Imagine the thrill of venturing into the trading arena, where calculated risks can yield significant rewards. Option trading, a realm of both excitement and potential, presents intriguing opportunities for savvy investors. Among the fundamental concepts to grasp in this domain is the strike price – a pivotal element that sets the stage for strategic decisions.

Image: www.learn-stock-options-trading.com

Unveiling the Strike Price: A Defining Element

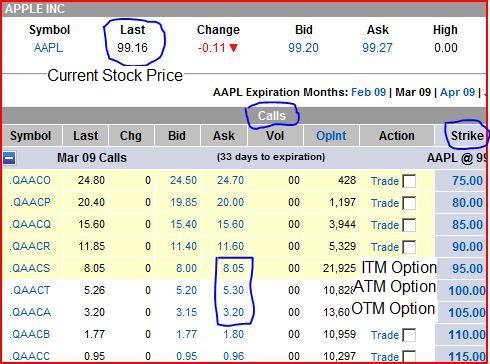

In the world of options, a strike price is the predetermined price level at which an option contract can be exercised. This critical parameter holds immense significance, acting as a benchmark against which the value of the option is measured. When it comes to options, there are two primary types: call options and put options. A call option grants the holder the right, but not the obligation, to buy an underlying asset at the strike price before a specific expiration date. Conversely, a put option entitles the holder to sell the underlying asset at the strike price.

Navigating the Dynamics of Strike Prices

The strike price plays a crucial role in determining the outcome of an option trade. If the market price of the underlying asset exceeds the strike price, a call option holder will exercise the right to buy the asset at a favorable price, potentially profiting from the price differential. In the case of a put option, if the market price falls below the strike price, the holder can capitalize by selling the asset at a higher price than its current market value.

However, the converse is equally true. If the market price of the underlying asset falls below the strike price for a call option or rises above the strike price for a put option, the option will expire worthless, resulting in a loss for the holder. Therefore, selecting the appropriate strike price is paramount to successful option trading.

The Journey of Determining the Ideal Strike Price

As aspiring option traders embark on their strategic pursuits, they must develop a keen eye for identifying optimal strike prices. Several factors come into play when making this crucial decision:

/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)

Image: cuartoymita.net

Market Trends and Volatility:

Thoroughly analyzing market trends and volatility patterns helps traders gauge the potential future direction of the underlying asset’s price. This forms the foundation for selecting strike prices that align with their investment objectives.

Time Value of Options:

The time value of an option, which represents its intrinsic value, also influences strike price selection. Traders must consider the time remaining until the option’s expiration date and factor in the potential for fluctuations in the underlying asset’s price within that timeframe.

Trading Strategy:

The choice of strike price is directly influenced by a trader’s specific strategy. Whether aiming for short-term gains through day trading or pursuing longer-term investments, the strike price should align with the desired strategy and risk tolerance level.

Empowering Traders with Expert Insights

Seasoned traders often emphasize the significance of strike price selection. They have learned valuable lessons through experience, including the importance of:

-

Setting Realistic Expectations: Traders should avoid chasing high premiums and instead focus on selecting strike prices that offer a balance between potential profitability and risk mitigation. Attempting to time market fluctuations precisely is a challenging endeavor, and setting realistic expectations can help traders avoid unnecessary losses.

-

Understanding Market Dynamics: Staying abreast of current events, news, and economic indicators is essential. By keeping a pulse on market conditions, traders can make informed decisions about strike prices and adjust their strategies accordingly.

-

Trading Cautiously: Option trading involves inherent risks, and traders should approach it with a prudent mindset. Carefully managing risk by selecting appropriate strike prices and using proper position sizing is crucial to preserving capital.

What Is A Strike In Option Trading

Image: www.youtube.com

The Path Forward for Aspiring Option Traders

Embracing the lessons shared by experienced traders, aspiring option traders can embark on their own journeys with a deepened understanding of strike prices and their impact on trading outcomes. By continually seeking knowledge, honing their analytical abilities, and practicing discipline in their trading strategies, they can increase their chances of success in this dynamic and rewarding arena.

Remember, option trading offers immense potential for profit but also carries inherent risks. Approaching it with a well-informed mindset, a strategic approach, and a patient demeanor is the key to unlocking the opportunities it presents.