Volatility Trading Strategy Options: Master the Market’s Fluctuations

Image: investmentu.com

Introduction

In today’s tumultuous financial landscape, volatility reigns supreme. It’s the unpredictable nature of price movements that can both confound and cripple traders. But amidst the chaos, there lies opportunity – through volatility trading strategies. This comprehensive guide will empower you with the knowledge and strategies to navigate the volatile markets, unlocking the potential for success.

What is Volatility Trading?

Volatility trading entails speculating on the degree of price fluctuations in an asset. By analyzing historical price patterns, traders can identify periods of high and low volatility and position themselves accordingly. The goal is to profit from price movements that surpass expectations.

Types of Volatility Trading Strategies

Volatility trading offers a myriad of strategy options, each catering to specific risk appetites and market conditions:

- VIX Trading: The VIX index measures market volatility expectations. Traders can buy VIX futures to profit from rising volatility and sell them to benefit from decreasing volatility.

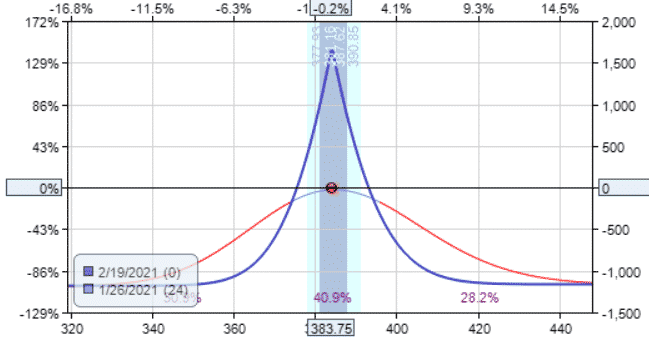

- Short-Term Call/Put Options: Buying call options on low-volatility stocks and selling put options on high-volatility stocks allows traders to capture premium during periods of exaggerated price fluctuations.

- Long-Term Volatility Funds: These actively managed funds invest in assets designed to benefit from high volatility, such as gold, TIPS, and VIX futures.

- ATR Crossover: The Average True Range (ATR) is a measure of volatility. By crossing different ATR levels, traders can identify potential trading opportunities.

- Bollinger Bands: Bollinger Bands are a technical analysis tool that plots a moving average alongside upper and lower bands. Traders buy when prices break above the upper band and sell when they fall below the lower band.

- Historical Volatility Targeting: By analyzing historical price movements, traders can determine the typical volatility range for an asset and set targets to trade within those parameters.

Expert Insights and Actionable Tips

- “Volatility is the friend of the nimble.” – Mark Douglas

Be prepared to adjust your strategy as market conditions evolve. - “Trade in the direction of the trend and the implied volatility.” – Bob Volman

Leverage trend analysis and volatility data to increase your potential for profit. - “Manage your risk on every trade.” – Paul Tudor Jones

Set stop-loss orders to limit potential losses and protect your capital.

Conclusion

Volatility trading can be an exhilarating and rewarding endeavor for those who approach it with knowledge and strategy. By embracing the market’s fluctuations, you can unlock the potential to profit from the inherent risk and volatility that permeate the financial landscape. Whether you opt for VIX trading, option strategies, or technical analysis, remember to approach volatility trading with respect, diligence, and a commitment to managing your risk.

Image: optionstradingiq.com

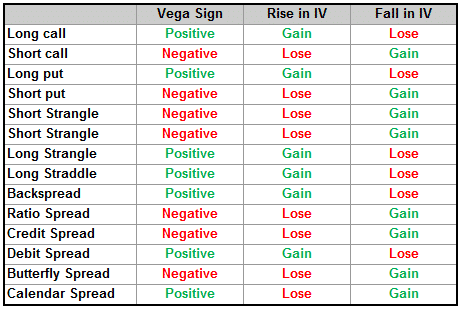

Volatility Trading Strategy Options

Image: optionstradingiq.com