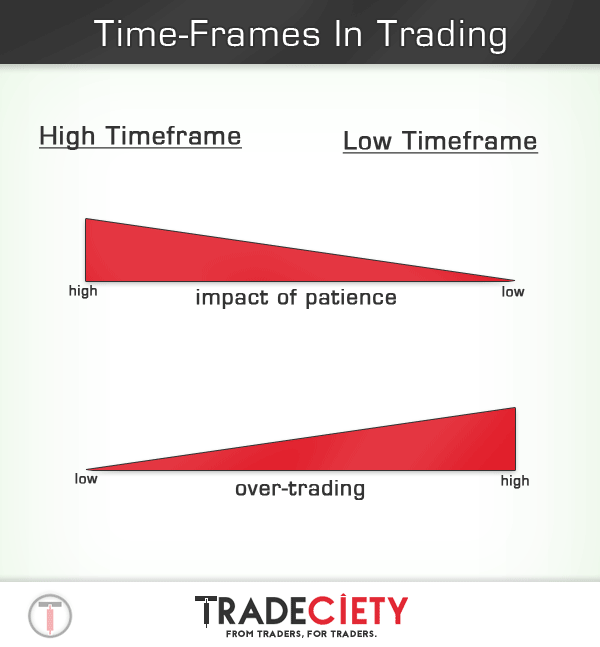

In the realm of options trading, the choice of timeframe can profoundly impact your trading decisions and overall returns. It’s like navigating a river: the wider the river, the more time you have to react; the narrower it is, the quicker you must make decisions. Grasping the right timeframe for your trading style and risk tolerance is crucial to unlocking the potential of options trading.

Image: tradeciety.com

Before delving into the intricacies of timeframe selection, let’s unravel the basics of options trading. An option contract grants you the right, but not the obligation, to buy or sell an underlying asset (a stock, for instance) at a specified price (the strike price) on or before a specified date (the expiration date). Understanding this concept is the cornerstone of options trading.

Understanding Timeframes in Options Trading

Short-Term Timeframes: A Fast-Paced Adventure

Short-term timeframes, ranging from minutes to a few days, are the adrenaline rush of options trading. These trades hinge on capturing short-term market movements, such as intraday price swings or earnings announcements. Traders in this arena must be nimble, swiftly adjusting to the market’s heartbeat to seize profit opportunities.

While the potential for quick returns is alluring, short-term timeframes also amplify risks. Rapid price movements can lead to substantial losses if not managed prudently. These timeframes suit experienced traders with a high tolerance for risk and the ability to make split-second decisions.

Intermediate-Term Timeframes: Striking a Balance

Intermediate-term timeframes, spanning from a week to several months, offer a more measured approach to options trading. These trades focus on capturing中期市场趋势, such as seasonal patterns or industry cycles. While the pace is less frenetic than short-term trading, it still requires agility and a close eye on market dynamics.

Intermediate-term timeframes strike a balance between risk and reward. They provide ample time to monitor positions and adjust strategies, reducing the intensity of decision-making. This timeframe is suitable for traders seeking a blend of potential returns and manageable risk.

Image: fxssi.com

Long-Term Timeframes: A Patient Pursuit

Long-term timeframes, stretching from months to years, embody the adage “slow and steady wins the race.” These trades capitalize on broad market trends, such as economic cycles or industry transformations. Long-term traders exercise patience and discipline, allowing their positions to ride out market fluctuations and capture significant growth potential.

The allure of long-term timeframes lies in their ability to reduce trading costs, minimize market noise, and increase the potential for substantial returns. However, they also require a high level of conviction in the underlying asset and the ability to withstand market volatility over extended periods.

Choosing the Right Timeframe for You

The optimal timeframe for options trading depends on your trading style, risk tolerance, and financial goals. Here are some expert tips to help you make an informed choice:

Weigh Your Experience and Skill Level:

If you’re a novice trader, starting with a longer timeframe is advisable. It provides more time to learn market dynamics and develop trading strategies. As your experience and skillset grow, you can gradually transition to shorter timeframes if desired.

Assess Your Risk Tolerance:

Short-term timeframes amplify risks, while long-term timeframes mitigate them. Determine your comfort level with potential losses and choose a timeframe accordingly. If you’re risk-averse, longer timeframes may be a better fit.

Consider Your Financial Goals:

Short-term timeframes offer the potential for quick gains but also rapid losses. Long-term timeframes aim for steady growth over an extended period. Align your timeframe selection with your financial objectives.

Frequently Asked Questions on Options Trading Timeframes

-

Q: What is the best timeframe for options trading?

A: The optimal timeframe depends on individual circumstances, including experience, risk tolerance, and financial goals.

-

Q: How do I choose the right timeframe for me?

A: Consider your trading experience, risk tolerance, and financial goals to select a timeframe that aligns with your needs.

-

Q: Can I change my timeframe later?

A: Yes, you can adjust your timeframe as you gain experience and your trading style evolves.

-

Q: Is it possible to trade options on multiple timeframes?

A: Yes, some traders diversify their strategies by trading options on different timeframes to capture opportunities in both short-term and long-term trends.

Options Trading Time Frame

https://youtube.com/watch?v=tSaNbqGhG20

Conclusion

Selecting the right timeframe in options trading is a crucial element for success. By understanding the different timeframes, their associated risks and rewards, and the factors that influence their selection, you can optimize your trading strategy and increase your chances of achieving your financial goals. Remember, the journey of options trading is a marathon, not a sprint. Choose a timeframe that allows you to navigate the market’s ebb and flow with confidence and patience.

Are you ready to embark on the adventure of options trading timeframes? Let the insights provided in this article guide your journey towards informed decision-making and profitable outcomes.