Binary options trading, a high-stakes financial instrument, has emerged as a viable trading option for investors seeking both high returns and calculated risks. With its straightforward premise and range of underlying assets, binary options have attracted traders from all walks of life. However, when it comes to the currency used in binary options trading, the landscape can be a bit murky. Understanding the currency dynamics is paramount for navigating this volatile market effectively.

Image: www.fontype.co.il

The Fundamentals: Base Currency and Asset Currency

At the core of binary options trading lies the interplay between two currencies: the base currency and the asset currency. The base currency is the currency in which the trader’s account is denominated, while the asset currency is the currency of the underlying asset being traded. For instance, if a trader holds a binary options account in USD (US dollar) and trades an asset priced in EUR (euro), the EUR would be the asset currency.

Diverse Choice of Base Currencies

Binary options brokers offer a range of base currencies to accommodate traders from different geographical regions and financial backgrounds. USD remains the most prevalent base currency, thanks to its global acceptance and stability. However, other popular base currencies include EUR, GBP (British pound), JPY (Japanese yen), and AUD (Australian dollar). The choice of base currency often depends on the trader’s preferred financial system and the availability of assets denominated in their desired currency.

The Asset Currency Spectrum

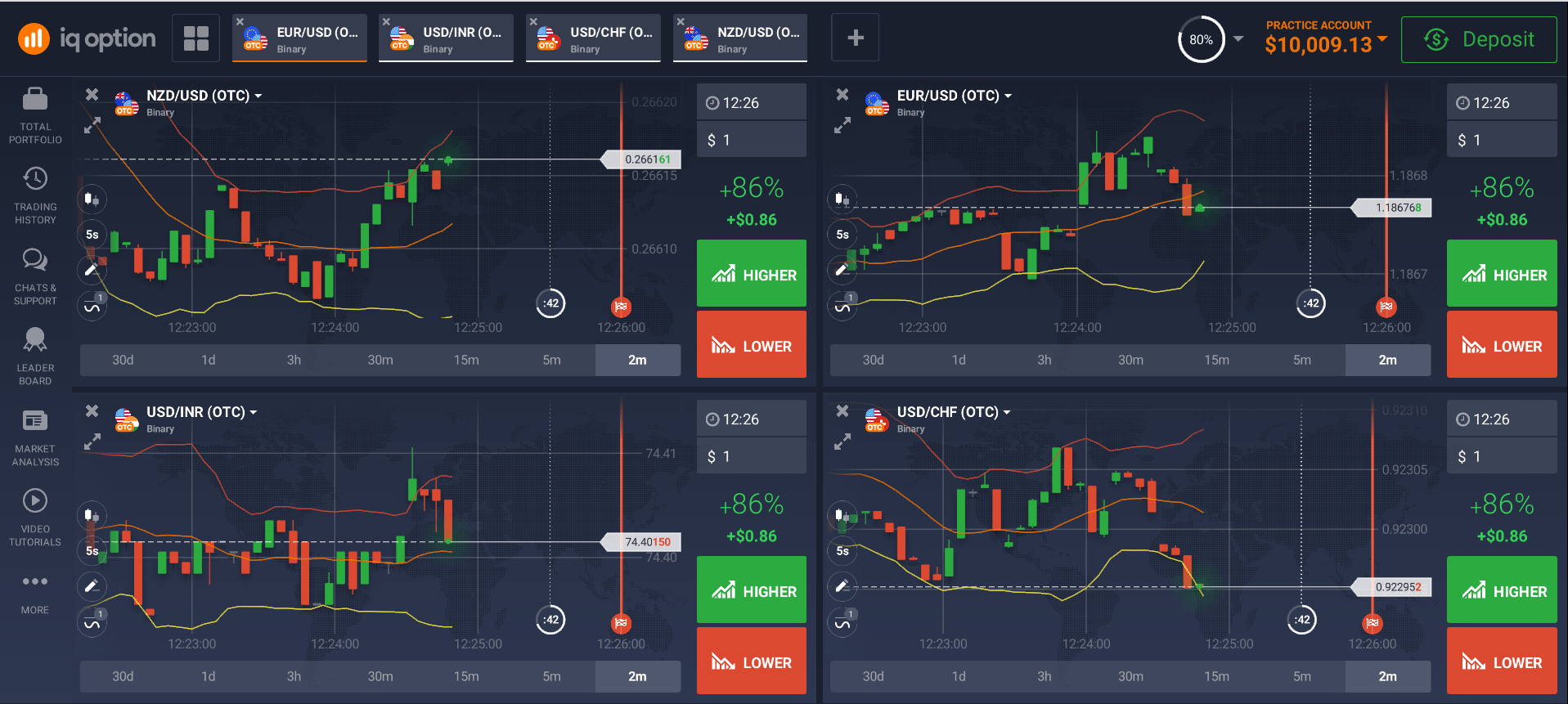

The asset currency in binary options trading encompasses a diverse range of global currencies, mirroring the vast array of underlying assets available for trading. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, form the backbone of the binary options market. However, the spectrum extends to emerging market currencies, including BRL (Brazilian real), INR (Indian rupee), and ZAR (South African rand), offering traders opportunities to capitalize on market fluctuations in developing economies. The choice of asset currency hinges on the trader’s market knowledge, risk appetite, and specific trading objectives.

Image: acondontec.blogspot.com

Impact of Currency Volatility on Trading

Currency volatility, a measure of how much a currency’s value fluctuates over time, plays a crucial role in binary options trading. When an asset’s currency exhibits high volatility, it amplifies the potential returns for successful trades. However, it also magnifies the risks, as adverse currency movements can lead to substantial losses. Traders must carefully consider the volatility of the asset’s currency before entering a trade.

Strategies for Managing Currency Risks

Managing currency risks is an essential aspect of successful binary options trading. One common strategy is diversification, where traders spread their investments across assets with different asset currencies. By doing so, they reduce their exposure to any single currency’s volatility. Another approach is hedging, using a financial instrument such as a currency pair to offset potential losses resulting from adverse currency fluctuations. Understanding the fundamentals of currency dynamics and employing appropriate risk management techniques can enhance a trader’s chances of profitability.

What Currency Is Used For Binary Options Trading

Image: t2conline.com

Conclusion

The currency landscape of binary options trading is a complex but navigable labyrinth for traders seeking to maximize their returns while minimizing risks. By understanding the interplay between base currency and asset currency, traders can make informed decisions about their trading strategies. Diversification and hedging techniques offer effective ways to manage currency volatility and increase the likelihood of successful trades. As the binary options market continues to evolve, so will the currency dynamics, making it imperative for traders to stay abreast of currency trends and market movements to make well-informed trading decisions.