Navigating the realm of stock options can be akin to venturing into uncharted territory, fraught with its own complexities. Fear not, fellow traders, for I present to you this comprehensive guide to unravel the mysteries of Quicken options trading. Let us embark on this financial adventure, unlocking the transformative power of these investment vehicles.

Image: www.quicken.com

Understanding Options Trading: The Basics

In essence, options trading grants you the right, but not the obligation, to buy or sell a particular stock at a predetermined price within a specific time frame. These contracts serve as tools of speculation and hedging, allowing you to capitalize on market price fluctuations or mitigate potential losses. With options, you enjoy the flexibility to exercise your right or simply let the contract expire worthless, without incurring any legal obligation.

Types of Options: Calls and Puts

Within the options trading arena, two primary types emerge: call options and put options. Call options bestow upon you the right to purchase a stock at a specified price, known as the strike price, before a set expiration date. Conversely, put options grant you the prerogative to sell a stock at the strike price within the same time frame. The choice between these options hinges on your market outlook; call options are wielded in anticipation of rising stock prices, while put options thrive in bear markets.

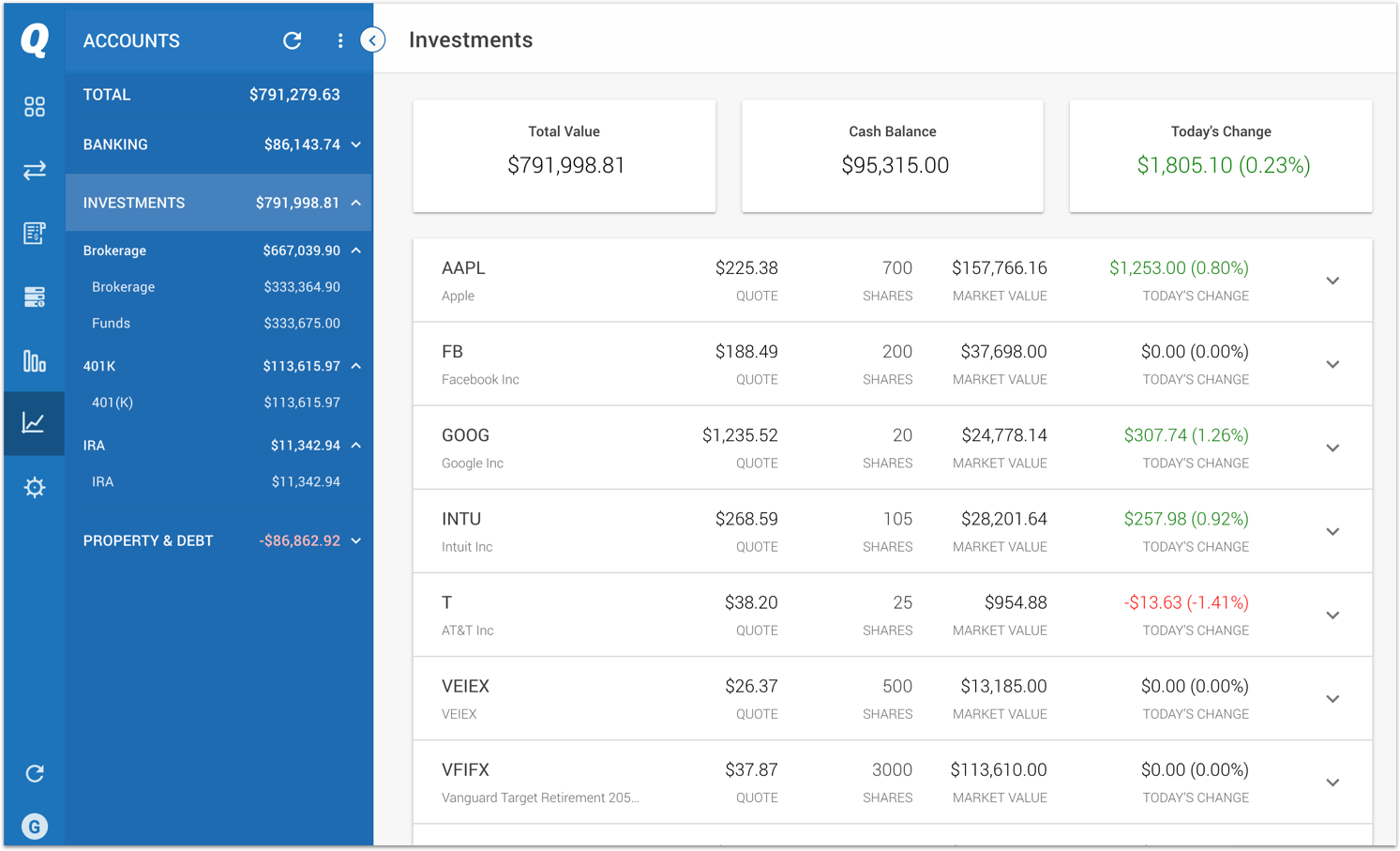

Quicken Options Trading: A Symphony of Software and Finance

Quicken, a renowned personal finance software, seamlessly integrates options trading into its feature-rich ecosystem. This harmonious partnership empowers you to manage your stock options, track market trends, and execute trades with unparalleled efficiency. Quicken’s user-friendly interface and robust suite of tools provide a comprehensive solution for both novice and seasoned traders.

Image: www.quicken.com

Tips and Expert Advice for Quicken Options Trading

Embarking on the Quicken options trading journey, it behooves you to harness the insights of seasoned experts. Here, I offer a treasure trove of tips and advice to enhance your trading prowess:

- Master the Fundamentals: Ground yourself in the intricacies of options trading before venturing into the market. Comprehend the concepts of strike prices, expiration dates, and the nuances of call and put options.

- Research and Due Diligence: Assimilate knowledge about the companies whose stocks you intend to trade. Evaluate their financial statements, industry outlooks, and market trends to inform your trading decisions.

- Define Your Goals: Determine your investment goals and risk tolerance. Are you seeking short-term gains or long-term returns? Are you comfortable with higher risk in pursuit of greater rewards?

- Start Cautiously: Commence your options trading odyssey with modest positions. Scale up gradually as you gain experience and confidence.

- Manage Risk: Options trading inherently carries risk. Employ a robust risk management strategy, including diversification and position sizing, to mitigate potential losses.

Frequently Asked Questions: Unraveling the Enigma of Options

To further illuminate the path of options trading, let us delve into a series of frequently asked questions and their elucidating answers:

- Q: What is the difference between an option and a stock?

- A: An option bestows the right, but not the obligation, to buy or sell an underlying stock at a predetermined price. Stocks, on the other hand, represent direct ownership in a company.

- Q: When should I buy call options?

- A: Call options are most suitable when you anticipate a rise in the underlying stock’s price.

- Q: What factors influence options prices?

- A: Options prices are influenced by a confluence of factors, including the underlying stock’s price, time to expiration, volatility, and interest rates.

- Q: How can I minimize risks in options trading?

- A: Risk mitigation strategies include diversification, position sizing, and employing a sound trading plan.

Quicken Options Trading

Conclusion: Empowering Your Financial Future

Quicken options trading empowers you to harness the transformative power of stock options within a single, cohesive platform. By embracing the principles outlined in this guide, coupled with diligent research and risk management practices, you can embark on a fulfilling journey toward financial success. Remember, knowledge is the bedrock upon which sound investment decisions are made. Dive into the depths of financial markets with confidence and unlock the potential of Quicken options trading.

Are you ready to delve into the fascinating world of options trading and harness its transformative power? Embrace the knowledge imparted in this guide and embark on an enriching adventure toward financial success.