Introduction:

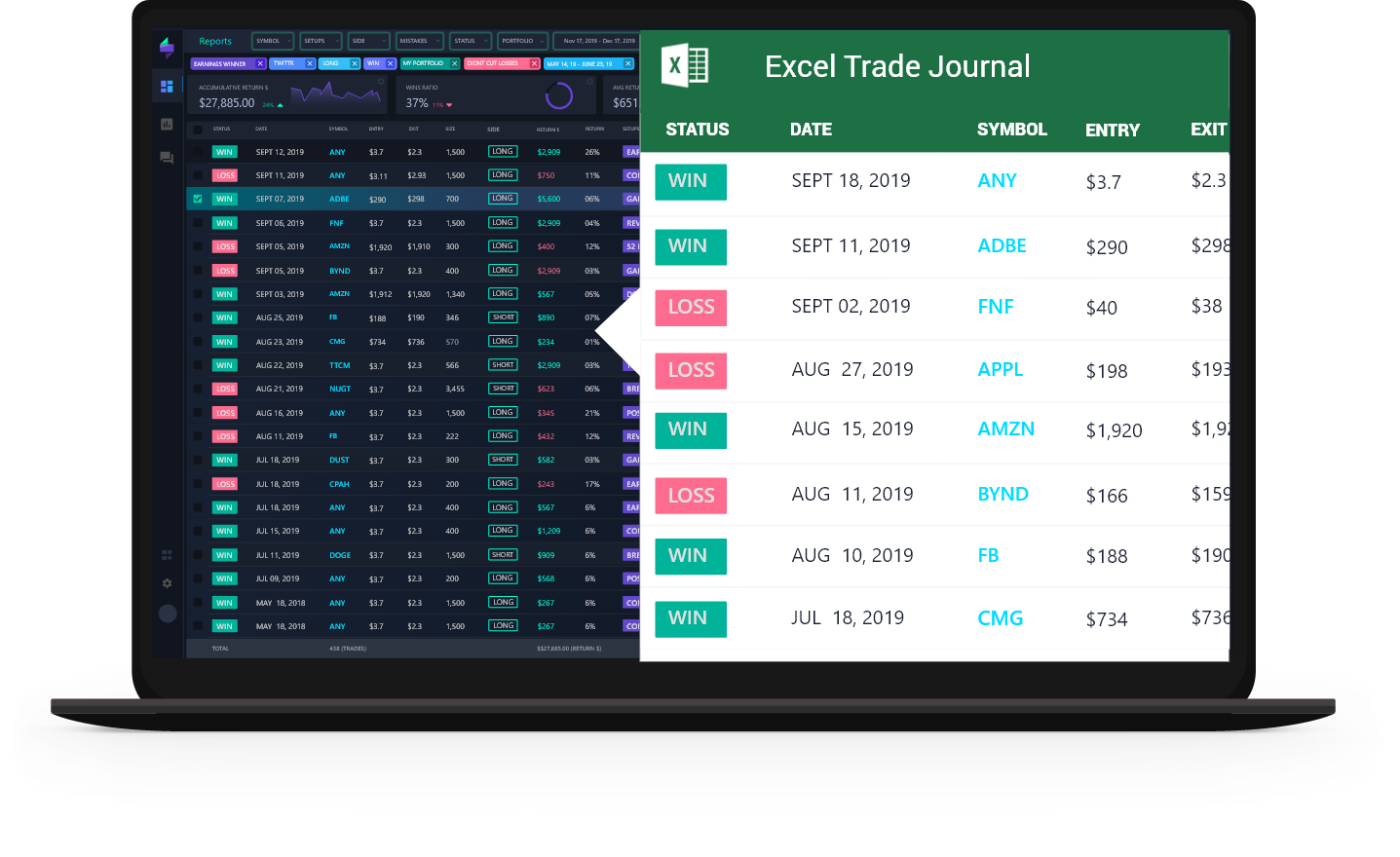

In the realm of options trading, meticulous record-keeping is paramount. A trading journal serves as a comprehensive log that documents every aspect of your trading activities, providing invaluable insights for growth and success. By diligently maintaining a trading journal, you gain the ability to analyze your performance, identify weaknesses, and refine your trading strategies to maximize profitability.

![[FREE DOWNLOAD] Trading Journal Spreadsheet Traders Bulletin | Free ...](https://www.tradersbulletin.co.uk/newwp/wp-content/uploads/2018/06/Screen-Shot-2018-06-14-at-20.31.12.png)

Image: tradersbulletin.co.uk

1. Understanding the Purpose of a Trading Journal:

A trading journal is akin to a personal inventory of your trading experiences. It facilitates reflection and analysis, allowing you to discern patterns and identify areas for improvement. By recording essential details such as the date and time of execution, underlying asset, strike price, expiration date, premium paid, and profit or loss, you create a valuable database that serves as the foundation for strategic decision-making.

2. Essential Components of a Trading Journal:

An effective trading journal should capture the following information:

- Date and time of trade execution

- Underlying asset (e.g., stock, index, commodity)

- Strike price (for options strategies)

- Expiration date

- Premium paid or received

- Profit or loss

- Trade type (e.g., buy, sell, close)

- Entry and exit prices

- Strategy employed

- Notes: Any relevant observations, technical analysis, or market conditions

3. The Power of Performance Analysis:

The true strength of a trading journal lies in its ability to facilitate performance analysis. By tracking your trades over time, you can objectively assess your strengths and weaknesses. Identify recurring patterns that contribute to success or lead to losses, enabling you to refine your strategies accordingly.

Image: tradersync.com

4. Identifying and Mitigating Risk:

A thorough trading journal helps you identify potential risks associated with your trading activities. By reviewing previous trades, you can determine the circumstances that led to positive or negative outcomes and adjust your risk management strategies to minimize potential losses.

5. Adaptive Strategies for Enhanced Returns:

A trading journal allows you to adapt your strategies based on changing market conditions and evolving market dynamics. By tracking the performance of different strategies, you can identify those that yield the best results in specific scenarios and incorporate them into your trading plan.

6. Emotional Discipline and Bias Mitigation:

Trading can be an emotionally charged activity, making it essential to maintain discipline and minimize bias. A trading journal serves as an unbiased record of your trades, allowing you to retrospect on decisions made under the influence of emotions and to develop a more objective and rational approach.

7. Streamlined Backtesting and Trade Optimization:

For seasoned traders, a trading journal is indispensable for backtesting trading strategies and optimizing trade parameters. By simulating trades based on historical data, you can evaluate the potential profitability of different strategies under various market conditions, allowing for data-driven improvements.

Trading Journal For Options Trading

Image: www.youtube.com

Conclusion:

In conclusion, maintaining a comprehensive trading journal is a fundamental practice for options traders seeking to enhance their profitability and mitigate risks. The invaluable insights it provides into performance, risk management, strategy optimization, and emotional discipline set the foundation for sustained success in the challenging realm of financial markets. Embrace the power of record-keeping and transform your trading endeavors with a trading journal that unlocks your potential for exceptional returns.