Introduction:

Image: db-excel.com

Options trading can be a lucrative and complex investment strategy that requires meticulous planning and tracking. Managing multiple options positions simultaneously can be daunting, especially without the right tools. This is where options trading tracker Excel templates come into play. By leveraging the versatility and computational power of Excel, these trackers offer traders a comprehensive solution to monitor their options trading activity, make informed decisions, and maximize profitability.

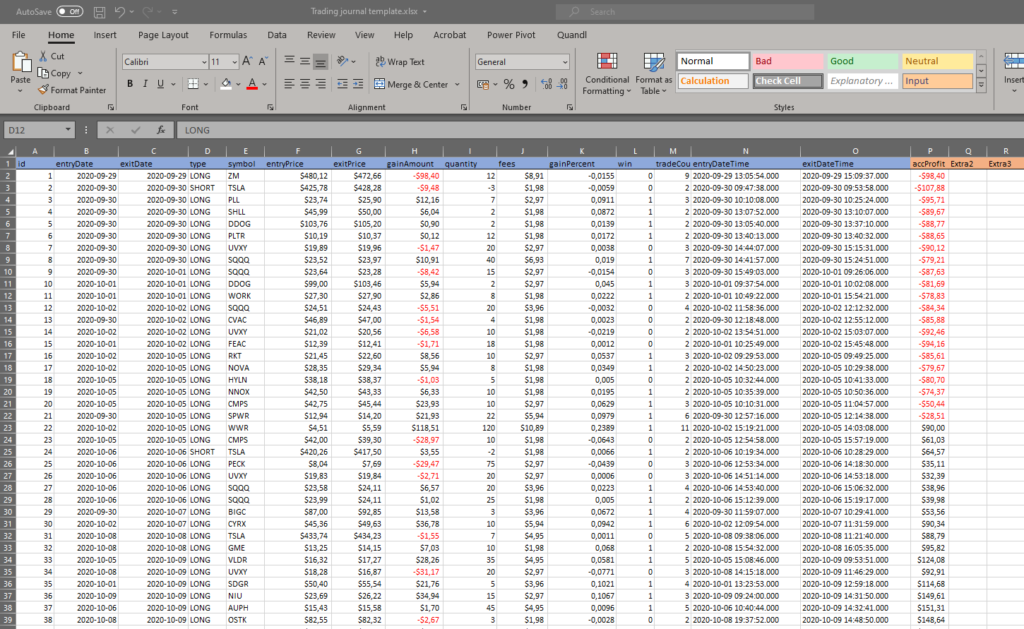

Understanding Options Trading Trackers

An options trading tracker is a spreadsheet that consolidates key data related to options positions. It typically includes information such as the underlying asset, option type (call or put), expiration date, strike price, premium paid, number of contracts, and profit/loss. By aggregating this data, traders can gain a clear overview of their portfolio’s performance and identify potential opportunities or risks.

Benefits of Using Excel Options Trading Trackers

Excel-based options trading trackers offer several advantages:

- Customization: Traders can tailor their trackers to meet their specific needs, adding or removing columns and data fields as necessary.

- Real-time Updates: With real-time Excel formulas, trackers automatically update as market conditions change, providing traders with the most up-to-date information.

- Time-Saving: Tracking options positions manually can be time-consuming. Excel trackers automate this process, saving traders valuable time that can be used for analysis and decision-making.

