Day Trading Options: Mastering the Art of Momentum Investing

Image: stockmarketsguides.com

Introduction

In the fast-paced world of investing, traders seek strategies that provide quick gains. Among the most lucrative options lies day trading options, a thrilling yet demanding approach that capitalizes on short-term price fluctuations. One effective strategy within this realm is the momentum strategy, which leverages the power of market momentum to identify and exploit profitable opportunities. In this article, we will delve into the intricacies of day trading options using the momentum strategy, empowering traders with the knowledge and tools to navigate this volatile marketplace.

Understanding Momentum in Options Trading

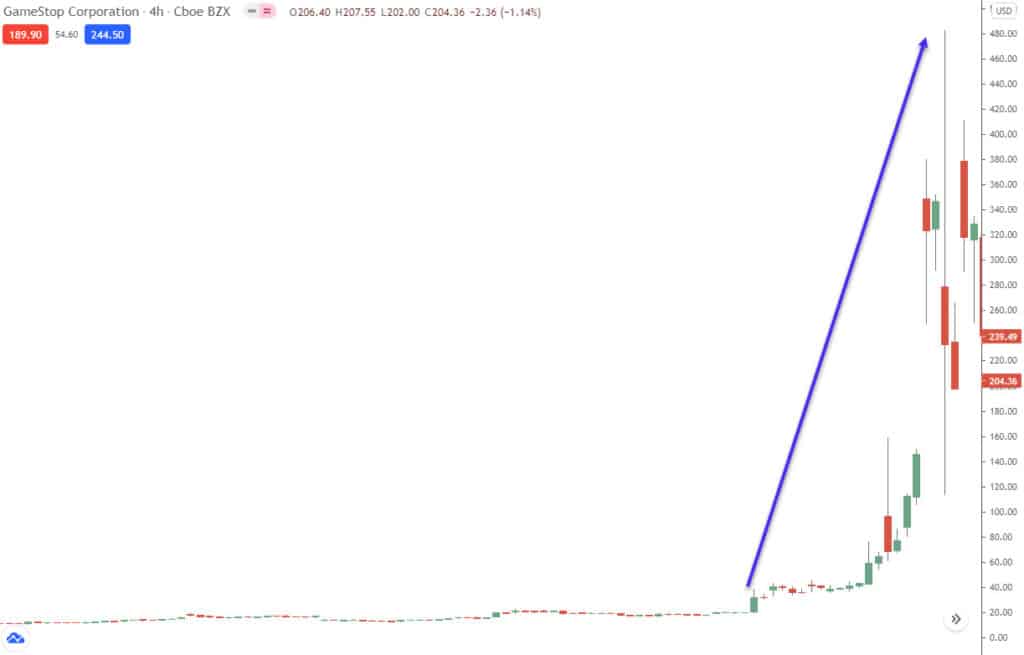

Momentum in financial markets refers to the directional bias of a security’s price over a specific period. The momentum strategy exploits this bias by identifying setups where the price is consistently moving in a particular direction, whether upward or downward. By identifying and trading in line with this momentum, traders aim to capture substantial profits by riding the wave of market sentiment.

Steps in Implementing the Momentum Strategy

Implementing the momentum strategy requires a systematic approach. Traders typically follow these steps:

- Identify a Momentum Indicator: Begin by choosing a momentum indicator that aligns with your trading style and market conditions. Popular indicators include Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD).

- Determine the Momentum’s Direction: Analyze the chosen momentum indicator to determine the price’s directional bias. For instance, if the RSI is above 70, it suggests the price is overbought and momentum is bullish. Conversely, values below 30 indicate overselling and bearish momentum.

- Set Entry and Exit Points: Establish clear entry and exit points based on the momentum indicator’s signals. For instance, enter a buy trade when the RSI crosses above 70 and exit when it falls below 60.

- Manage Risk: Implement strict risk management strategies, such as setting stop-loss and take-profit orders, to limit potential losses and secure gains.

Tips and Best Practices

- Short Time Frames: Momentum strategies typically focus on time frames ranging from 15 minutes to 1 hour, capitalizing on short-term price fluctuations.

- Liquidity and Volatility: Opt for options with high liquidity and volatility to ensure timely execution and amplify profit potential.

- Technical Support and Resistance: Utilize technical analysis to identify support and resistance levels, providing potential entry and exit points that align with market trends.

- Trend Confirmation: Confirm the momentum’s direction using multiple momentum indicators or additional technical analysis tools.

- Emotional Discipline: Maintain emotional stability and avoid impulsive trading decisions. Stick to your trading plan and rules to avoid irrational deviations.

Conclusion

Mastering the momentum strategy in day trading options requires a combination of technical knowledge, analytical skills, and emotional discipline. By understanding market momentum, traders can identify and exploit short-term price movements, unlocking substantial profit opportunities. However, it is crucial to note that day trading involves substantial risk and should only be undertaken by experienced traders with a comprehensive understanding of the markets and trading strategies.

Image: admiralmarkets.com

Day Trading Options The Momentum Strategy

Image: www.netpicks.com