In the heart-pounding world of option trading, timing is everything. The decision of which timeframe to embrace can profoundly shape your trading destiny, dictating your triumphs and mitigating your perils. Embark on this captivating journey as we delve into the intricacies of different timeframes, empowering you with the knowledge and strategies to conquer the ever-evolving market landscape.

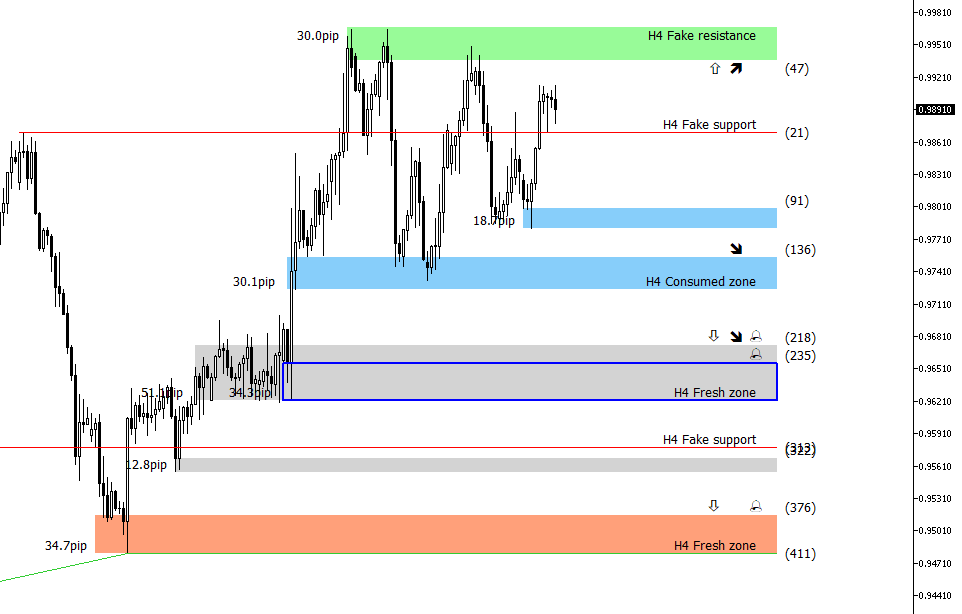

Image: www.mt4tradingbox.com

Timeframes Demystified: Laying the Foundation

A timeframe, in the realm of option trading, refers to the duration over which an option contract remains valid. This may range from a few minutes to several years, igniting a symphony of possibilities to align with your unique trading style and risk tolerance. Let’s unravel the tapestry of commonly encountered timeframes:

-

Scalping (Minutes to Hours): lightning-fast traders, scalpers seek fleeting profit opportunities within intraday price movements. Suitable for those with eagle-eyed focus and a tolerance for rapid-fire decision-making.

-

Day Trading (Within a Single Trading Day): confining their adventures to the ebb and flow of a single trading day, these traders hunt for market imbalances, capitalizing on short-term price fluctuations. Requires market savviness and the ability to maintain composure amidst market volatility.

-

Swing Trading (Days to Weeks): swing traders seek to harness intermediate-term trends, holding their positions for days or weeks at a time. Offers a more measured approach, catering to those with patience and the ability to identify emerging market trends.

-

Position Trading (Weeks to Months): embarking on an extended voyage, position traders navigate long-term market cycles, holding their positions for weeks or even months. Requires a profound understanding of market fundamentals and the ability to endure protracted periods of market fluctuations.

Choosing the Right Timeframe: Aligning Your Trading Style

In the realm of option trading, finding the perfect timeframe is akin to unearthing a hidden treasure. The optimal choice seamlessly aligns with your trading style, tolerance for risk, and available capital. Here’s a guiding compass to illuminate your path:

-

Capital Constraints: low capital levels may favor shorter timeframes, providing more frequent trading opportunities. Conversely, ample capital can empower you to navigate longer timeframes, allowing for more substantial position-sizing.

-

Risk Tolerance: if the thought of losing sleep over overnight market gyrations sends shivers down your spine, shorter timeframes might offer a soothing balm. For those with a higher tolerance for risk, longer timeframes can present the allure of amplified returns.

-

Trading Style: the restless spirit of a scalper thrives in the heart-stopping intensity of rapid trading, while the patient strategist revels in the chess-like maneuvers of position trading. Choose a timeframe that complements your inherent trading inclinations.

Expanding Horizons: Embracing Multiple Timeframes

Conquering the trading realm often demands the wisdom of embracing multiple timeframes. By harmonizing different perspectives, you can gain a holistic understanding of the market’s ebbs and flows, crafting a robust trading strategy. Consider the following strategic combinations:

-

Scalping and Swing Trading: detecting short-term opportunities while simultaneously capturing intermediate-term trends, blending agility with patience.

-

Day Trading and Position Trading: navigating the swift currents of intraday price movements while simultaneously positioning for longer-term market shifts, encompassing both short-term gains and strategic investments.

-

Combining All Timeframes: orchestrating a symphony of timeframes, scalpers can seize fleeting profits, day traders can capitalize on short-term trends, swing traders can harness intermediate-term momentum, and position traders can capture long-term market cycles, maximizing profit potential.

Image: taniforex.com

Expert Insights: Navigating the Trading Seas

In the treacherous waters of option trading, the counsel of seasoned traders serves as an invaluable beacon. Here, glean the wisdom of experts who have weathered market storms and emerged victorious:

-

“Timing is paramount in option trading. Choosing the right timeframe can make or break your strategy.” – Mark Douglas, renowned trading psychologist.

-

“Shorter timeframes can be exhilarating, but they also demand intense focus and rapid decision-making. Longer timeframes offer more room for analysis, but patience is key.” – Kathy Lien, acclaimed forex analyst.

Which Timeframe Is Best For Option Trading

Conclusion: Embracing the Power of Time

In the intricate world of option trading, mastering the art of timeframe selection is a cornerstone of enduring success. Whether you prefer the adrenaline rush of scalping or the strategic elegance of position trading, understanding the intricacies of each timeframe empowers you to craft a personalized trading strategy that aligns with your ambitions and strengths. Remember, the optimal timeframe is not etched in stone but rather a fluid concept that adapts to your evolving trading journey. Embrace the power of time and unlock the full potential of option trading.

As you venture forth on this thrilling path, remember that learning is a continuous odyssey. Immerse yourself in educational resources, engage with trading communities, and never cease to explore the ever-evolving landscape of option trading. May your quest for knowledge and prosperity lead you to a horizon of boundless possibilities.