Introduction

In the realm of options trading, controlling risk is paramount. One powerful tool that traders employ is the One Cancels the Other (OCO) order. This ingenious strategy allows traders to simultaneously place two contrasting orders with the stipulation that only one can be executed. By understanding the mechanics and effective implementation of OCO orders, traders can significantly enhance their risk management practices and safeguard their capital.

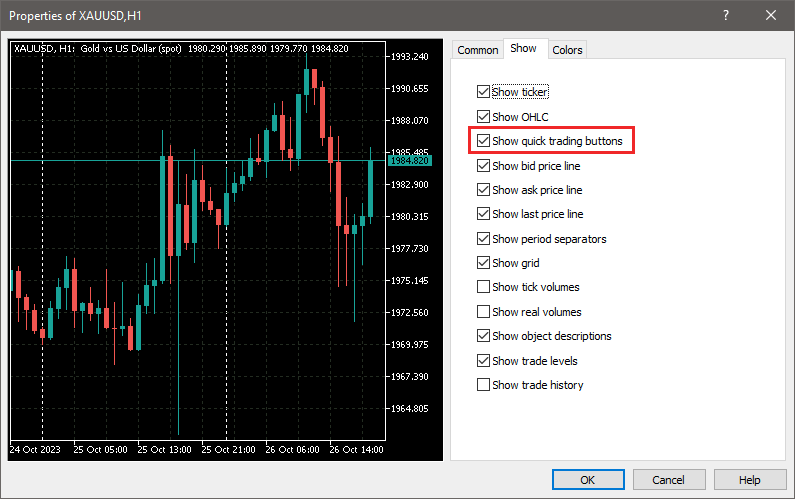

Image: www.mql5.com

Understanding OCO Orders

An OCO order consists of two contingent orders placed on the same underlying asset. Upon the execution of one order, the other is automatically canceled. This mechanism ensures that only one of the two orders is executed, preventing simultaneous trades that could lead to substantial losses.

Types of OCO Orders

OCO orders fall into two primary categories:

-

Limit OCO: Involves placing both a limit order (to buy or sell at a specific price) and a stop order (to buy or sell at a specified threshold price).

-

Market OCO: Consists of pairing a market order (to buy or sell at the current market price) with a stop order.

Applications of OCO Orders

OCO orders serve multiple purposes in options trading:

-

Loss Mitigation: Traders can establish a stop order as part of an OCO to limit potential losses if the underlying asset price moves against their position.

-

Profit Taking: By setting a limit order as part of an OCO, traders can automatically lock in profits when the price reaches a desired level.

-

Market Volatility Management: OCO orders allow traders to prepare for both bullish and bearish market movements. They can enter a market order to capitalize on a sudden price surge while setting a stop order to protect their profits in case of a reversal.

Image: heraldsheets.com

Expert Insights on Using OCO Orders

-

“OCO orders provide a potent risk management tool, enabling traders to determine their acceptable risk-reward ratio and execute trades with confidence.” – John Carter, renowned derivatives trader

-

“Leverage OCO orders to define your trading strategy beforehand, removing the need for emotional decision-making in volatile markets.” – Larry Connors, best-selling trading author

-

“Practice utilizing OCO orders in a paper trading account before implementing them in live trading to gain proficiency.” – Steven Goldstein, options trading instructor

Actionable Tips for Optimal OCO Execution

-

Determine clear entry and exit points for your trades before placing OCO orders.

-

Set realistic price targets to avoid overreaching or underestimating market potential.

-

Monitor market conditions closely to anticipate price movements and adjust your OCO orders accordingly.

-

Consider using a reputable online brokerage that supports OCO order functionality.

One Cancels Other Trading With Options

Image: support.zerodha.com

Conclusion

One Cancels the Other (OCO) trading with options offers a sophisticated approach to risk management, empowering traders to enter and exit positions with greater confidence and discipline. By embracing OCO orders as part of their trading arsenal, traders can mitigate potential losses, capture profits, and adapt to market volatility effectively. Remember to approach OCO trading with an informed and strategic mindset, utilizing the insights of experts and practicing proper execution to maximize its benefits.