Image: tradingportfolios.com

Discover the Essential Metrics for Evaluating Option Trading Performance

In the dynamic and ever-evolving world of options trading, traders constantly strive to maximize profits while mitigating risks. Evaluating the performance of option trading strategies is crucial for refining techniques and improving overall returns. However, the key question remains: what are the appropriate benchmarks against which these strategies should be compared?

Defining Benchmarks for Option Trading

A benchmark serves as a standard or reference point against which an investment strategy’s performance is measured. In the context of option trading, benchmarks provide a basis for evaluating a strategy’s effectiveness and identifying areas for improvement. Several factors play a pivotal role in determining suitable benchmarks:

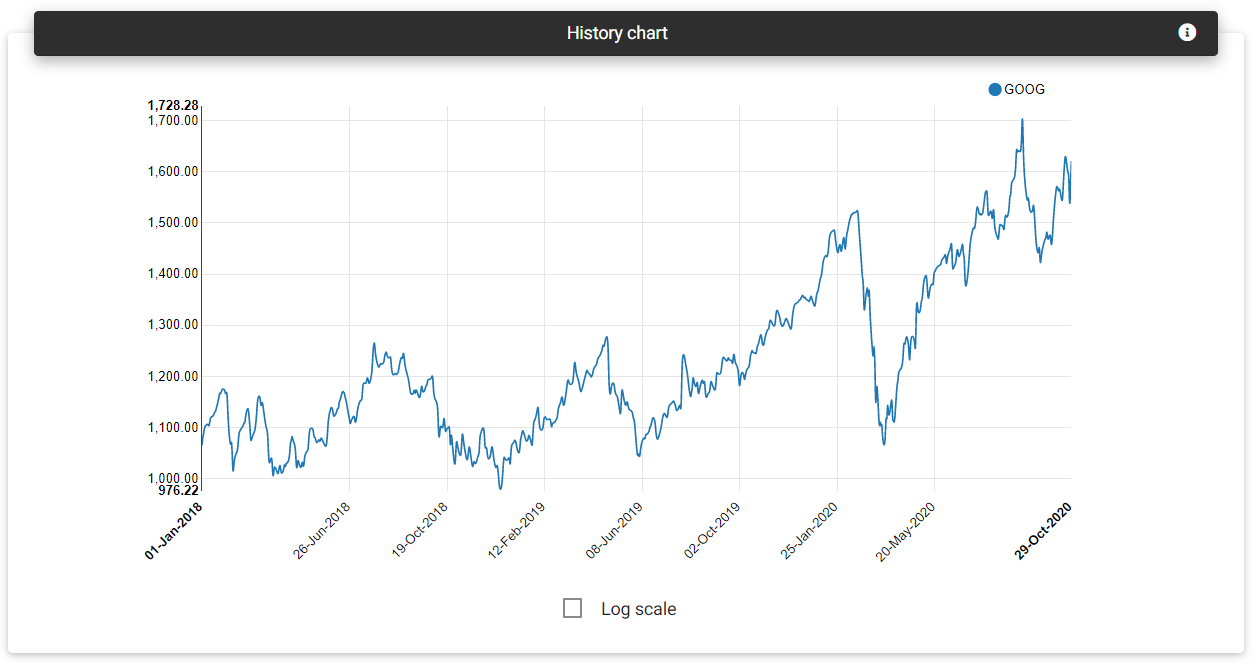

- Historical performance (historical benchmark): Comparing the strategy’s performance to historical data provides a gauge of consistency and risk-adjusted returns over time.

- Similar strategies (relative benchmarks): Comparing strategies within the same asset class or with similar risk profiles enables traders to assess competitive advantages and potential opportunities.

- Broad market (index benchmark): Utilizing a broad market index, such as the S&P 500, allows traders to evaluate strategy performance relative to general market trends.

Key Metrics for Benchmarking Option Trading Strategies

To conduct a comprehensive and meaningful benchmark analysis, traders should focus on key metrics that capture the essential aspects of option trading performance. These metrics include:

- Return on Investment (ROI): Represents the percentage gain or loss from the initial investment, providing a measure of overall profitability.

- Net Profit: The total profit generated by the strategy after accounting for trading costs, such as commissions and fees.

- Winning Percentage: Calculates the percentage of trades that resulted in a profit, indicating the strategy’s success rate.

- Sharpe Ratio: Measures risk-adjusted returns, providing insight into the strategy’s ability to generate excess returns.

- Maximum Drawdown: Quantifies the maximum decline in portfolio value from a peak, indicating the strategy’s sensitivity to market fluctuations.

Adjusting Benchmarks for Risk and Complexity

When selecting benchmarks, it is essential to consider the risks and complexity of the option trading strategy being evaluated. More aggressive strategies with higher potential returns should be benchmarked against higher-risk assets or indexes. Conversely, conservative strategies with lower expected returns may align better with more stable benchmarks.

Importance of Benchmarking

Benchmarking plays a crucial role in option trading by:

- Providing objective performance assessments

- Identifying strengths and weaknesses in trading practices

- Facilitating decision-making and risk management

- Enhancing risk-adjusted returns

- Empowering traders to fine-tune their strategies

Conclusion

Benchmarking option trading strategies against appropriate benchmarks is fundamental for assessing their performance, making informed adjustments, and achieving long-term trading success. Traders must carefully consider historical performance, similar strategies, and market indices when establishing benchmarks and evaluate key metrics to gain insights into their strategy’s profitability, risk exposure, and competitive advantages. By incorporating benchmarking into their trading practices, traders can elevate their performance and maximize their potential in the dynamic landscape of options trading.

Image: louwrentius.com

What To Benchmark Option Trading Strategies Against

Image: www.youtube.com