Are you an aspiring trader yearning to delve into the exciting world of options? Look no further than SureTrader, a renowned platform that empowers you to navigate the complexities of this financial instrument. Options trading offers a lucrative opportunity to harness market volatility and potentially enhance your investment returns. In this comprehensive guide, we embark on a journey to unlock the secrets of trading options on SureTrader, equipping you with the knowledge and strategies to succeed.

Image: twitter.com

What are Options and Why Trade Them?

Options are financial contracts that grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price (the strike price) on or before a certain date (the expiration date). Options trading provides numerous advantages, including the ability to speculate on market direction, hedge against risk, and generate income.

Getting Started with SureTrader

SureTrader stands out as an intuitive and feature-rich platform designed specifically for options traders. To get started, simply create an account and fund it with the necessary capital. The platform offers a user-friendly interface, real-time market data, and advanced charting tools to enhance your decision-making process.

Mastering the Basics

Before diving into the world of options trading, it’s crucial to grasp the fundamental concepts. Understand the difference between calls and puts, expiration dates, and strike prices. Learn about the Greeks, a set of metrics that quantify an option’s sensitivity to various market factors, enabling you to assess risk and potential returns.

Image: www.youtube.com

Trading Strategies for Success

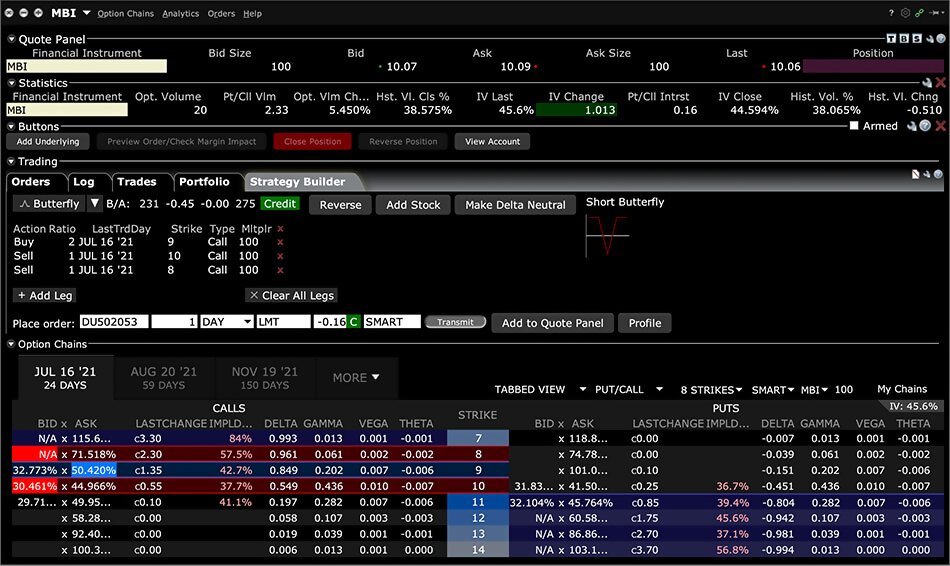

Successful options trading involves developing a repertoire of effective strategies. Consider bullish and bearish strategies, such as buying calls to profit from rising prices or buying puts to profit from falling prices. Explore advanced strategies like spreads and butterflies, which combine multiple options to create custom risk-return profiles.

Managing Risk and Rewards

Risk management is paramount in options trading. Determine your risk tolerance and allocate your capital wisely. Monitor your positions closely and employ stop-loss orders to limit potential losses. Study historical market patterns, volatility, and liquidity to better predict future price movements and mitigate risk.

Real-World Applications

Options trading offers a wide range of applications. Utilize options to enhance your investment strategies, such as hedging equity portfolios or generating income through covered calls. Explore advanced techniques like collar strategies to manage portfolio volatility.

The Power of Research and Education

Continuous education is vital in options trading. Stay abreast of market trends, read books and articles, and attend webinars and seminars to expand your knowledge. Leverage SureTrader’s comprehensive educational resources, including webinars, tutorials, and a dedicated support team, to enhance your understanding.

Trading Options On Suretrader

Image: www.interactivebrokers.co.uk

Conclusion

Embracing the world of options trading on SureTrader opens up a wealth of opportunities to leverage market volatility and potentially boost your financial returns. By equipping yourself with the knowledge, strategies, and risk management techniques outlined in this guide, you can navigate the intricacies of this dynamic market and unlock the true power of options trading. Remember, consistent learning, careful planning, and a disciplined approach are the keys to success in this rewarding endeavor.