Introduction

In the realm of financial markets, options trading emerges as a sophisticated instrument for managing risk and unlocking potential gains. For those navigating the intricate world of options trading, TD Bank stands as a prominent player offering a comprehensive platform to execute these strategies. This article embarks on a detailed exploration of options trading on TD Bank, unraveling its intricacies and arming you with valuable insights to navigate this dynamic arena.

Image: www.youtube.com

Understanding Options

Options, in the financial context, confer upon their holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). This flexibility offers investors the ability to position themselves against market fluctuations, mitigate risks, and potentially generate substantial returns.

Types of Options

Options are primarily classified into two broad categories:

- Call Options: Grant the holder the right to purchase an underlying asset at the strike price. When an investor anticipates a rise in the asset’s value, call options present a lucrative opportunity.

- Put Options: Empower the holder to sell an underlying asset at the strike price. These are commonly utilized when an investor foresees a decline in the asset’s valuation.

Trading Options on TD Bank

TD Bank presents traders with a robust platform to execute options trades efficiently. Their user-friendly interface and advanced trading tools cater to the diverse needs of both novice and seasoned investors. To commence trading options on TD Bank, creating an investment account is the initial step. Once the account is established, you can delve into the vast array of available options contracts offered by the bank.

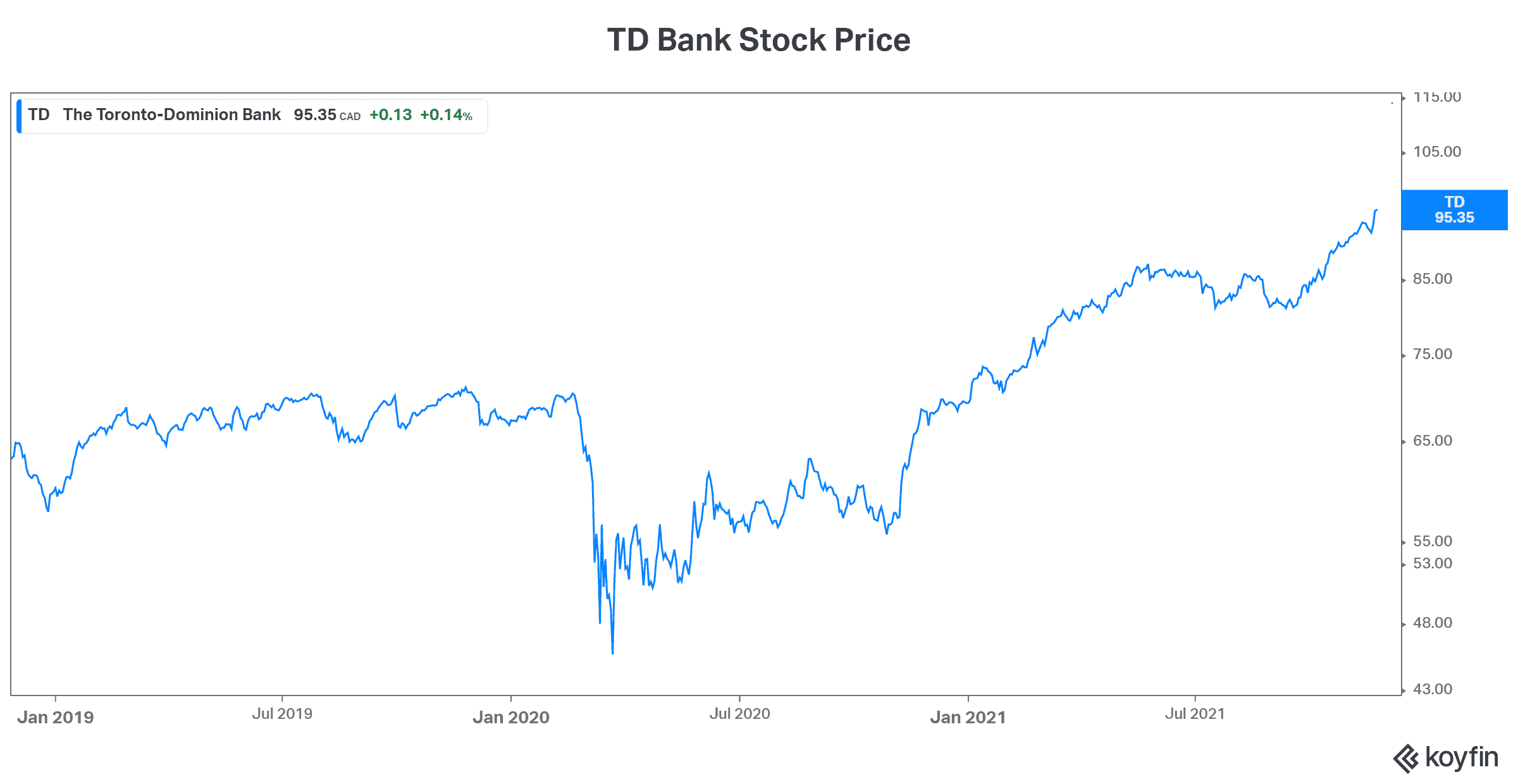

Image: www.fool.ca

Key Considerations for Options Trading

Before venturing into options trading, it is imperative to grasp several fundamental concepts that underpin its complexities:

- Volatility: Volatility measures the magnitude of price fluctuations in an asset. Higher volatility increases the potential returns but also amplifies the associated risks.

- Time Decay: Options lose value over time, irrespective of the underlying asset’s performance. Investors must carefully assess the expiration date in relation to their investment horizon.

- Greeks: These are numerical values representing the sensitivity of an option’s price to various factors such as the underlying asset’s price, volatility, and interest rates. Understanding Greeks is crucial for managing risk.

Benefits of Options Trading

Incorporating options into an investment strategy offers a spectrum of potential benefits:

- Risk Management: Options serve as a powerful hedging tool, allowing investors to offset potential losses associated with adverse market movements.

- Income Generation: Selling options, known as option writing, can generate income from the option premium. This strategy appeals to investors seeking regular returns.

- Leverage: Options provide a degree of leverage, amplifying the potential returns without requiring substantial capital. However, it is crucial to understand that leverage also magnifies the potential risks.

Trading Options On Td Bank

Image: dividendearner.com

Conclusion

Trading options on TD Bank empowers investors with a versatile financial instrument to navigate the fluctuations of financial markets. While options offer the potential for significant returns, it is imperative to approach this realm with prudence and a solid understanding of the inherent complexities. By embracing the principles outlined in this guide, you can unlock the rewards of options trading while mitigating potential risks.