Introduction

Image: thewaverlyfl.com

In the realm of investing, the lure of commission-free trading has revolutionized access to the financial markets. Gone are the days when exorbitant fees acted as barriers to entry, hindering individuals from participating in wealth creation. Commission-free stock and options trading platforms have emerged as game-changers, democratizing the investment landscape and empowering a new generation of investors. By eliminating the financial burden of transaction fees, these platforms have paved the way for cost-effective portfolio management and the pursuit of financial goals.

The significance of commission-free trading cannot be overstated. By minimizing the friction associated with buying and selling securities, investors can maximize their returns and make the most of every investment dollar. Whether you’re a seasoned trader or a novice venturing into the market for the first time, understanding the ins and outs of commission-free trading is crucial for optimizing your investment strategy.

Navigating the Landscape: Types of Commission-Free Trading Platforms

The world of commission-free trading spans a diverse array of platforms, each catering to specific investor needs and preferences. Here’s a breakdown of the key types:

-

Online Brokerages: Leading the charge are online brokerages that offer commission-free trading of stocks, exchange-traded funds (ETFs), and options. These platforms are accessible through user-friendly websites or mobile apps, providing a convenient and cost-effective way to manage investments.

-

Robo-Advisors: For those seeking a more hands-off approach, robo-advisors automate the investment process by generating tailored portfolios based on individual risk tolerance and financial goals. While commission-free trading may not be universal across all robo-advisors, some platforms offer commission-free ETF trading or limited commission-free stock trading.

-

Social Trading Platforms: Bringing a social aspect to investing, social trading platforms allow users to connect with other investors, share ideas, and potentially copy the trades of successful traders. Some social trading platforms offer commission-free stock trading for certain stocks or within specific time frames.

The Benefits of Commission-Free Trading

-

Cost Savings: Commission-free trading eliminates the transactional burden, allowing investors to save significantly on fees. This cost saving translates into higher potential returns and accelerated portfolio growth.

-

Increased Flexibility: Without the pressure of commissions, investors can trade more frequently, adjusting their portfolios as market conditions evolve. This flexibility enables them to capitalize on opportunities and mitigate risks effectively.

-

Accessibility: Commission-free trading platforms have made investing more accessible to all, regardless of their financial status. Individuals with limited capital can now participate in the market, democratizing wealth creation.

Understanding Options Trading

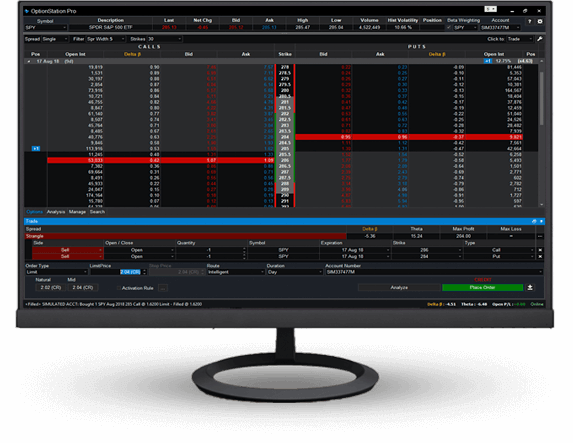

Options trading introduces a higher level of sophistication to commission-free trading. Options are financial instruments that grant the option buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined timeline. Options trading can be used to enhance income generation, hedge against risk, and achieve specific investment objectives.

-

Call Options: Call options give the buyer the right to buy an asset at a specified price before a specific date. They are typically used to speculate on the potential price increase of an asset.

-

Put Options: Put options provide the buyer the right to sell an asset at a specified price before a specific date. They are commonly used to hedge against potential price declines or to benefit from the decrease in an asset’s value.

Strategies to Enhance Commission-Free Trading

-

Dollar-Based Investing: When investing in higher-priced stocks, consider using dollar-based investing instead of share-based investing. By setting a dollar amount to invest instead of a specific number of shares, you can benefit from commission-free trading regardless of stock price.

-

Trailing Stop-Loss Orders: To safeguard profits and minimize losses in options trading, implement trailing stop-loss orders. These orders automatically adjust the stop-loss price based on market fluctuations, ensuring that you exit the trade at a favorable return while protecting your capital.

Conclusion

Commission-free stock and options trading platforms have revolutionized investing by removing a significant financial hurdle and empowering individuals with greater control

Image: www.tradestation.io

Commision Free Stock And Options Trading Platform

Image: www.stockbrokers.com