Unveiling the Significance of OI in Options Markets

Options trading, a dynamic realm of risk management and speculative opportunities, revolves around contracts that grant the right, but not the obligation, to buy or sell an underlying asset at a specified price on a predetermined date. At the heart of this trading arena, open interest (OI) emerges as a critical indicator that mirrors market sentiment and provides invaluable insights into price and volatility dynamics.

Image: www.tradingview.com

Defining Open Interest

In the lexicon of options trading, open interest refers to the aggregate number of outstanding contracts for a particular option, whether they are calls or puts. These contracts represent the total number of options contracts that have been bought and not yet sold or exercised. Think of it as the tally of all options agreements that are actively engaged in the market at any given moment.

Understanding OI’s Significance

Open interest serves as a potent barometer for gauging market sentiment and assessing the level of participation in option contracts. A sizeable OI suggests heightened market involvement, indicating substantial activity surrounding a specific option or underlying asset. As a result, traders closely monitor OI to discern the direction and intensity of market sentiment towards an option.

Moreover, OI offers valuable information about option pricing and volatility. A significant increase in OI often coincides with heightened volatility, as traders seek to hedge against potential price fluctuations or position themselves for speculative profits. Conversely, a substantial decline in OI suggests waning market interest and potential price stability.

Exploring the Nuances of OI in Option Strategies

Traders can leverage the insights provided by open interest to strategize their option trades effectively:

Image: en.rattibha.com

a) Identifying Trend Reversals:

A surge in OI on the side opposite to the prevailing trend can signal a potential trend reversal. For instance, if an underlying asset exhibits a downtrend but witnesses a substantial increase in call options OI, it may hint at an impending upward price movement.

b) Assessing Market Support and Resistance Levels:

Heavier OI at specific strike prices may indicate potential support or resistance levels in the underlying asset’s price. These concentrations of contracts reflect the number of traders anticipating price movements in those areas.

c) Gauging Implied Volatility:

Open interest can also provide clues about implied volatility. Typically, higher OI corresponds with elevated implied volatility, as traders are pricing in more significant potential price fluctuations. Conversely, low OI generally equates to lower implied volatility.

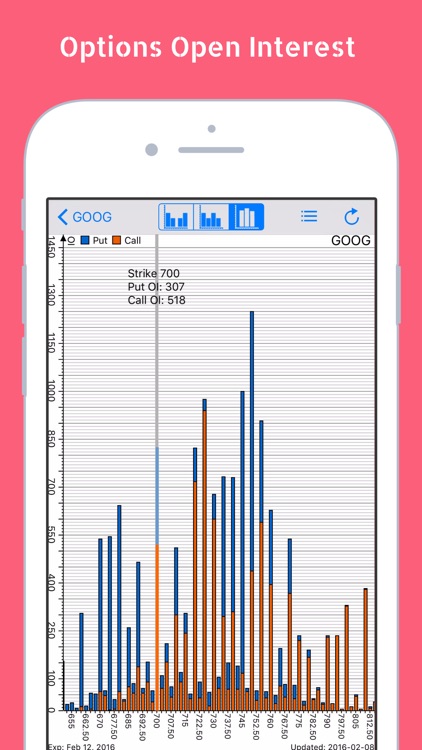

What Is Oi In Options Trading

Image: appadvice.com

Conclusion

Unveiling the implications of open interest for options traders empowers them with potent market intelligence. By analyzing and interpreting OI, traders can gain valuable insights into market sentiment, price dynamics, and volatility trends. These insights arm them to make informed decisions, fine-tune trading strategies, and navigate the complexities of options markets successfully.