Introduction

The Barclays option trading strategy has gained prominence as a sophisticated technique for skilled traders seeking to maximize their potential in the financial markets. Options, as financial instruments derived from underlying assets such as stocks or commodities, provide traders with the opportunity to leverage price movements and generate substantial returns. This article delves into the intricate details of the Barclays option trading strategy, empowering traders with the knowledge and tools to implement this strategy effectively.

Image: www.deccanchronicle.com

Understanding the Basics

An option is a derivative contract that grants the buyer the right, but not the obligation, to buy or sell the underlying asset at a predefined price on or before a specified date. The Barclays option trading strategy involves utilizing a combination of call and put options to potentially profit from price fluctuations in either direction. Call options grant the buyer the right to buy the underlying asset, while put options grant the right to sell it.

Features of the Strategy

The Barclays option trading strategy is characterized by its distinctive features that enable traders to address complex market conditions:

- Hedging for Risk: The strategy utilizes both call and put options simultaneously to hedge against potential losses caused by adverse price movements.

- Flexibility and Versatility: Traders can adjust the strike prices and expiration dates of the options to tailor the strategy to different market conditions and risk profiles.

- Capital Efficiency: The strategy can be implemented with relatively low upfront capital compared to traditional stock trading.

How it Works

The Barclays option trading strategy involves the following steps:

- Market Analysis: Conduct thorough market research to identify potential trading opportunities.

- Strategy Formulation: Determine the strike prices, expiration dates, and quantities of call and put options to be traded.

- Trade Execution: Execute the trades through a reputable brokerage platform.

- Monitor and Adjust: Continuously monitor the performance of the options and make necessary adjustments to optimize returns.

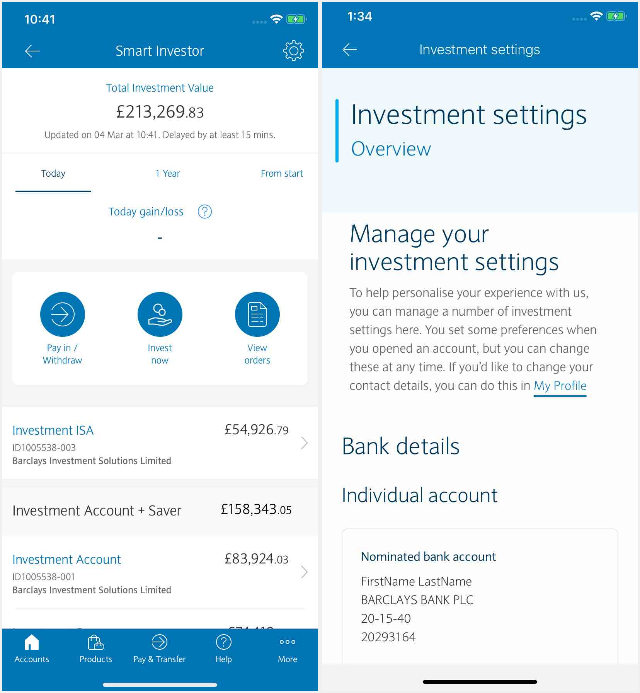

Image: tradingplatforms.com

Examples and Applications

To illustrate the practical applications of the Barclays option trading strategy, consider the following examples:

- Bullish Expectation: If anticipating an upward trend in the stock market, traders can buy a call option with a strike price higher than the current market price. Simultaneously, they can sell a put option with a strike price slightly below the market price to limit potential losses.

- Bearish Expectation: Conversely, if traders anticipate a market downturn, they can buy a put option with a strike price lower than the current market price. Additionally, they can sell a call option to generate income and further enhance their position.

- Potential for substantial returns

- Flexibility and adaptability to different market conditions

- Capital efficiency compared to traditional stock trading

- Complexity and risk involved, requiring a high level of trading skill

- Costs associated with option premiums

- Time decay of options, impacting potential returns

Advantages and Disadvantages

Like any trading strategy, the Barclays option trading strategy offers unique advantages and disadvantages:

Advantages:

Disadvantages:

Barclays Option Trading Strategy

https://youtube.com/watch?v=SDFatD2IKXY

Conclusion

The Barclays option trading strategy is a powerful technique for skilled traders seeking to maximize their returns in the financial markets. Its unique combination of call and put options enables traders to hedge risk, adapt to changing conditions, and potentially generate substantial profits. However, it is crucial to approach this strategy with a deep understanding of option trading principles, effective risk management, and continuous market surveillance. For those who possess the necessary expertise and risk tolerance, the Barclays option trading strategy can be a valuable tool in their financial arsenal.