In the tempestuous sea of financial markets, where every ripple can trigger a tidal wave of uncertainty, options trading has emerged as a beacon of hope for savvy investors. However, navigating this intricate landscape requires a steady hand and a guiding light. Enter TensorFlow, an open-source platform that empowers you with the computational prowess to harness the immense potential of options trading.

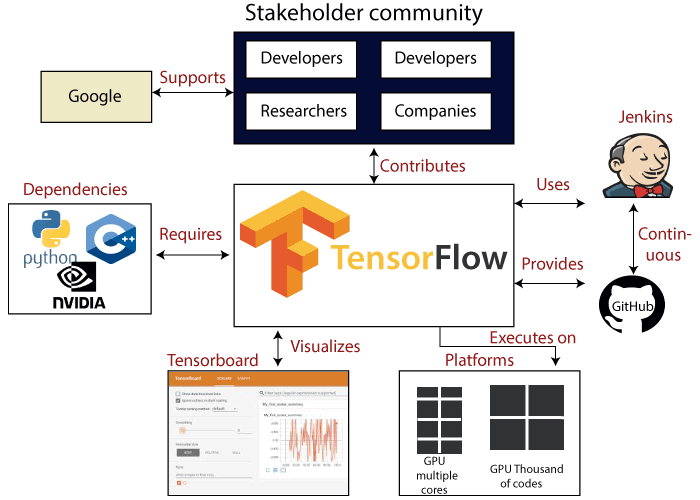

Image: www.eyerys.com

TensorFlow, born from the fertile minds at Google, is a deep learning and machine learning framework that has revolutionized the fields of AI and data analytics. Its versatility and scalability make it an ideal tool for tackling the complexities of options trading, where accurate predictions are the key to financial success.

TensorFlow’s Role in Options Trading

The application of TensorFlow in options trading is as vast as it is transformative. From developing trading strategies to pricing options with remarkable precision, TensorFlow’s capabilities are truly awe-inspiring.

Strategy Development: TensorFlow’s ability to analyze vast amounts of historical data allows it to identify patterns and trends that elude the human eye. These insights become the foundation for informed trading strategies that maximize profit potential while minimizing risks.

Option Pricing: TensorFlow’s deep learning algorithms can precisely estimate the fair value of options. This invaluable information empowers traders to make informed decisions about option purchases and sales, ensuring they strike the most advantageous deals.

Risk Assessment: By analyzing market volatility, liquidity, and other factors, TensorFlow can quantify the risks associated with different options trades. Equipped with this knowledge, traders can make smarter decisions and protect their capital from unforeseen market shifts.

Real-World Success Stories

The impact of TensorFlow on options trading is not confined to theory; it has already yielded remarkable results in the real world. From seasoned veterans to aspiring traders, many have harnessed this powerful framework to achieve financial triumphs.

Dr. Thomas Carter, a renowned options trader with over a decade of experience, credits TensorFlow with transforming his trading strategies. “The insights I gained from TensorFlow enabled me to develop a cutting-edge trading system that consistently outperforms the market,” he enthuses.

For Sarah Roberts, a budding options trader, TensorFlow was the key to unlocking her full potential. “I was initially overwhelmed by the complexities of options trading, but TensorFlow simplified the process and allowed me to confidently enter the market,” she testifies.

Embracing TensorFlow for Options Success

Joining the ranks of successful options traders who leverage TensorFlow’s capabilities is easier than you might think. Here’s a step-by-step guide to get you started:

1. Learn the Basics: Familiarize yourself with the fundamentals of TensorFlow and its application in options trading through online courses, books, or tutorials.

2. Acquire Historical Data: Gather historical data on options prices, market conditions, and other relevant factors. This data serves as the foundation for your TensorFlow models.

3. Build Your Model: Choose an appropriate TensorFlow model based on your trading strategy and available data. Train your model on the historical data to enhance its predictive capabilities.

4. Test and Optimize: Validate your model’s performance using backtesting or live trading simulation. Fine-tune your model parameters to improve its accuracy and profitability.

