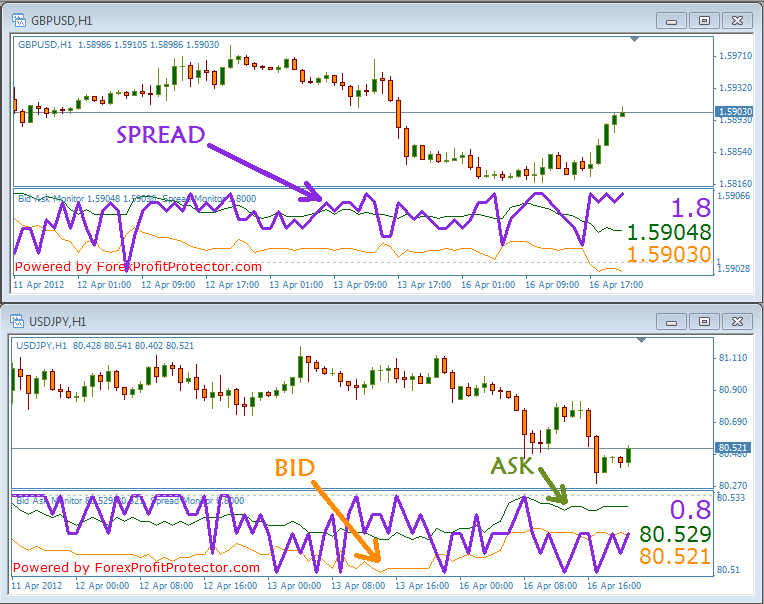

When you’re option trading, the bid-ask spread is the difference between the highest price someone is willing to pay for an option (the bid) and the lowest price someone is willing to sell it for (the ask). This spread is important because it affects how much you’ll pay or receive when you trade options.

Image: forexprofitprotector.com

In a perfect world, the bid-ask spread would be zero. This would mean that there would be no difference between the price you could sell an option for and the price you could buy it for. However, in reality, the bid-ask spread is always greater than zero. This is because market makers, who are the people who facilitate option trades, need to make a profit.

The Impact of the Bid-Ask Spread

The bid-ask spread can have a significant impact on your option trading profits. If the spread is wide, it will be more difficult to make a profit. This is because you’ll have to pay more to buy an option and you’ll receive less when you sell it.

For example, let’s say you want to buy an option that has a bid price of $1.00 and an ask price of $1.05. If you buy the option at the ask price, you’ll have to pay $1.05 for it. However, if you sell the option at the bid price, you’ll only receive $1.00 for it. This means that you’ll lose $0.05 on the trade, even if the option’s price doesn’t change.

How to Minimize the Impact of the Bid-Ask Spread

There are a few things you can do to minimize the impact of the bid-ask spread on your option trading profits.

- Trade during high-volume trading hours. The bid-ask spread is typically widest during low-volume trading hours. This is because there are fewer market makers available to trade options, which makes it more difficult to find a buyer or seller who is willing to trade at a favorable price.

- Trade liquid options. Liquid options are options that have a high trading volume. This means that there are always market makers available to trade these options, which makes it easier to find a buyer or seller who is willing to trade at a favorable price.

- Use limit orders. A limit order is an order to buy or sell an option at a specific price. This can help you to avoid getting filled at an unfavorable price.

- Be patient. Don’t be afraid to wait for the bid-ask spread to narrow before you trade an option. This can help you to get a better price on your trade.

Conclusion

The bid-ask spread is an important factor to consider when option trading. By understanding the impact of the spread and taking steps to minimize its impact, you can improve your chances of making a profit.

Are you interested in learning more about the bid-ask spread? If so, please leave a comment below and I’ll be happy to provide you with additional information.

Image: coinmarketcap.com

Why Does The Bid Ask Spread Matter When Option Trading

Image: www.youtube.com

FAQs

- What is the bid-ask spread? The bid-ask spread is the difference between the highest price someone is willing to pay for an option (the bid) and the lowest price someone is willing to sell it for (the ask).

- Why does the bid-ask spread matter? The bid-ask spread affects how much you’ll pay or receive when you trade options.

- How can I minimize the impact of the bid-ask spread? You can minimize the impact of the bid-ask spread by trading during high-volume trading hours, trading liquid options, using limit orders, and being patient.