Introduction

I’ve witnessed firsthand how mastering the art of swing trading options can transform even novice traders into market wizards. Understanding the ideal duration for your trades is crucial to this mastery. Join me as we explore the fascinating world of swing trading options and unravel the secrets to maximizing your gains by pinpointing the perfect timeframes.

Image: www.bank2home.com

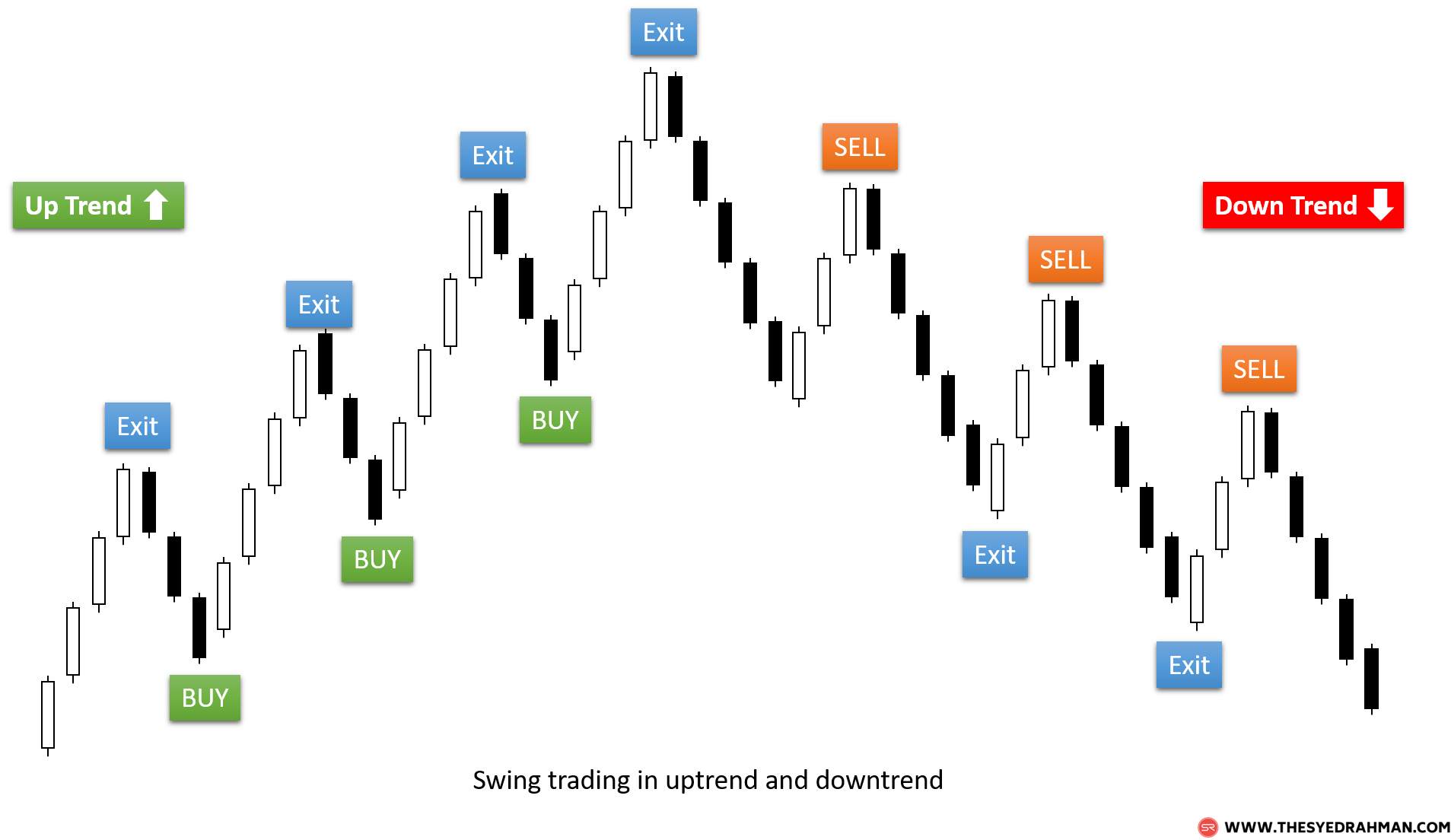

Swing Trading Defined

Swing trading, a harmonious blend of technical analysis and patience, empowers traders to capitalize on short-term price fluctuations that typically span several days to a few weeks. By identifying swing points—peaks and troughs in the price action—traders aim to enter and exit positions at optimal moments, harnessing the momentum of the market’s swings.

Timeframes in Swing Trading Options

The duration of a swing trade hinges on various factors, including the underlying asset’s volatility, the market conditions, and the trader’s risk tolerance. Generally, swing trades can be classified into three primary timeframes:

- Short-term (1-5 days): Ideal for capturing quick price movements on highly volatile assets. Requires a high level of trading experience and close monitoring of the markets.

- Medium-term (5-10 days): Provides a balance between short-term gains and risk management. Suitable for assets with moderate volatility and traders with some experience.

- Long-term (10-20 days): Allows for greater profit potential while reducing risk, but requires patience and a thorough understanding of market trends. Ideal for less volatile assets and experienced traders.

Determining the Best Timeframe

The optimal timeframe for swing trading options is a dynamic concept, influenced by a multitude of factors that demand careful consideration:

- Asset volatility: Highly volatile assets necessitate shorter timeframes to mitigate risk, while less volatile assets allow for longer-term trades.

- Market conditions: Bullish markets favor longer timeframes, while bearish markets favor shorter timeframes due to increased volatility.

- Risk tolerance: Risk-averse traders opt for shorter timeframes, while those with higher risk tolerance can explore longer timeframes.

Additionally, traders can leverage technical analysis to identify potential swing points and determine appropriate timeframes. This involves studying price charts, support and resistance levels, and momentum indicators to gauge the market’s direction and underlying trends.

Image: www.srtrader.com

Tips from the Pros

Seasoned swing traders have accumulated invaluable insights over time. Here are some pearls of wisdom to enhance your trading endeavors:

- Focus on a few timeframes: Master one or two timeframes to develop a deep understanding of their nuances and rhythm.

- Test different timeframes: Experiment with various timeframes to discover which aligns best with your trading style and risk tolerance.

- Don’t get married to one timeframe: Adapt your timeframe to the ever-changing market conditions to maximize profitability.

- Consider the time of day: Market behavior often varies depending on the time of day. Identify the most favorable trading sessions for your strategy.

FAQs

What is the most profitable timeframe for swing trading options?

The best timeframe depends on multiple factors and varies from trader to trader. It’s crucial to experiment and determine the most suitable timeframe for your individual trading style.

Is it possible to swing trade options on any asset?

While swing trading can be applied to various assets, it’s particularly effective for stocks, ETFs, and indices with significant price fluctuations.

How can I improve my swing trading performance?

Develop a comprehensive trading plan, conduct thorough research, and continually monitor market trends. Seek mentorship from experienced traders and stay up-to-date with trading strategies.

Best Time Duration For Swing Trading Options

Image: followthemoney.com

Conclusion

Swing trading options is a rewarding yet challenging endeavor that demands a deep understanding of market dynamics and the optimal timeframe for trades. By carefully assessing the asset’s volatility, market conditions, and your risk tolerance, you can pinpoint the ideal timeframe that aligns with your trading goals. Remember to experiment with different timeframes, heed the advice of experienced traders, and adapt your approach to the ever-evolving market landscape. Are you ready to embark on the path to swing trading mastery? The time to act is now.