The Allure of Option Trading

“The thrill of trading options has always intrigued me,” recalls Sarah, a seasoned investor. “The potential for exponential gains, combined with the ability to hedge my portfolio, seemed like the perfect playground.”

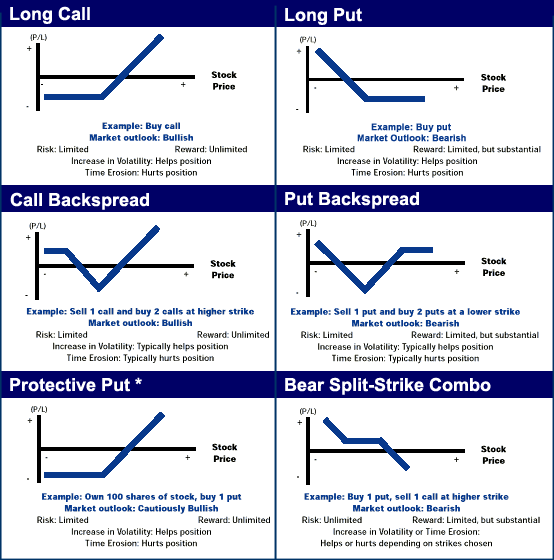

Image: tradeproacademy.com

But Sarah’s initial excitement soon turned into a rollercoaster of emotions. The complexities of option trading, coupled with the high-stakes nature of the market, left her overwhelmed and searching for guidance. Her quest led her to explore free option trading strategies, paving the way for a newfound understanding and confidence in this enigmatic financial realm.

Demystifying Option Trading: A Path To Empowerment

Options are financial contracts that grant buyers the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price (strike price) on a specific date (expiration date). The flexibility of options, coupled with their potential for both profit and loss, makes them an alluring and potentially profitable instrument for investors of all levels.

However, navigating the labyrinth of option trading requires a strategic mindset and a comprehensive understanding of key concepts such as time decay, option greeks, and volatility. Embarking on this journey with free option trading strategies can provide a valuable roadmap for beginners, empowering them with the knowledge and confidence to make informed trading decisions.

Navigating Key Option Trading Concepts

Time Decay: Options are time-sensitive instruments; their value erodes as time passes, regardless of market movements.

Option Greeks: These mathematical quantities measure the sensitivity of an option’s price to changes in underlying asset price, time, volatility, and interest rates.

Volatility: This metric captures the magnitude of price fluctuations in the underlying asset, directly impacting option pricing and trading strategies.

Understanding these concepts equips traders with the tools to mitigate risks and optimize returns in the dynamic world of option trading.

Unveiling Free Option Trading Strategies: A Blueprint for Success

Covered Call Strategy: This strategy involves selling (writing) a call option against a stock you own. The goal is to generate income from the option premium while retaining the underlying stock.

Cash-Covered Put Strategy: Similar to the covered call strategy, this involves selling (writing) a put option against cash. If the put is exercised, the trader is obligated to buy the underlying asset at the strike price.

Bull Call Spread: This strategy involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price, both with the same expiration date. The trader profits from an increase in the underlying asset price within a predetermined range.

Bear Put Spread: The inverse of the bull call spread, this strategy involves selling a put option at a lower strike price and buying a put option at a higher strike price. The trader profits from a decline in the underlying asset price within a specific range.

These free option trading strategies provide a solid foundation for beginners, offering a structured approach to harness the potential of options while effectively managing risks.

Image: rmoneyindia.com

Expert Tips for Flourishing in the Options Market

Start Small: Begin with modest trades to gain familiarity with option trading mechanics and risk management.

Educate Yourself: Continuously seek knowledge and understanding of options concepts, strategies, and market dynamics.

Use a Paper Trading Account: Test and refine your strategies in a risk-free environment before venturing into live trading.

Monitor Market Conditions: Stay alert to macroeconomic events, earnings reports, and other factors that can impact option prices.

By integrating these expert tips into your trading approach, you can enhance your decision-making and increase your chances of success.

Frequently Asked Questions: Unraveling Option Trading Perplexities

Q: Is option trading suitable for beginners?

A: With proper education and risk management, beginners can navigate option trading and potentially reap its rewards.

Q: Can you lose more than you invested in option trading?

A: Yes, incorrect trading decisions can lead to substantial losses, exceeding the initial investment amount.

Q: What is the best free option trading strategy for beginners?

A: The covered call strategy is a suitable starting point for novices, offering a balanced approach between risk and reward.

Q: How long does it take to learn option trading?

A: The learning curve varies depending on an individual’s commitment and aptitude, but expect to dedicate time and effort to grasp the intricacies.

Free Option Trading Strategies

Image: seekingalpha.com

Embrace the Future of Option Trading

The realm of option trading is constantly evolving, with new strategies, technologies, and market dynamics emerging. To thrive in this ever-changing landscape, it is imperative to embrace the spirit of continuous learning and adaptation.

Engage in industry forums, follow reputable trading blogs, and leverage educational resources to stay abreast of the latest trends and developments. This proactive approach will empower you to make informed decisions, optimize your trading strategies, and unlock the true potential of free option trading.

Are you ready to embark on a journey into the dynamic world of option trading? Seize the opportunity to equip yourself with free option trading strategies, expert advice, and a quenchless thirst for knowledge. The path to financial empowerment lies before you—take the first step today.