Embark on a swing trading odyssey with me, a seasoned trader who has navigated the exhilarating and challenging world of options using the esteemed Thomset PDF as my guiding light. Join me as I delve into the intricacies of swing trading, unraveling its strategies, and revealing the secrets to harnessing it for market success.

Image: disneyartdrawingseasycoloringpages.blogspot.com

Swing Trading: A Lucrative Endeavor

Understanding Swing Trading Options

Swing trading, an art form in the financial arena, involves holding stocks for a duration that transcends intraday trading but falls short of long-term investing. It capitalizes on price fluctuations, enabling traders to profit from market swings within a timeframe ranging from several days to a few weeks.

Options, versatile financial instruments, empower traders to speculate on the price trajectory of an underlying asset without incurring the obligation to buy or sell. Swing trading options allows traders to amplify their returns while mitigating risk, making it a compelling strategy for market navigation.

The Thomset PDF: A Treasure Trove of Knowledge

In the vast landscape of trading resources, the Thomset PDF stands tall as a beacon of wisdom. This meticulously crafted guidebook unveils the secrets of swing trading options, meticulously detailing strategies, risk management techniques, and market analysis approaches. It has become the cornerstone of my trading journey, providing invaluable insights that have propelled my success.

Latest Trends in Swing Trading Options

The world of swing trading options is constantly evolving, with new strategies and advancements emerging. By staying abreast of these trends, you can gain a competitive edge and maximize your profitability. Forums and social media platforms are valuable sources of real-time updates, allowing you to tap into the collective knowledge of experienced traders and industry experts.

Image: optiontradingfortune.com

Options For Swing Trading Thomset Pdf

Image: www.youtube.com

Expert Advice for Navigating Market Turbulence

Drawing upon my expertise and the lessons learned from the Thomset PDF, I present you with invaluable tips for thriving in the dynamic realm of swing trading options:

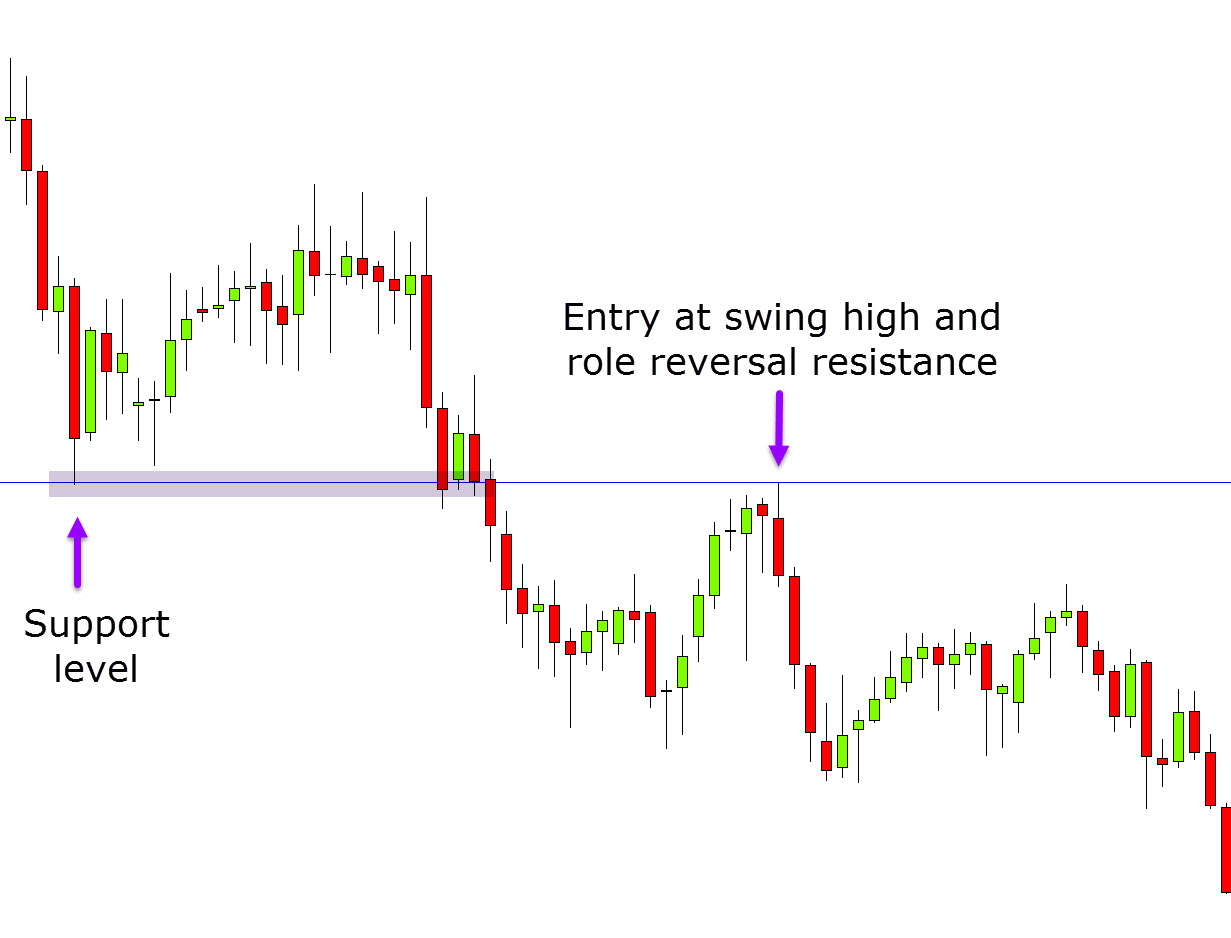

- Harness Technical Analysis: Decipher price action patterns, moving averages, and support and resistance levels to identify potential trading opportunities.

- Master Risk Management: Implement stop-loss orders and position sizing strategies to safeguard your capital and minimize potential losses.

- Monitor the Market: Keep a watchful eye on market news and economic indicators that may influence option prices.

- Choose Liquid Options: Focus on options with high trading volume to ensure efficient execution and minimize slippage.

- Continuously Educate: Dedicate time to honing your knowledge and skills. Attend webinars, read industry publications, and engage in discussions with fellow traders.

FAQ on Swing Trading Options

- What is the optimal holding period for swing trading options? Typically, swing trades are held for a few days to several weeks, allowing traders to capture market swings.

- How do I choose the right strike price for options? Consider the current market price, historical volatility, and your trading objectives when selecting a strike price.

- What are the risks associated with swing trading options? Market volatility, liquidity concerns, and time decay are inherent risks in swing trading options.

Embark on Your Swing Trading Journey

Whether you’re a seasoned trader or a novice eager to explore the world of swing trading options, the Thomset PDF is an indispensable companion. Its comprehensive guidance and expert insights will empower you to navigate market complexities and seize lucrative opportunities. Embrace the challenge, arm yourself with knowledge, and embark on a rewarding swing trading adventure.

Are you ready to delve deeper into the world of swing trading options and unlock its transformative potential? Let the Thomset PDF be your guide on this exciting journey.