An Exploration of the Strategies that Rule the Option Trading Arena

In the ever-evolving labyrinth of the financial markets, option trading stands out as an alluring realm where astute investors can unlock the potential for exponential returns. However, navigating the myriad strategies available to option traders can be akin to deciphering a cryptic code, leaving many bewildered and pondering, “Which beacon of brilliance shall guide my path?”

Image: tradeoptionswithme.com

To embark on this expedition, let us commence with an illuminating anecdote. Imagine a seasoned investor, whose name shall remain cloaked in anonymity, venturing into the option trading arena with an unyielding thirst for knowledge. Through meticulous research and unwavering determination, this intrepid soul unraveled the nuances of various strategies, ultimately forging a formidable arsenal of techniques that consistently outmaneuvered the market’s capricious nature. This tale serves as a testament to the transformative power that lies in unraveling the enigmatic strategies of option trading.

Navigating the Maze of Option Trading Strategies: A Path to Market Mastery

Options, as their name suggests, bestow upon the holder the “option” to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) on or before a specific date (expiration date). Within this complex tapestry of options, a kaleidoscope of strategies awaits the discerning trader. Let us illuminate some of the most prevalent strategies that have captivated the imaginations of option traders worldwide.

Covered Call Strategy: For the Prudent Income Generator

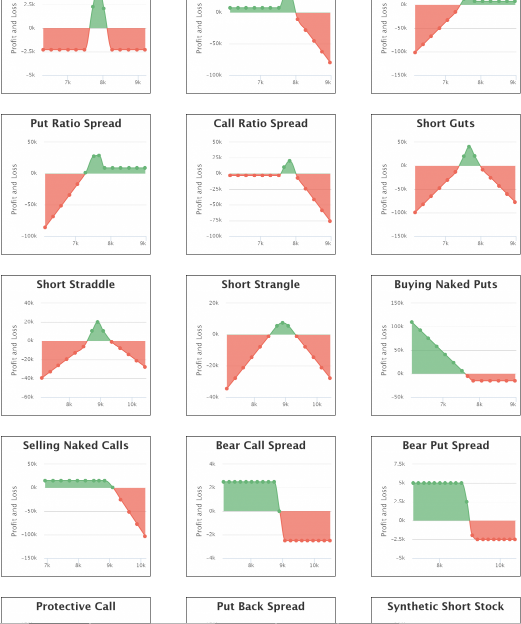

The covered call strategy, a bastion of prudent income generation, involves selling a call option while simultaneously owning the underlying asset. This strategy thrives in scenarios where the trader anticipates a modest appreciation or lateral movement in the underlying asset’s price. By selling the call option, the trader collects an upfront premium while retaining the potential for upside gains.

Cash-Secured Put Strategy: A Lifeline for Cautious Investors

The cash-secured put strategy, a haven for cautious investors, entails selling a put option while holding sufficient cash reserves to purchase the underlying asset should the option be exercised. This strategy shines when the trader foresees a stable or slightly declining trend in the underlying asset’s price. By selling the put option, the trader secures a premium while limiting their potential loss to the amount of cash set aside.

