In the fast-paced world of financial markets, options trading has emerged as a compelling strategy for investors seeking short-term gains. Weekly options, which expire within a week of their issuance, offer a unique opportunity for traders to capitalize on market movements over a compressed timeframe. This article delves into the intricate details of weekly options trading performance, shedding light on its advantages, risks, and essential strategies.

Image: www.youtube.com

Unveiling the Potential of Weekly Options

Weekly options, unlike their longer-term counterparts, provide traders with a more rapid cadence of trading opportunities. Their shorter lifespans make them ideal for traders who prefer short-term exposure to market fluctuations. Moreover, weekly options tend to exhibit lower premiums compared to longer-term options, potentially reducing the capital required to enter a trade.

While weekly options offer enticing profit potential, understanding their mechanics is crucial. Premiums for weekly options decay rapidly as the expiration date approaches, creating a time-sensitive element that traders must navigate. This time decay can amplify losses if the market moves against a trader’s position.

Options Trading Performance: Strategies for Short-Term Success

To achieve optimal weekly options trading performance, traders employ a range of strategies:

-

Call Options Trading: When bullish on an underlying security, traders can purchase call options. If the underlying security increases in value, call options gain value, offering traders the potential for significant profits.

-

Put Options Trading: When bearish on an underlying security, traders can purchase put options. If the underlying security decreases in value, put options gain value, again presenting an opportunity for profitable returns.

-

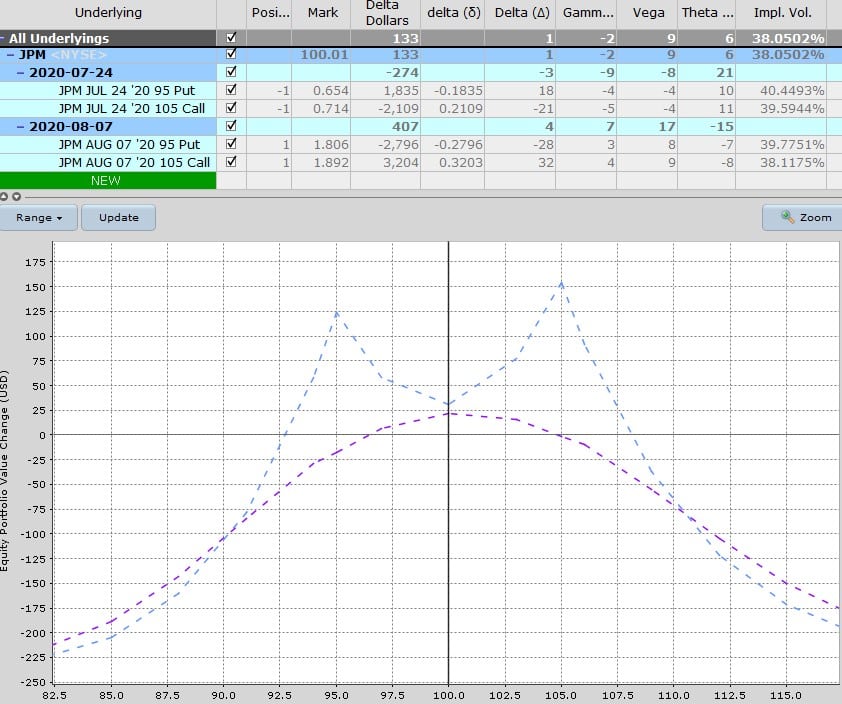

Iron Condor: This neutral strategy involves selling both call and put options at different strike prices to capitalize on a range-bound underlying security. Traders seek to profit from the premiums collected and potential fluctuations within the set price range.

-

Strangles and Straddles: These advanced strategies involve buying call and put options with the same expiration date but different strike prices. Traders implementing these strategies expect significant price movements and aim to capture profits from volatility regardless of the direction.

Navigating the Risks and Challenges

While weekly options trading can be alluring, it carries inherent risks that traders must acknowledge:

-

Time Decay: As mentioned earlier, the time value of weekly options decays rapidly, potentially leading to significant losses if the underlying security does not move as anticipated.

-

Volatility Risk: Weekly options are highly sensitive to underlying security price movements, especially those with high volatility. Rapid fluctuations can lead to substantial gains or losses in a short period.

-

Liquidity Concerns: Weekly options may have lower trading volume compared to longer-term options, potentially making it challenging to enter or exit trades quickly, especially during periods of market volatility.

Image: www.youtube.com

Weekly Options Trading Performance

Image: optionstradingiq.com

Conclusion: Weekly Options Trading – A Calculated Pursuit

Weekly options trading presents both opportunities and risks, offering a unique avenue for investors seeking short-term market exposure. To maximize performance, traders must thoroughly understand the mechanics of weekly options, implement effective trading strategies, and meticulously manage risk. By carefully navigating the intricate landscape of weekly options trading, investors can potentially harness the power of these instruments to generate lucrative returns within a compressed time frame.