Dive into the World of Commodity Options

For traders seeking to tap into the dynamic world of commodities, commodity option trading in Multi Commodity Exchange (MCX) presents an exceptional opportunity. This intricate yet rewarding market provides a unique blend of risk management and profit potential. In this comprehensive guide, we will delve into the nuances of commodity option trading in MCX, empowering you to navigate this exciting landscape with confidence.

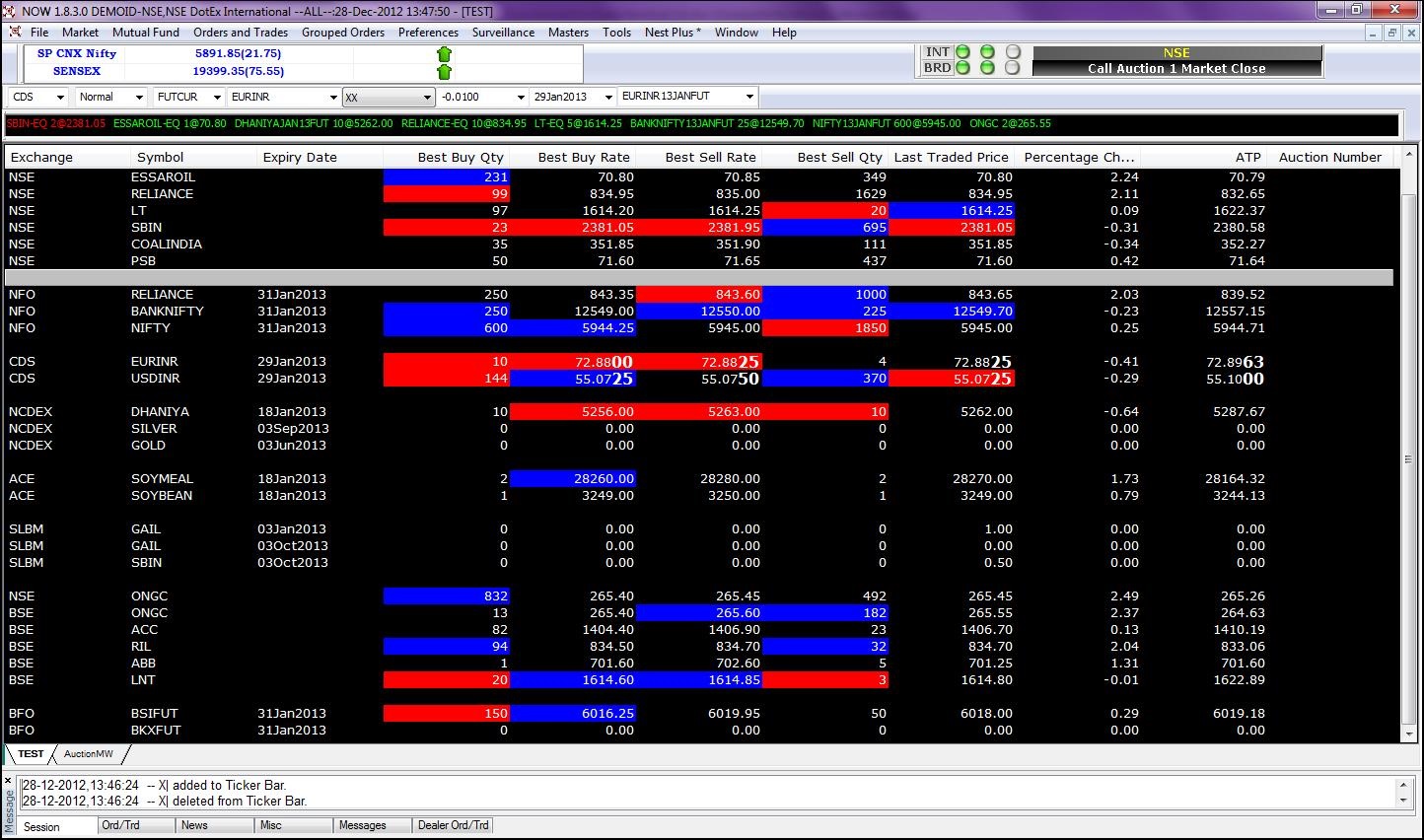

Image: optiontradingfortune.com

What are Commodity Options?

Commodity options are financial instruments that confer upon the holder the right, but not the obligation, to buy or sell a specified quantity of an underlying commodity at a predetermined price on a future date. They function as a double-edged sword, allowing traders to protect themselves from price fluctuations or capitalize on market movements, depending on their trading strategies.

Exploring the Mechanics of Commodity Option Trading in MCX

MCX, India’s leading commodity exchange, offers a wide array of commodity options for traders to choose from. These include options on precious metals (gold, silver), base metals (copper, aluminum), energy (crude oil, natural gas), and agricultural products (wheat, sugar). Each option contract represents a standard quantity of the underlying commodity, with a specified strike price and expiration date.

- Strike Price: This is the price at which the underlying commodity can be bought or sold when exercising the option.

- Expiration Date: This marks the date on which the option contract expires, rendering it worthless.

To trade commodity options, traders require a brokerage account with MCX. The trading process involves the following steps:

- Choose the Underlying Commodity: Select the commodity option you wish to trade based on market analysis and trading objectives.

- Determine the Strike Price: Analyze the current market price and future expectations to select the appropriate strike price.

- Choose the Expiration Date: Consider your trading time frame and market outlook when choosing the expiration date.

- Place the Trade: Initiate the option order through your brokerage platform, specifying the type of option (call or put) and other parameters.

Tips for Successful Commodity Option Trading in MCX

Mastering commodity option trading in MCX requires a combination of knowledge, strategy, and risk management. Here are some expert tips to enhance your trading experience:

- Conduct thorough research: Stay updated with market news, technical analysis, and expert insights to make informed trading decisions.

- Manage risk cautiously: Implement proper risk management strategies, such as stop-loss orders and position sizing, to mitigate losses.

- Consider market sentiment: Monitor market sentiment through social media platforms, news sources, and technical indicators to gauge market direction.

- Utilize technical analysis: Leverage technical analysis tools, such as charting and indicators, to identify trading opportunities and assess market trends.

Image: www.youtube.com

Frequently Asked Questions on Commodity Option Trading in MCX

Q: What are the different types of commodity options?

A: There are two main types of commodity options: call options, which confer the right to buy the underlying commodity, and put options, which confer the right to sell the underlying commodity.

Q: Can I profit from both rising and falling commodity prices?

A: Yes, it’s possible to profit from both rising and falling commodity prices by employing appropriate strategies. Call options are suitable for bullish markets, while put options are ideal for bearish markets.

Q: What factors influence the pricing of commodity options?

A: Commodity option prices are influenced by several factors, including the spot price of the underlying commodity, volatility, interest rates, and time to expiration.

Commodity Option Trading In Mcx

Image: www.vecosys.com

Conclusion

Embarking on the journey of commodity option trading in MCX offers traders a wealth of possibilities. With a clear understanding of the mechanics, strategies, and risks involved, you can harness the power of this dynamic market. Remember to conduct thorough research, adopt sound risk management practices, and embrace a mindset of continuous learning to optimize your trading outcomes.

Are you ready to embark on the exciting world of commodity option trading in MCX? Take the first step by exploring this comprehensive guide and unlocking the potential for profitable and rewarding trading experiences.