In the realm of financial markets, options trading stands out as a captivating and potentially lucrative strategy. It’s akin to entering a vast ocean of possibilities, fraught with both thrill and risk. Whether you’re a seasoned trader or just starting to explore the financial seas, understanding the profound nature of options trading is paramount.

Image: www.projectfinance.com

Delving into the depths of option trading, you’ll discover a world of derivatives. These financial instruments derive their value from an underlying asset, such as stocks, commodities, or indices. Options trading essentially revolves around the purchase or sale of these contracts, providing traders with the ability to either bet on or protect their exposure to the underlying asset’s price fluctuations.

Deciphering Options Trading

Understanding options trading necessitates delving into the core concepts that define it. Essentially, an option contract bestows upon the holder the right, not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price, on or before a predetermined date, referred to as the expiration date.

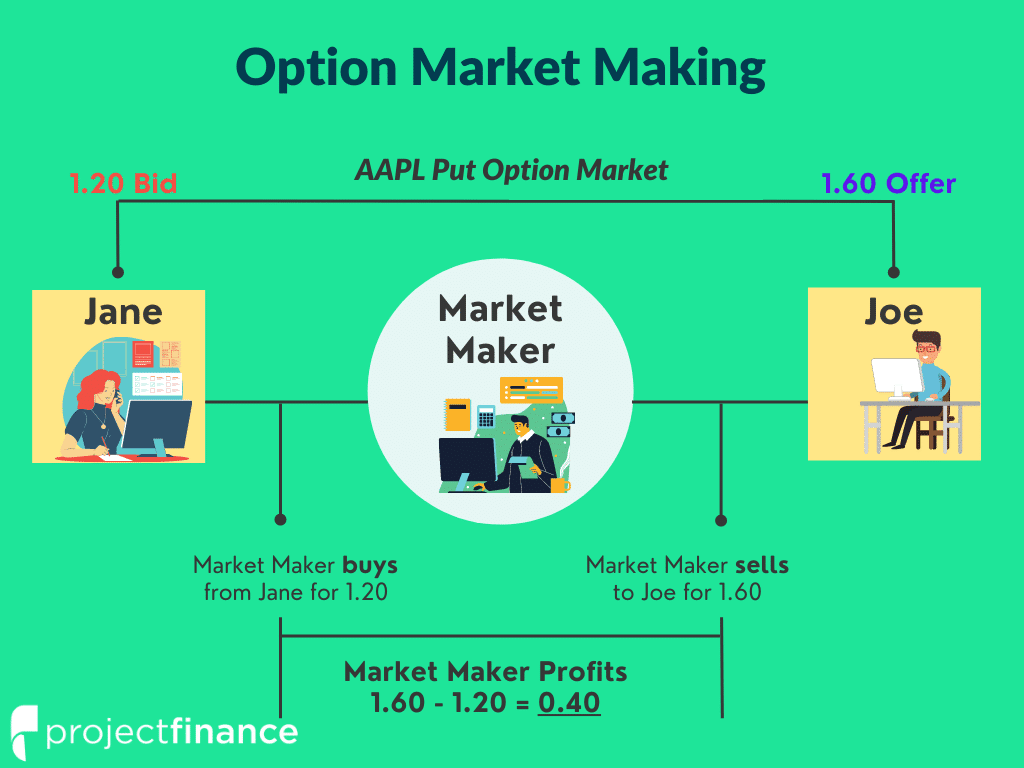

There are two primary types of options: **call options** and **put options**. Call options grant the holder the right to purchase an underlying asset, while put options confer the right to sell the asset. The choice between these two options depends on whether the trader anticipates a rise or fall in the asset’s price, respectively.

Call Options: Embracing Upside Potential

Call options soar in value when the underlying asset’s price ascends. By purchasing a call option, the trader anticipates a future price increase, securing the right to buy the asset at a predetermined price, regardless of the prevailing market price.

Put Options: Hedging Against Market Volatility

Put options, on the other hand, flourish amidst a declining market. They empower traders to sell the underlying asset at a fixed price, even if the market price plummets. Put options serve as a protective measure, insulating traders from potential losses in a falling market.

Image: corporate.cyrilamarchandblogs.com

Leveraging Options Trading: Strategies and Insights

The world of options trading unfolds a tapestry of strategies, each tailored to specific objectives and risk appetites. Whether your aim is to capitalize on market trends, safeguard against volatility, or generate income, a thoughtful approach is indispensable.

Begin by grasping the **basics of options pricing**. Comprehensive models, such as the Black-Scholes model, illuminate the factors that influence an option’s value, empowering you to price options judiciously.

Next, **identify strategic opportunities**. Options trading presents a wealth of ways to enhance your financial prowess. Analyze market trends, dissect company fundamentals, and stay abreast of macroeconomic factors to pinpoint lucrative trading opportunities.

Remember, options trading, like any financial endeavor, involves inherent risk. **Adopt sound risk management practices**. Define clear profit targets and stop-loss levels, diligently monitor your positions, and avoid overleveraging. Prudence is the captain’s compass in the turbulent seas of financial markets.

Frequently Asked Questions on Options Trading

Q: What’s the difference between a call and a put option?

A: Call options confer the right to buy an asset, anticipating a price increase. Put options grant the right to sell, hedging against a price decline.

Q: How do I determine the value of an option?

A: Use a pricing model, like the Black-Scholes model, which considers factors like strike price, expiration date, volatility, and risk-free interest rates.

Q: What’s the key to successful options trading?

A: Research, strategy, and risk management. Understand options pricing, identify market opportunities, and implement prudent risk controls to navigate financial markets skillfully.

Define Option Trading

Image: www.angelone.in

Unveiling Your Trading Potential

Options trading, with its complexities and rewards, beckons you to explore the depths of financial markets. Whether you’re a seasoned trader or a burgeoning investor, embracing the nuances of options trading can unlock a realm of possibilities.

Remember, however, that financial markets are dynamic and unpredictable. While options trading can be a potent tool, it’s crucial to approach it with caution and a healthy understanding of the risks involved.