Introduction

In the realm of financial markets, options trading has emerged as a potent force, attracting both experienced investors and retail traders alike. Among the financial institutions that have played a pivotal role in shaping the retail options trading landscape stands Barclays, a global banking and financial services leader. This article delves into the multifaceted impact of Barclays on retail options trading, exploring its historical contributions, innovative offerings, and potential effects on the market’s future.

Image: tradingplatforms.com

Barclays’ Pioneering Role

Barclays traces its roots in options trading back to the 1990s, when it played a pioneering role in introducing retail options to the UK market. Through strategic acquisitions and partnerships, the bank established itself as a leading provider of options products and services for retail investors. Its expertise in risk management and market analysis positioned Barclays as a trusted partner for traders seeking guidance and execution capabilities.

Innovative Product Development

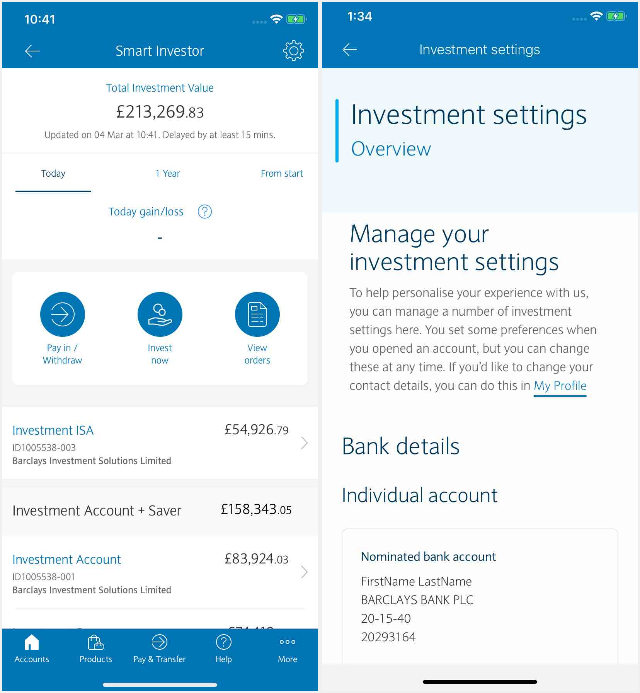

Barclays has consistently pushed the boundaries of innovation in retail options trading. It was among the first institutions to introduce online options trading platforms, providing traders with convenient and efficient access to the markets. Moreover, Barclays recognized the growing need for personalized investment solutions and developed a suite of tailored options strategies designed to meet the specific needs of retail investors.

Educational Initiatives and Thought Leadership

Beyond its product offerings, Barclays has played a vital role in educating retail traders about the complexities of options trading. The bank has published numerous articles, guides, and webinars that empower traders with knowledge, empowering them to make informed decisions. Barclays’ thought leadership extends to industry-leading research and insights that shape market conversations and influence market trends.

Image: info.techwallp.xyz

Market Access and Liquidity

Barclays serves as a key market maker for retail options, ensuring liquidity and competitive pricing for traders. Its extensive network of market participants, including broker-dealers and institutional investors, helps facilitate seamless execution of options orders. As a result, retail traders have access to a broad range of options contracts and can execute their trades with confidence and efficiency.

Potential Impact on the Future of Retail Options Trading

Barclays’ influence on retail options trading is likely to continue shaping the market’s trajectory in the years to come. As technology advances and new innovations emerge, Barclays is well-positioned to leverage its expertise and adapt its offerings to meet the evolving needs of traders. The bank’s commitment to innovation, education, and market access will continue to foster growth and empower retail participants in the options trading arena.

Barclays Impact Of Retail Options Trading

Conclusion

Barclays has played a transformative role in the evolution of retail options trading, from its pioneering efforts in the 1990s to its ongoing commitment to innovation and trader education. Through its diverse offerings, comprehensive educational initiatives, and exceptional market access, Barclays has empowered countless retail investors to navigate the options markets with confidence. As the market continues to expand and evolve, Barclays is poised to remain a key player, shaping the future of retail options trading and contributing to the financial success of its clients.