Title: Unraveling the Tax Labyrinth: A Comprehensive Guide to Options Trading Taxation

Image: www.journalofaccountancy.com

Introduction:

Imagine stepping into a world of financial opportunity and uncertainty—the realm of options trading. While the allure of potential profits tantalizes, the intricacies of tax calculations can often leave even seasoned investors feeling disoriented. Fear not, dear reader, for this article serves as your navigatory beacon, guiding you through the complex landscape of options trading taxation, empowering you to make informed decisions that optimize your post-trade returns.

Options contracts, derivatives that derive their value from underlying assets such as stocks, bonds, or commodities, are a powerful tool for investors seeking both speculative upside and strategic risk management. However, the tax implications of options trading can vary significantly depending on the type of options, holding period, and trader status. Understanding these nuances is crucial to maximizing your after-tax profits.

Types of Options and Taxation:

Options fall into two primary categories: calls and puts. Call options provide the buyer with the right but not the obligation to purchase an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Put options, on the other hand, offer the buyer the right to sell an underlying asset.

Call options not exercised before expiration date are considered speculative and are taxed at short-term capital gains rates if held for less than a year or long-term capital gains rates if held for a year or longer. Put options treated similarly.

Short-Term vs. Long-Term Holding:

The holding period of an option contract is a critical factor in determining its tax treatment. Options held for less than a year are subject to short-term capital gains taxes, which are typically higher than long-term capital gains taxes. This distinction encourages investors to hold options for the long term, potentially reducing their tax liability.

Tax Rates for Options Trading:

The tax rates applicable to options trading vary based on the investor’s tax bracket. Short-term capital gains are taxed at the same rate as ordinary income, while long-term capital gains are taxed at a lower rate. The long-term capital gains rate structure comprises three brackets: 0%, 15%, and 20%. The applicable bracket depends on the investor’s taxable income.

Trader Status and Tax Implications:

Your status as an individual or professional trader also affects your tax liability. Professional traders who derive the majority of their income from options trading may be subject to different tax rules than non-professional traders. It’s advisable to consult with a tax professional who specializes in options trading taxation to ensure compliance and optimal tax planning.

Other Tax Considerations in Options Trading:

Beyond the basics outlined above, there are several other tax considerations in options trading, such as:

- Premium Decay: The time value of an option premium decays over time, which can impact the realized gain or loss.

- Wash Sale Rule: Selling an option at a loss and acquiring a similar option within 30 days may result in disallowance of the loss for tax purposes.

- Passive Activity Loss Limitations: Losses from options trading may be subject to passive activity loss limitations, restricting their deductibility.

Conclusion:

Understanding the complexities of options trading taxation is essential for informed investing. By mastering the principles outlined in this article, you can navigate the tax landscape with confidence, maximizing your after-tax returns and minimizing the impact of tax burdens. Remember to seek professional advice when necessary, empowering yourself to make strategic tax planning decisions that align with your financial goals. As you venture into the world of options trading, may this guide serve as your steadfast companion, ensuring that tax calculations no longer hold the power to impede your financial success.

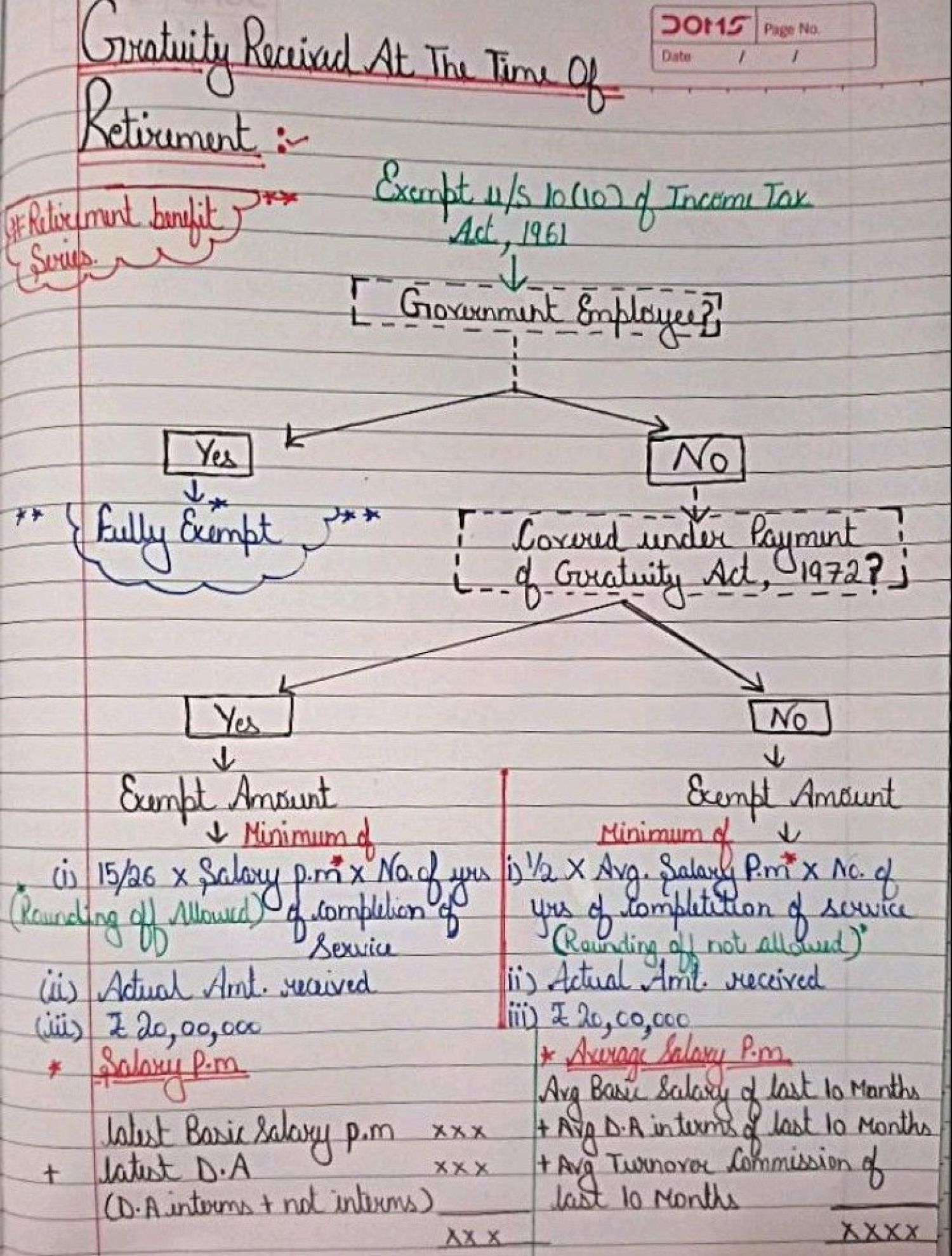

Image: carajput.com

Tax Calculation On Options Trading

Image: kuda-pereehat.com