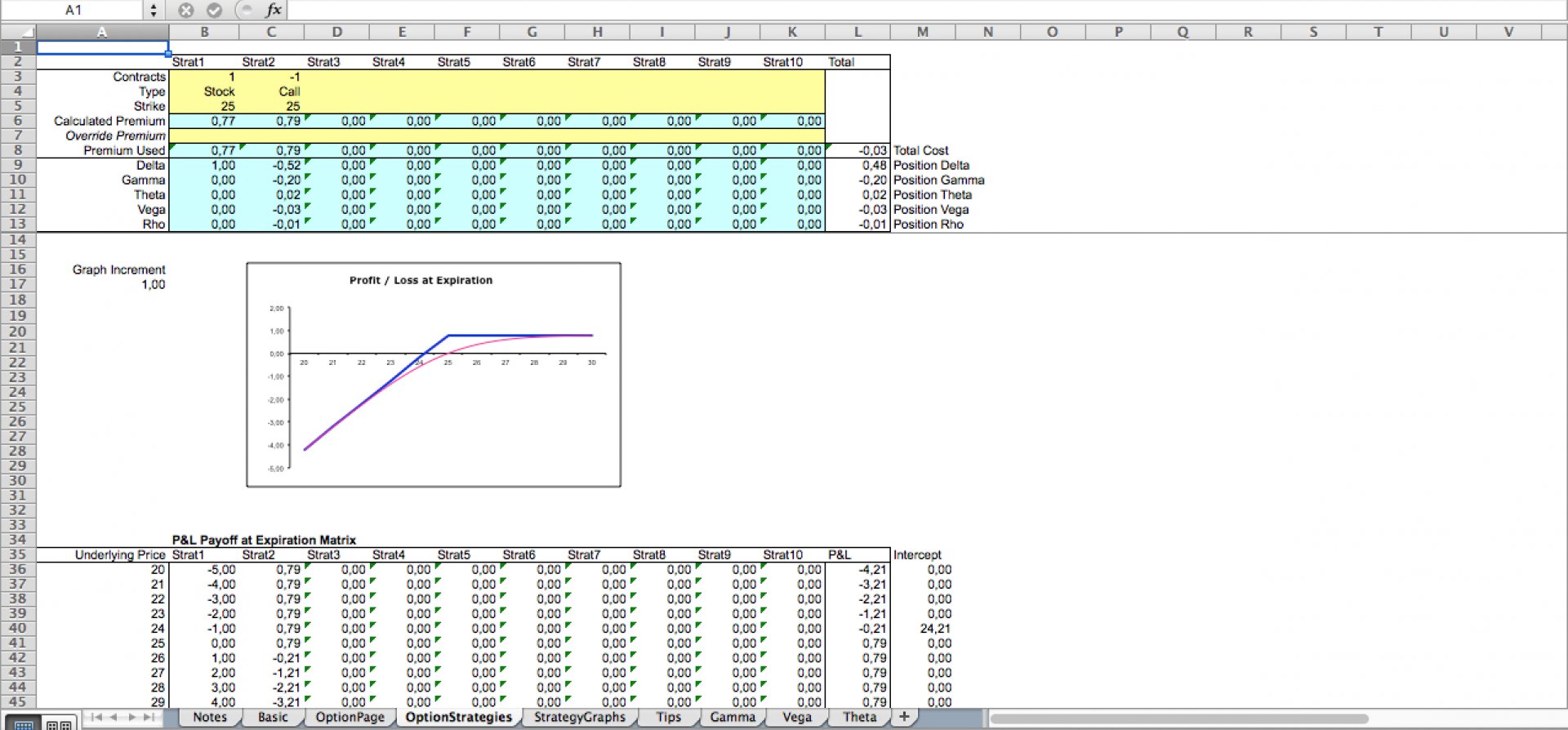

Exploring the Anatomy of an Option Contract

Every option contract carries specific characteristics that traders should be aware of. These include:

- Symbol: This unique identifier assigns each option contract to a specific underlying asset and expiration date.

- Type: Call or put, indicating the right to buy or sell the underlying.

- Strike Price: The price at which the option holder can buy or sell the underlying.

- Expiration Date: The date on which the option expires, after which it becomes worthless.

- Premium: The price paid for the option contract.

- Settlement: The process of exercising an option contract, resulting either in a physical delivery of the asset or a cash settlement.

Understanding Option Pricing

To make informed trades, it’s crucial to understand the factors that influence option prices. These include:

- Underlying Asset Price: The price of the underlying asset significantly impacts option prices.

- Strike Price: The relationship between the underlying and strike prices affects the option value.

- Expiration Date: Time decay plays a role in option pricing as options with shorter to expiration lose value faster.

- Volatility: Market volatility affects option prices, with increased volatility typically driving up prices.

- Interest Rates: Interest rates can impact the price of options, influencing the cost of carrying the option to its expiration date.

Diving into Options Strategies

Now that you’re armed with a solid foundation, let’s explore the vast array of strategies that options trading has to offer. Some of the most popular strategies include:

- Covered Call: A strategy that involves selling call options against an underlying asset that you own, limiting potential profit but also minimizing risk.

- Cash-Secured Put: A conservative strategy where you sell a put option while holding cash to cover potential assignment of the underlying at the strike price.

- Broken Wing Butterfly: A combination strategy that creates a range-bound position and aims to profit from premium decay.

- Iron Condor: A neutral strategy that involves combining a bull call spread with a bear put spread to capitalize on limited market movements.

- Debit Spreads: Strategies that involve buying one option and selling another with the same expiration date but different strike prices.

- Credit Spreads: Strategies that involve selling one option and buying another with the same expiration date but different strike prices.

Managing Risk and Maximizing Returns

In options trading, proper risk management is paramount. Here are some key considerations:

- Choosing the Right Strategies: Carefully evaluate your risk tolerance and investment goals before selecting an option strategy.

- Understanding Leverage: Options involve leverage that can magnify both gains and losses.

- Setting Stop-Losses: Establish stop-loss orders to limit potential drawdowns in case of unfavorable price movements.

- Margin Accounts: Understand the potential risks and requirements of trading options in a margin account.

- Monitor Your Positions: Regular monitoring of your option positions is essential for timely adjustments or exits.

Conclusion

Mastering options trading requires a comprehensive understanding of the concepts, strategies, and risk management involved. Our “Trading Options Workbook PDF” provides you with a solid foundation to navigate the exciting world of options and make informed decisions. Remember, knowledge is power, and by embracing the insights within this workbook, you can unlock the tremendous potential that options trading has to offer.

Image: westlalawyermarketing.blogspot.com

Trading Options Workbook Pdf

Image: www.eloquens.com