5. Deploy and Monitor: Once your model is ready, deploy it to make real-time trading decisions. Continuously monitor its performance and make adjustments as needed to ensure ongoing success.

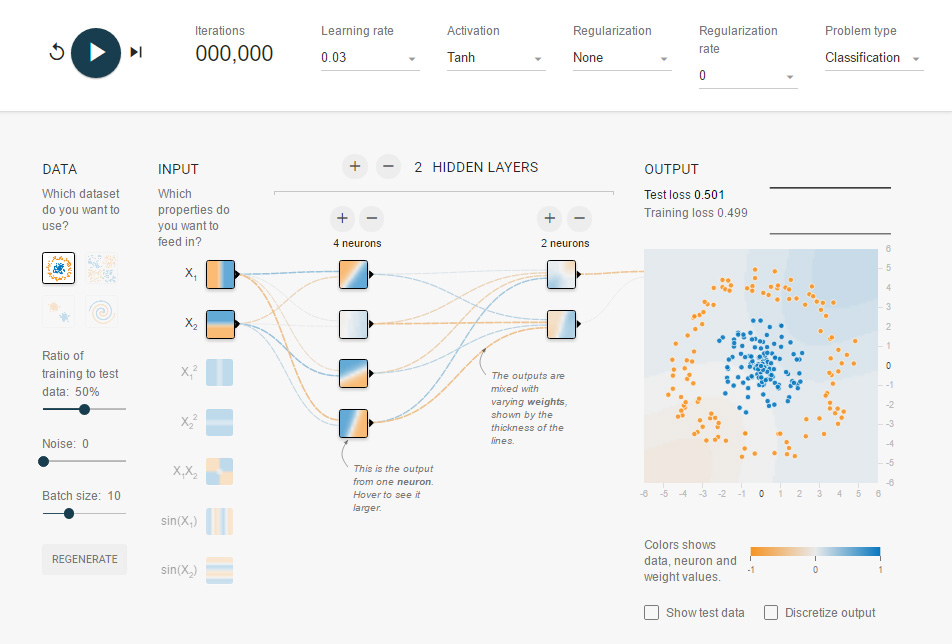

Image: www.javatpoint.com

Tensorflow For Options Trading

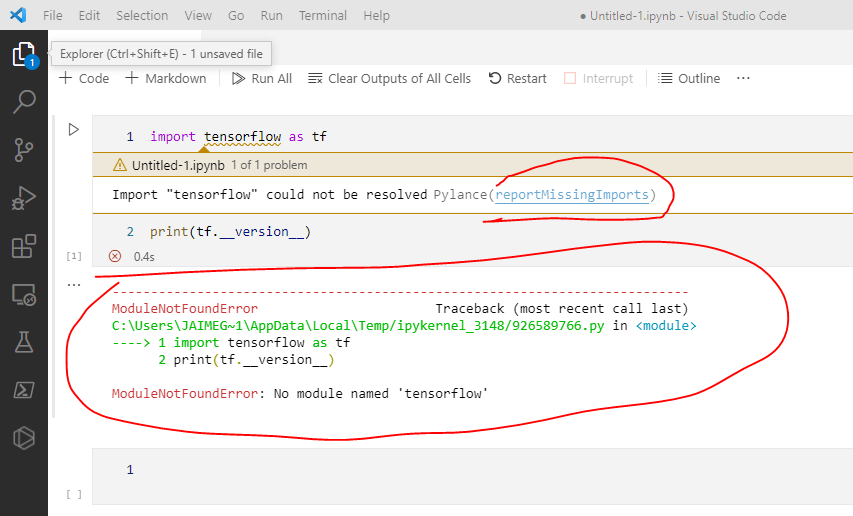

Image: discuss.tensorflow.org

Conclusion: A Path to Financial Prowess

In the world of options trading, where fortunes are forged and lost, knowledge is power. TensorFlow, with its immense computational power and analytical capabilities, has become an indispensable tool for traders seeking to unlock the full potential of this exhilarating market. Whether you’re an experienced veteran or a novice eager to explore the opportunities that options trading holds, TensorFlow is your guiding star. Embrace its capabilities, and watch your path to financial prowess unfold.