Options trading, with its inherent risks and rewards, demands a meticulous approach to analysis and decision-making. While success in this domain is not guaranteed, keeping a comprehensive options trading journal can significantly enhance your insights, improve your trading strategies, and ultimately maximize your profits.

Image: www.tradingdiarypro.com

The Essence of an Options Trading Journal

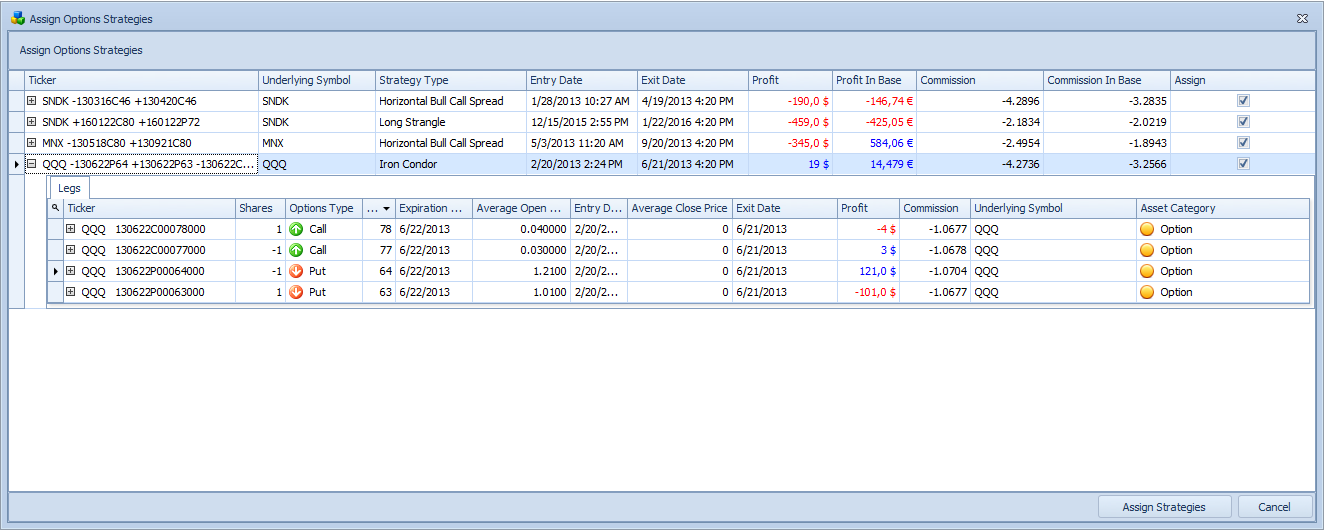

An options trading journal is a personal record that documents your options trading activities in a structured manner. It encompasses details of each trade, including the instrument traded, the strategy employed, entry and exit points, the rationale behind the trade, and its outcome. By diligently maintaining such a journal, you gain invaluable insights into your trading behaviors, strengths, and areas for improvement.

Benefits of an Options Trading Journal

The benefits of an options trading journal are multifaceted. Firstly, it serves as a record of historical trades, providing a valuable reference point for analysis and evaluation. By examining past trades, you can identify patterns in your trading behavior, such as consistent mistakes or missed opportunities. This in-depth understanding enables you to refine your strategies, minimize errors, and optimize your decision-making process.

Secondly, an options trading journal promotes accountability. The act of documenting your trades compels you to critically assess your actions and take ownership of your performance. By being held accountable for your decisions, you are more likely to adopt a disciplined and systematic approach to trading.

Furthermore, an options trading journal fosters continuous learning. As you record your trades and analyze their outcomes, you can pinpoint deficiencies in your understanding of options trading concepts or identify new trading techniques that could enhance your profitability. This journal becomes a repository of knowledge, evolving alongside your own trading expertise.

Essential Elements of an Options Trading Journal

An effective options trading journal should capture pivotal data points related to each trade. The following elements are crucial:

- Symbol: Note the underlying security or index for the option you are trading.

- Option Type: Specify whether you are trading calls or puts, and their expiration date and strike price.

- Trade Date and Time: Record the precise date and time you entered and exited the trade.

- Quantity: Indicate the number of options contracts you traded.

- Entry and Exit Prices: Capture the prices at which you bought and sold your options.

- Strategy: Describe the options trading strategy you implemented, such as a long call, short put, or covered call.

- Rationale: Briefly explain the reasons you entered the trade, considering market conditions, technical analysis, or fundamental factors.

- Notes: Jot down any additional observations or insights regarding the trade.

Image: www.etsy.com

Frequency of Recording Trades

The frequency with which you update your options trading journal is crucial. Ideally, you should record each trade immediately after execution to avoid potential gaps or discrepancies in your data. This timely recording ensures that your journal remains a comprehensive and accurate representation of your trading activities.

Trading Journal For Options

Conclusion

In the tumultuous world of options trading, where market dynamics shift constantly, an options trading journal stands as an invaluable tool. By diligently recording your trades, analyzing past performance, and identifying areas for improvement, you empower yourself with the insights and knowledge necessary for consistent success. Let an options trading journal be your guide as you navigate the complexities of this dynamic market and unlock your full trading potential.