Introduction

In the ever-fluctuating realm of financial markets, volatility reigns supreme. Traders, both seasoned and novice, grapple with the dynamic nature of market movements, seeking ways to navigate its highs and lows. Enter volatility strategies – an arsenal of options trading techniques designed to exploit or hedge against market volatility.

Image: investmentu.com

This comprehensive guide will delve into the intricacies of volatility strategies, unraveling their historical roots, fundamental principles, and practical applications. Whether you’re an experienced trader seeking to refine your arsenal or a curious novice eager to enter the world of options, this exploration will illuminate the path to navigating market volatility with precision.

Understanding Volatility

Volatility, the lifeblood of options trading, measures the rate and extent of price fluctuations in an underlying asset. It can be likened to a rollercoaster ride, with periods of intense swings followed by relative calmness. Understanding volatility is paramount in options trading, as it influences both risk and potential rewards.

Thankfully, volatility is not a capricious force; it can be quantified through statistical measures like historical volatility (HV) and implied volatility (IV). HV, calculated using past price data, provides a glimpse into an asset’s historical fluctuations. IV, as the name suggests, represents the market’s expectations of future volatility. These measures guide traders in formulating appropriate volatility strategies.

Volatility Strategies in Practice

Options traders wield a diverse toolkit of volatility strategies, each tailored to harness specific market conditions. For instance, the straddle strategy, an aptly named neutral stance, involves buying both a call and a put option with the same strike price and expiration date. This strategy capitalizes on high volatility, making it suitable for periods of heightened market uncertainty.

In contrast, the strangle strategy, like its cousin the straddle, involves purchasing both a call and a put option. However, unlike the straddle, the strangle options have different strike prices, providing a wider range of potential profit while also reducing the overall cost. This strategy flourishes in moderately volatile markets.

Options Trading in Action

Volatility strategies are not mere theoretical constructs; they are potent tools employed by traders around the world. Imagine a seasoned investor anticipating a surge in volatility for a particular stock. The investor meticulously crafts a straddle strategy, purchasing both a call and a put option at the money (i.e., with a strike price close to the current market price).

As the predicted market turmoil materializes, the stock price rollercoaster commences. The trader’s straddle strategy comes into its element, with the call and put options appreciating in value as volatility spikes. As the market settles and volatility subsides, the trader exits their positions, pocketing a tidy profit as a reward for their well-timed volatility play.

Image: original-herbs.com

Adapting to the Dynamic Landscape

The world of options trading is in constant evolution, with new strategies and variations emerging to meet the demands of ever-changing market conditions. Skillful traders remain attuned to these developments, diligently learning and mastering the latest techniques.

In recent years, the rise of algorithmic trading has reshaped the landscape of options trading. These lightning-fast, computer-driven trading systems monitor markets and execute strategies in fractions of a second. While algorithmic trading offers the advantage of precision and speed, it’s essential for human traders to stay abreast of its implications and remain agile in adapting to the evolving market dynamics.

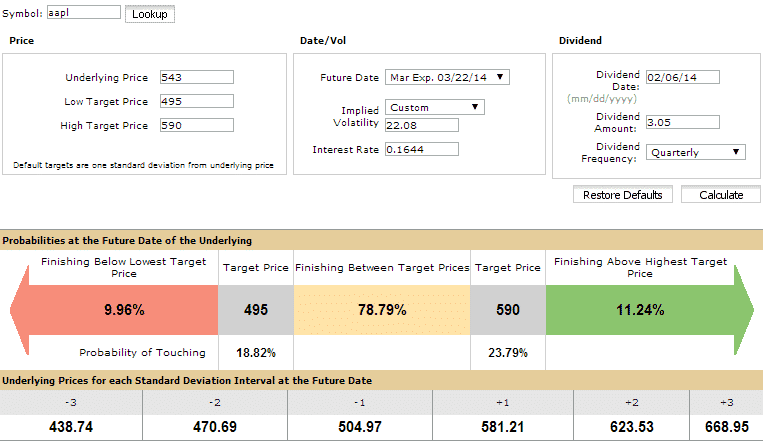

Volatility Strategies Options Trading

Image: optionstradingiq.com

Conclusion

Volatility strategies in options trading represent a powerful tool in the hands of astute traders. By comprehending the nature of volatility, mastering the art of option valuation, and discerningly selecting the appropriate strategies, traders can navigate the ever-changing market currents with poise and finesse.

Remember, knowledge is the cornerstone of successful trading, and the pursuit of it should be an ongoing endeavor. Embrace the challenge, explore new strategies, refine your skills, and prepare to seize the opportunities presented by the vibrant and volatile financial markets.