In the fast-paced world of finance, volatility reigns supreme. It’s the unpredictable dance of asset prices that can either make or break your investment strategies. But what if there was a way to tame this volatility and harness its power to your advantage? Enter the Volatility Edge.

Image: www.instafxng.com

The volatility edge is a trading strategy that leverages the fluctuations in an underlying asset’s price to generate consistent profits. It involves understanding the factors that influence volatility and using options contracts to exploit the resulting market movements. By employing this strategy, traders can minimize their exposure to risk while maximizing their potential returns.

The Roots of Volatility

Volatility is essentially the extent to which an asset’s price fluctuates over time. It’s influenced by a myriad of factors, including economic conditions, political events, market sentiment, and the supply and demand dynamics specific to the asset itself. Understanding these drivers is crucial for successfully implementing the volatility edge strategy.

Options: Tools for Harnessing Volatility

Options are financial instruments that provide the flexibility to trade an asset’s future price without actually owning it. They offer traders a range of strategies, from simple bets on the direction of the price to complex hedging techniques.

In the volatility edge strategy, options are used to gain exposure to the fluctuations in an asset’s price without taking on significant risk. By carefully selecting and managing their options positions, traders can capitalize on the volatility without becoming overly vulnerable to adverse market movements.

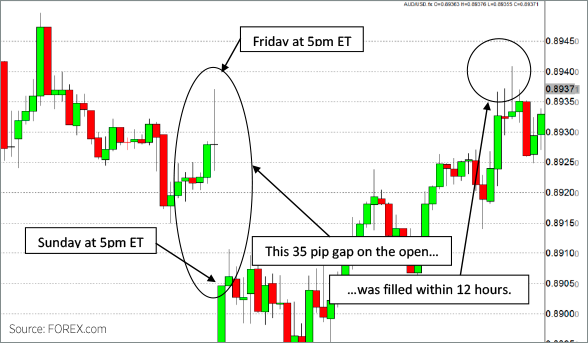

Real-World Applications

The volatility edge strategy has proven successful in various market environments. For instance, during periods of high volatility, traders can use options to profit from the increased price swings. Conversely, in more stable markets, options can be employed to generate returns through strategies that benefit from minimal price fluctuations.

Hedge funds and sophisticated traders often utilize the volatility edge approach to enhance their portfolios. They may use options to hedge against market downturns, generate alpha above benchmark returns, or create structured products that cater to specific investors’ needs.

Image: www.option-dojo.com

Expert Insights and Actionable Tips

Renowned volatility expert Peter L. Brandt emphasizes the importance of understanding market structure and technical analysis in leveraging the volatility edge. He advises traders to identify “volatility dislocations” – situations where market volatility differs from historical norms – as these can provide opportunities for profitable trades.

Another seasoned trader, Jay Kaeppel, underscores the value of maintaining discipline and patience when implementing the volatility edge strategy. He stresses the need to trade with a clear plan and stick to the predefined set of rules and risk management parameters.

The Volatility Edge In Option Trading Pdf

Image: www.pinterest.co.uk

Embrace the Volatility Edge

Navigating the volatile financial markets requires both skill and strategy. The volatility edge, when applied with proper understanding and execution, can provide traders with a significant advantage. By leveraging the power of options and mastering the dynamics of volatility, you can unlock the potential for consistent profits and become a more empowered investor.

Remember, education is key when it comes to mastering the volatility edge. Seek out reliable resources, consult with experienced traders, and practice managing options positions in simulated environments before venturing into live trading. With dedication and a well-informed approach, you can harness the volatility edge and seize the opportunities it presents in the ever-evolving world of finance.