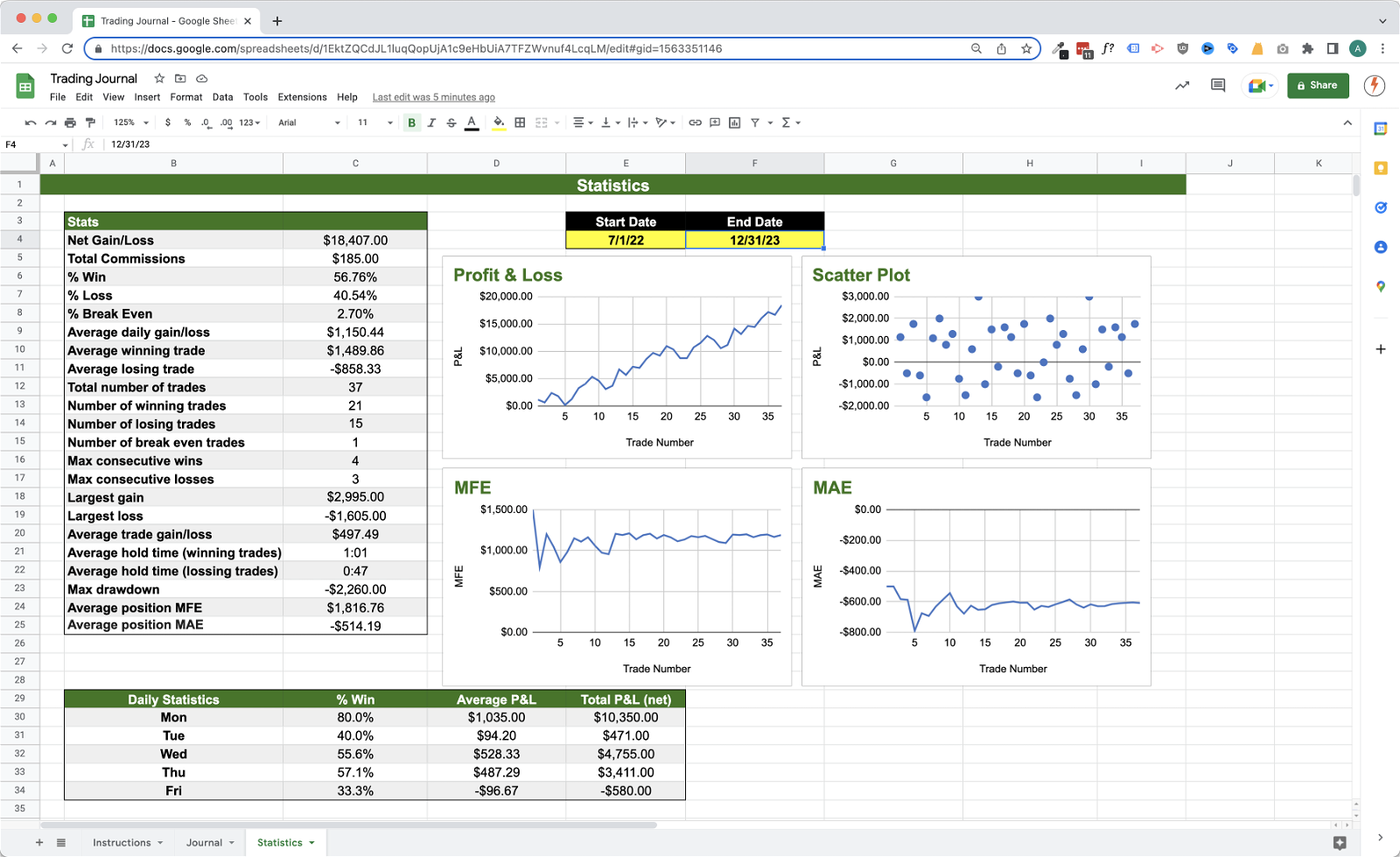

- Visual Analysis: Charts and graphs generated within the tracker provide a visual representation of portfolio performance, making it easier to identify trends and patterns.

- Error Reduction: Automated calculations and formulas in Excel trackers reduce the likelihood of errors, ensuring accuracy in portfolio management.

Creating an Options Trading Tracker in Excel

Creating an options trading tracker in Excel involves setting up a spreadsheet with the following columns:

- Underlying Asset: Name of the asset on which the option is based.

- Option Type: Call or Put.

- Expiration Date: Date on which the option expires.

- Strike Price: Exercise price of the option.

- Premium Paid: Price paid per share for the option contract.

- Number of Contracts: Number of option contracts purchased or sold.

- Profit/Loss: Calculated based on the current market price of the underlying asset and option premium.

Additional columns can be added to track parameters such as break-even points, target profit, and risk tolerance.

Using Options Trading Trackers Effectively

To maximize the benefits of options trading trackers, consider the following best practices:

- Use a Consistent Layout: Maintain a standardized format across all your tracking spreadsheets to ensure ease of comparison and analysis.

- Keep It Organized: Enter data accurately and regularly to ensure the tracker remains a reliable tool for decision-making.

- Set Realistic Goals: Determine your profit targets and risk tolerance before entering trades to guide your decision-making process.

- Monitor Performance: Track portfolio performance regularly to identify underperformers, adjust positions, and learn valuable trading lessons.

Conclusion

Options trading tracker Excel templates empower traders by providing a comprehensive and customizable platform for tracking and analyzing options positions. By harnessing the power of Excel, these trackers offer real-time updates, error reduction, time-saving, and visual analysis capabilities that are essential for successful options traders. Embrace the advantages of options trading trackers and transform your portfolio management strategy for improved profitability and decision-making.

Image: kinfo.com

Options Trading Tracker Excel

Image: www.jumpstarttrading.com