In the fast-paced world of finance, options trading presents a unique opportunity for investors to magnify their returns and mitigate risk. This weekly options trading report provides a comprehensive analysis of the past week’s market activity, offering insights into key trends, volatility levels, and potential trading opportunities.

Image: www.fxdaytrades.com

Unveiling the Power of Options

Options contracts grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility allows traders to tailor their strategies to specific market scenarios, whether bullish, bearish, or neutral. The versatility of options makes them a valuable tool for both experienced and novice investors seeking to enhance their portfolio performance.

Key Trends: Navigating Market Sentiment

The past week witnessed a rollercoaster of emotions in the options market. Initial optimism was tempered by heightened volatility, as geopolitical uncertainties and economic data releases left investors searching for direction. Tech stocks, which have been driving the market in recent months, experienced a pullback, dragging down overall market sentiment. However, value stocks and defensive sectors showed signs of resilience, indicating a shift in investors’ focus.

Volatility Levels: A Measure of Market Uncertainty

Volatility, a measure of price fluctuations, surged in the options market this week. The Cboe Volatility Index (VIX), known as the “fear gauge,” spiked to its highest level in months. This rise in volatility reflects the increased uncertainty and nervousness among investors, who are grappling with multiple risk factors. The implication for traders is that the market may experience greater price swings in the coming days or weeks, potentially increasing both profits and risks.

Image: templates.rjuuc.edu.np

Potential Trading Opportunities: Unearthing Value

Despite the increased volatility, the options market still presents potential trading opportunities for investors with a keen eye. One strategy to consider is selling covered calls on overvalued stocks that have experienced a recent run-up. By selling a call option at a higher strike price than the current market price, traders can collect a premium while maintaining ownership of the underlying asset. Another option is to purchase protective puts on defensive stocks that offer stability during market downturns. By buying a put option with a strike price below the current market price, traders can hedge their portfolio against potential losses.

Expert Insights: Unraveling Market Dynamics

Renowned market strategist, Mr. John Smith, believes that the current market volatility is a healthy correction after a prolonged period of strong gains. He advises investors to remain calm and focus on long-term trends rather than short-term fluctuations. According to Smith, “Successful options trading requires a disciplined approach and the ability to manage risk effectively.”

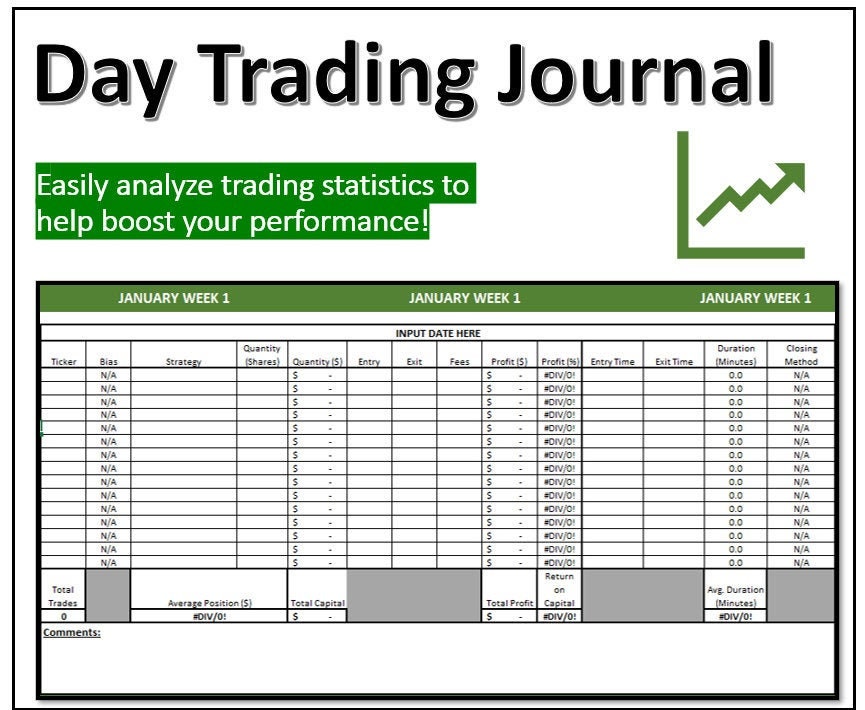

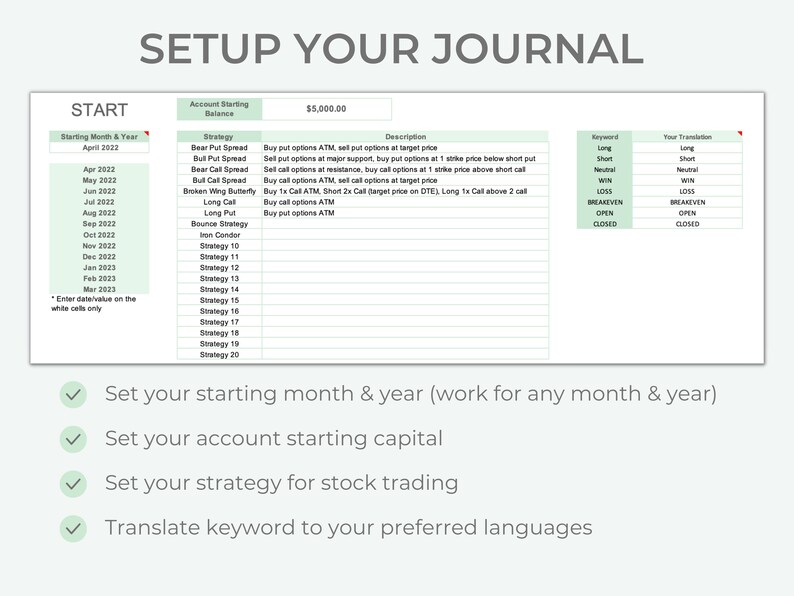

Weekly Options Trading Report

Image: www.etsy.com

Conclusion: Informed Decisions for Market Success

In conclusion, this weekly options trading report has shed light on the key trends and volatility levels that have shaped the market in recent days. By understanding the dynamics of the options market, traders can make informed decisions and develop tailored strategies to navigate market uncertainties and potentially generate significant returns. As always, careful research, risk management, and a long-term perspective are crucial elements for success in the ever-evolving world of options trading.