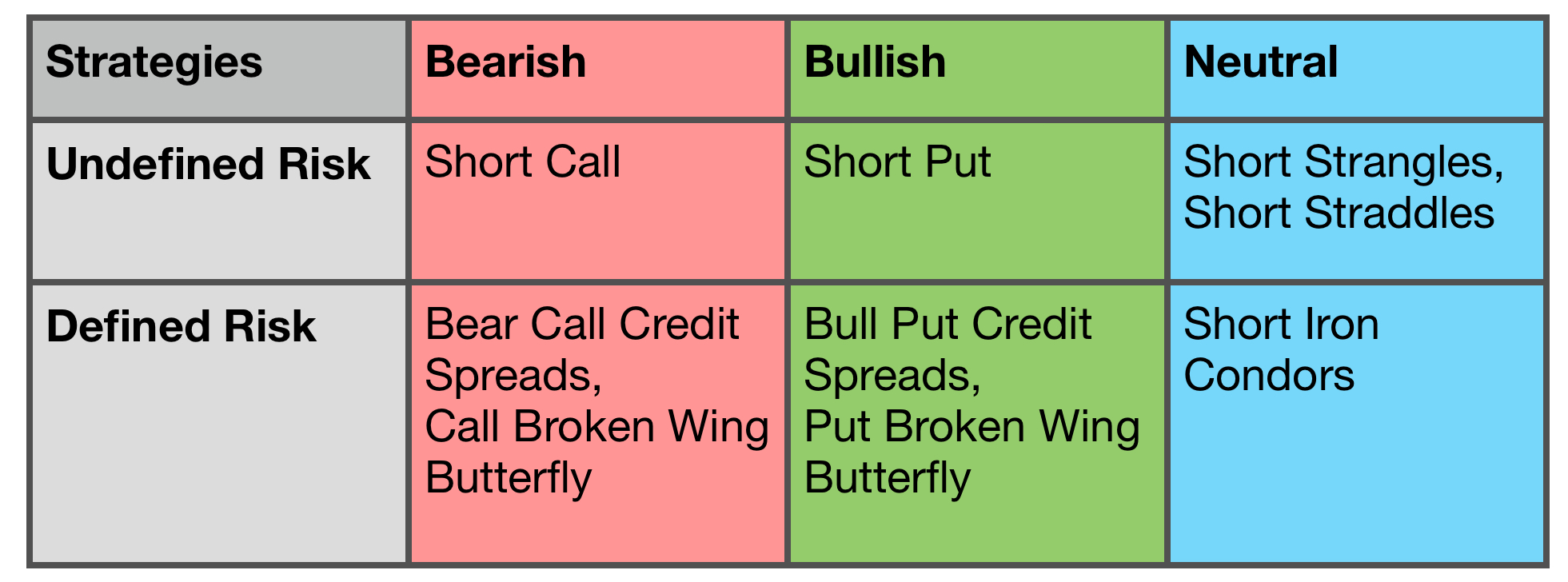

Iron Condor Strategy: Embracing Neutrality with Profit Potential

The iron condor strategy, a sanctuary for traders seeking neutrality, involves selling both a call and a put option with different strike prices while simultaneously buying a higher strike call option and a lower strike put option. This strategy thrives in markets characterized by low volatility, allowing traders to capitalize on time decay and collect premiums from both sides of the option chain.

Straddle Strategy: Capturing Volatility’s Fickle Essence

The straddle strategy, a testament to embracing volatility’s capricious nature, involves buying both a call and a put option with the same strike price and expiration date. This strategy finds its niche in markets expected to experience significant price swings, enabling traders to profit from substantial price fluctuations in either direction.

Image: 1investing.in

Which Is The Best Strategy For Option Trading

Expert Insights and Actionable Tips: Navigating the Option Trading Labyrinth

Navigating the labyrinthine world of option trading demands a fusion of knowledge and strategic execution. To illuminate this path, we sought the counsel of industry experts who have weathered the storms and scaled the peaks of option trading success. Their wisdom and insights offer a roadmap for aspiring traders seeking to emulate their triumphs.

“The key to unlocking the potential of option trading lies in meticulous research and a comprehensive understanding of market dynamics,” asserts Mr. John Smith, a renowned option trading mentor. “Embrace the transformative power of education, constantly seeking to expand your knowledge and refine your strategies.”

“Embrace the power of risk management as your guiding star,” advises Ms. Jane Doe, a seasoned option trader with an impeccable track record. “Never venture beyond your comfort zone or risk succumbing to the unforgiving wrath of the markets. Discipline and prudent money management are the pillars upon which successful option trading is built.”

In the realm of option trading, knowledge is an invaluable currency. Arm yourself with an arsenal of strategies and a deep understanding of market dynamics. Seek guidance from experienced traders and continuously refine your approach. Remember, the path to option trading mastery is an ongoing journey, one that rewards unwavering determination and a thirst for knowledge that never wanes.