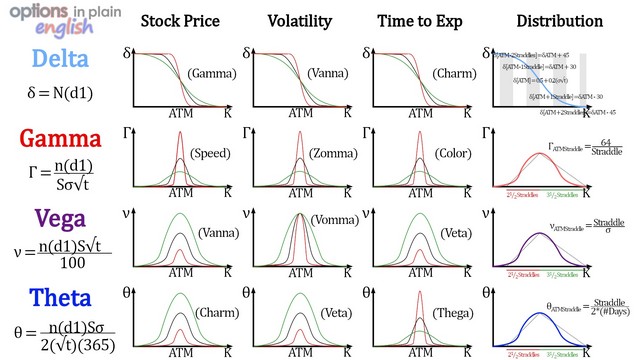

OptionsGreeks are metrics that measure the sensitivity of an option’s price to changes in underlying factors.Understanding these greeks is crucial for effective options trading as they help traders quantize risk and optimize their strategies.In this comprehensive guide, we will provide a free download of an options greeks calculator and delve into the concepts of Delta, Gamma, Theta, Vega, and Rho, equipping you with the knowledge to navigate the dynamic world of options trading.

![Options Greeks Cheat Sheet [FREE Download] - HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/options-greeks-cheat-sheet-2048x1448.png)

Image: howtotrade.com

Understanding Options Greeks: A Cornerstone of Smart Trading

Options, financial instruments that provide the right but not the obligation to buy or sell an underlying asset, offer a versatile approach to risk management and speculation. Options Greeks, essentially mathematical equations, quantify the intricate relationship between an option’s price and external factors such as the underlying asset’s price, time decay, volatility, and interest rates. These greeks empower traders to meticulously calculate potential gains or losses, tailor strategies to their risk tolerance, and exploit market inefficiencies.

Delta: The Core of Option Sensitivity

Delta, measured on a scale of -1 to +1, gauges the rate of change in an option’s price relative to the underlying asset’s price. A Delta of 0.5 indicates that a $1 increase in the underlying’s price will lead to a $0.5 increase in the option’s price, while a Delta of -0.7 suggests a $1 decrease in the underlying will result in a $0.7 increase in the option’s price. Delta provides a direct measure of an option’s price sensitivity to changes in the underlying asset, serving as a pivotal input for hedging strategies.

Gamma: Capturing the Curve

Gamma, expressed as the change in Delta for a 1% change in the underlying’s price, quantifies the curvature of an option’s Delta. Positive Gamma implies that the Delta is increasing, leading to a greater sensitivity of the option’s price to changes in the underlying asset’s price. Conversely, negative Gamma indicates decreasing Delta and reduced sensitivity. Gamma’s significance lies in its ability to capture the non-linear relationship between an option’s price and the underlying’s price, particularly relevant for strategies involving rapid price movements.

Image: patternswizard.com

Theta: The Relentless Tick of Time Decay

Theta measures the rate of decrease in an option’s price as time passes. This decay in value, known as time decay, is a constant force working against the option holder, especially for short-term options.Theta is expressed in dollar terms per day, indicating the dollar amount an option loses in value with each passing day. Understanding Theta’s impact is pivotal for option traders seeking to optimize entry and exit points to minimize the adverse effects of time decay.

Vega: Embracing Volatility

Vega quantifies the sensitivity of an option’s price to changes in implied volatility, a key measure of market expectations for future price fluctuations in the underlying asset.Vega is particularly relevant for options traders seeking exposure to volatility, often employing strategies that capitalize on expected increases in volatility. Unlike Delta, which gauges price sensitivity to the underlying’s price, Vega provides insight into price sensitivity to changes in volatility, offering a valuable tool for navigating uncertain markets.

Rho: Decoding Interest Rate Dynamics

Rho measures the sensitivity of an option’s price to changes in interest rates. This is particularly relevant for long-term options, as interest rates can significantly impact the time value of money. A positive Rho indicates that an increase in interest rates will lead to an increase in the option’s price, while a negative Rho suggests a decrease in the option’s price with rising interest rates. Understanding Rho’s implications helps option traders account for interest rate dynamics in their pricing models.

Download Your Options Greeks Calculator: Embark on Informed Trading

Our complimentary options greeks calculator provides a user-friendly interface to calculate these essential metrics, empowering traders with real-time insights into their options positions.Simply input relevant parameters such as the underlying asset’s price, time to expiration, volatility, and interest rates, and our calculator will swiftly compute Delta, Gamma, Theta, Vega, and Rho, equipping you with a comprehensive understanding of your options Greeks.

Trading Options Greeks Free Download

Image: optionsinplainenglish.com

Conclusion: Mastering Options Greeks for Trading Success

Options Greeks, invaluable tools for quantifying risk and optimizing trading strategies, provide a gateway to informed decision-making. By harnessing the knowledge of Delta, Gamma, Theta, Vega, and Rho, traders can navigate the dynamic landscape of options trading with greater confidence.Our free options greeks calculator further empowers traders, offering a convenient and accurate tool for real-time calculations. Embrace the power of options Greeks and elevate your trading journey towards financial success.