Title: Unveiling the Significance of Open Interest in Options Trading: A Guide to Understanding Market Sentiment

Image: www.anak2u.com.my

Prologue:

In the realm of options trading, where every trade carries the potential for significant gains and equally substantial losses, understanding the market’s pulse is crucial. Amidst a plethora of indicators, open interest stands out as a powerful tool for gauging trader sentiment and assessing market conditions. Embark on this informative journey to delve into the enigmatic world of open interest and its implications for savvy options traders.

Understanding Open Interest

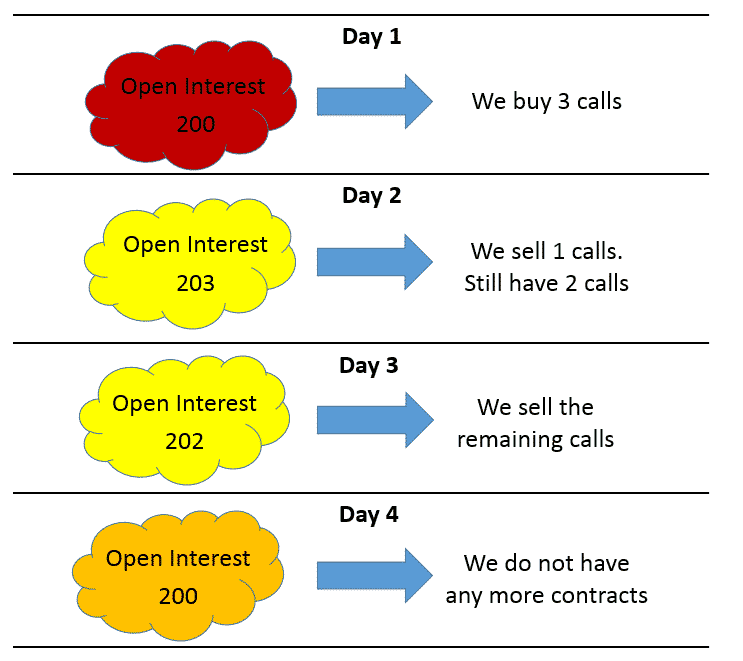

Open interest, simply put, represents the aggregate of all outstanding options contracts at a specific point in time. It reflects the number of options that have been bought and sold but have not yet been exercised or expired. As an options trader, monitoring open interest empowers you to gauge the market’s stance towards a particular underlying asset.

Decoding Open Interest Trends

A rising open interest level signifies an influx of new contract creation in the market. This surge often indicates that traders anticipate significant price movement for the underlying asset in the near future. Conversely, a decline in open interest suggests that existing contracts are being closed or not replaced, potentially signifying a cooling of trader sentiment.

Assessing Market Direction

Open interest can also serve as a directional indicator. Generally, a persistent increase in open interest alongside rising prices is seen as a bullish trend. It suggests that more traders are entering the market with bullish bets, expecting the asset’s price to appreciate further. On the other hand, a simultaneous increase in open interest and declining prices may signal a bearish trend, as traders hedge their positions or bet on further price declines.

Sentiment Analysis and Volatility Expectations

Observing open interest can offer insights into speculative and hedging activities in the market. High open interest often correlates with heightened market volatility, as traders anticipate a period of significant price fluctuations. Additionally, changes in open interest can help identify when institutions or large traders are entering or exiting the market.

Limitations of Open Interest

While open interest is a valuable tool, it’s important to note its limitations. Open interest does not provide information about the specific strike prices or expiration dates of the contracts, which can impact the interpretation of market sentiment. Moreover, it only captures data on open contracts and does not consider contracts that have already been closed.

Practical Applications for Traders

Skilled options traders leverage open interest as a key component of their market analysis arsenal. By monitoring the absolute level of open interest and its trajectory, they can gain valuable insights into market sentiment. Additionally, observing changes in open interest relative to price movements allows traders to identify potential turning points and adjust their trading strategies accordingly.

Conclusion:

Open interest, a dynamic metric in options trading, provides a window into the collective mindset of market participants. By understanding its significance, traders can gain a competitive edge. However, it’s crucial to approach open interest analysis with caution and in conjunction with other indicators to make informed trading decisions. As you embark on your options trading journey, remember to harness the power of open interest to gauge market sentiment, assess volatility expectations, and navigate market trends with greater confidence.

Image: warsoption.com

What Does Open Interest Signify In Options Trading

Image: www.timothysykes.com