Introduction

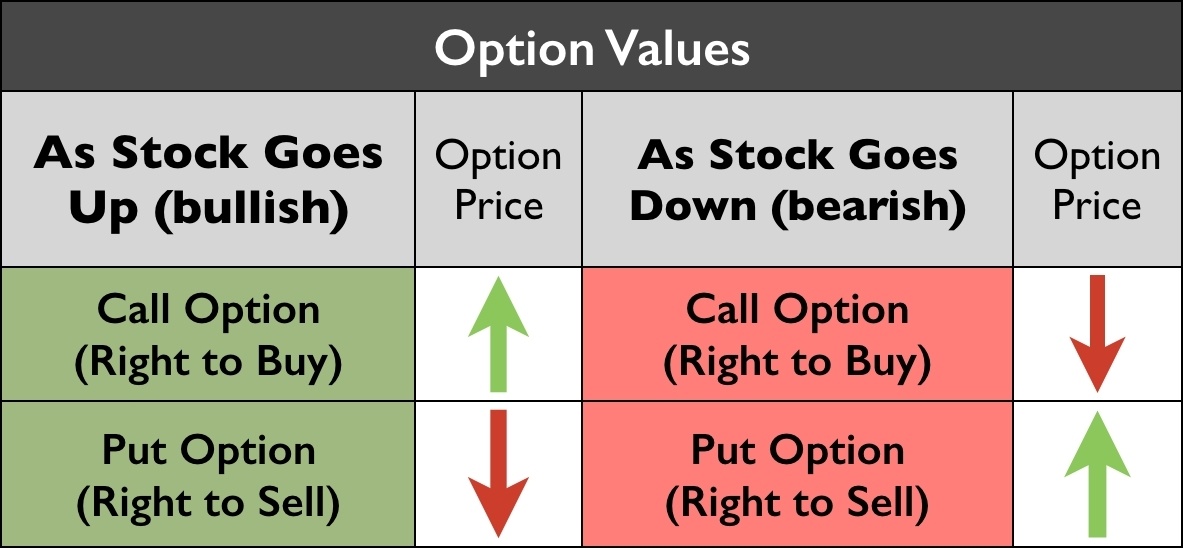

In the realm of option trading, the possibility of incurring losses is an inherent aspect that traders must navigate. These losses primarily stem from fluctuations in the underlying asset’s price, leading to a decrease in the option’s value. Understanding the intricate mechanisms behind option premium losses empowers traders with the knowledge to mitigate risks and optimize their trading strategies.

Image: warsoption.com

Option premiums, the fees paid at the onset of a contract, symbolize the trader’s speculation on the future price direction of the underlying asset. However, these premiums can dwindle or vanish altogether if the price movement is unfavorable. Delving into the intricacies of option premium losses will equip traders with the indispensable knowledge to make informed decisions.

What are Option Premium Losses?

Option premium losses occur when the value of an option contract decreases, resulting in a decline in the trader’s initial investment. This loss is the difference between the premium paid at the trade’s inception and the proceeds received upon its expiration or early exercise. Several factors influence option premium losses, including the price movement of the underlying asset, time decay, and implied volatility.

For instance, suppose a trader acquires a call option for a particular stock with a premium of $2 per share. If the stock’s price fails to surpass the option’s strike price by the expiration date, the option will likely expire worthless, leaving the trader with a loss of the entire $2 premium.

Causes of Option Premium Losses

Price Movement

The primary driver of option premium losses is the price movement of the underlying asset. Out-of-the-money options, with a strike price significantly different from the current market price, are particularly susceptible to losses if the price trend continues in the opposite direction.

Image: tradesmartu.com

Time Decay

As options near their expiration date, their value gradually diminishes due to time decay. This inherent characteristic of options forces traders to consider not only the direction of the underlying asset’s price but also the time frame within which the option is expected to expire.

Implied Volatility

Implied volatility, a measure of the market’s anticipation of future price fluctuations, significantly impacts option premiums. When implied volatility is high, options become more expensive, and their premiums are more likely to experience losses if the volatility subsides.

Tips for Mitigating Option Premium Losses

While option premium losses are an inherent risk in trading, several strategies can help traders reduce their exposure to these losses:

Proper Market Assessment

Traders should undertake thorough market research to gauge the underlying asset’s price movement patterns, historical volatility, and projected future trends. This knowledge enables traders to make informed decisions about the strike price and expiration date of the options they acquire.

Trading Within Tolerance Levels

Traders should allocate funds for option trading cautiously and within their risk tolerance levels. Losing an entire investment can have devastating effects on one’s financial well-being. Allocating a portion of one’s portfolio to option trading diversifies risk and prevents catastrophic losses.

Frequently Asked Questions

Q: Are option premium losses inevitable?

A: Not necessarily. While losses are always a possibility, employing risk management strategies and thorough market analysis can help traders mitigate their exposure to losses.

Q: What types of options are most prone to premium losses?

A: Out-of-the-money options with significant differences between their strike prices and the underlying asset’s current market price have a higher likelihood of expiring worthless, resulting in a loss of the entire premium.

Q: How can I recover from option premium losses?

A: Recovering from option premium losses requires re-evaluating one’s trading strategy, enhancing market analysis techniques, and potentially exploring alternative trading instruments that better align with one’s risk tolerance and investment goals.

In Option Trading When Are Option Premium Losses Calculated

Image: warsoption.com

Conclusion

Option premium losses, the nemesis of traders, are an intrinsic aspect of option trading. However, understanding the nature of these losses, their causes, and effective loss mitigation strategies empowers traders to navigate the market more confidently. By embracing a disciplined and informed approach, traders can optimize their trading strategies and enhance their chances of reaping handsome rewards.

If you’re interested in learning more about option premium losses or other aspects of option trading, feel free to explore reliable resources online or seek guidance from financial professionals.