Introduction

Navigating the volatile world of options trading requires a well-defined plan that balances risk and potential rewards. An options trading plan sample serves as a blueprint for strategizing trades, setting price targets, and managing the emotional roller coaster of market movements. This comprehensive guide will delve into the key elements of an options trading plan sample, empowering traders with the knowledge and tools to navigate the financial markets successfully.

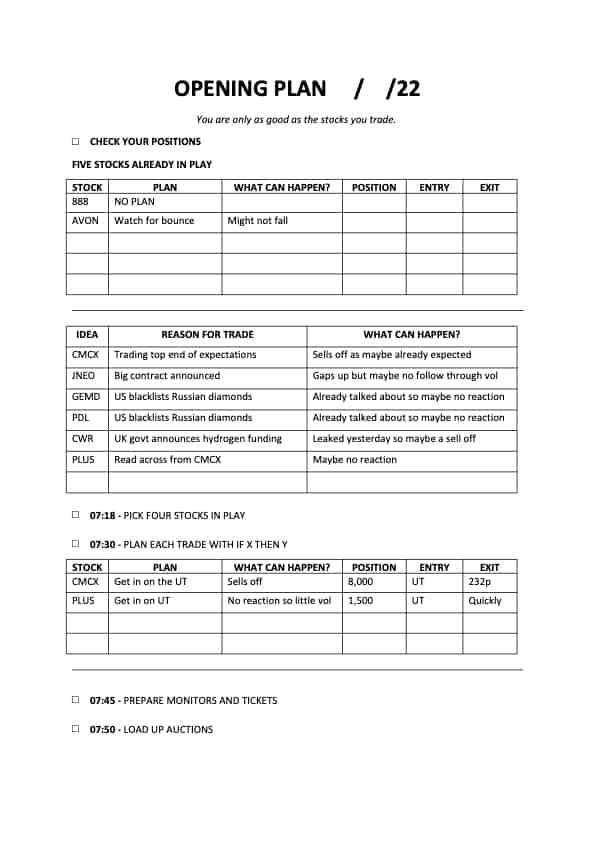

Image: www.shiftingshares.com

Understanding Options Trading

Options contracts grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This unique characteristic distinguishes options from other financial instruments and introduces an element of flexibility and leverage. Traders can capitalize on potential price movements in the underlying asset without directly owning it, opening up countless trading possibilities.

Why an Options Trading Plan is Essential

The complexities of options trading demand a well-structured plan that serves as a guidepost for making informed decisions. An options trading plan sample provides the following benefits:

- Reduced Risk: By clearly outlining risk parameters, position sizing, and exit strategies, traders can manage their exposure to potential losses and protect their capital.

- Disciplined Execution: Adhering to a trading plan enforces discipline and reduces impulsive decisions based on emotions. It ensures that trades are made objectively and in alignment with the trader’s goals.

- Performance Evaluation: Tracking adherence to the plan, trading results, and performance metrics allows traders to continuously evaluate their strategies and identify areas for improvement.

Core Elements of an Options Trading Plan Sample

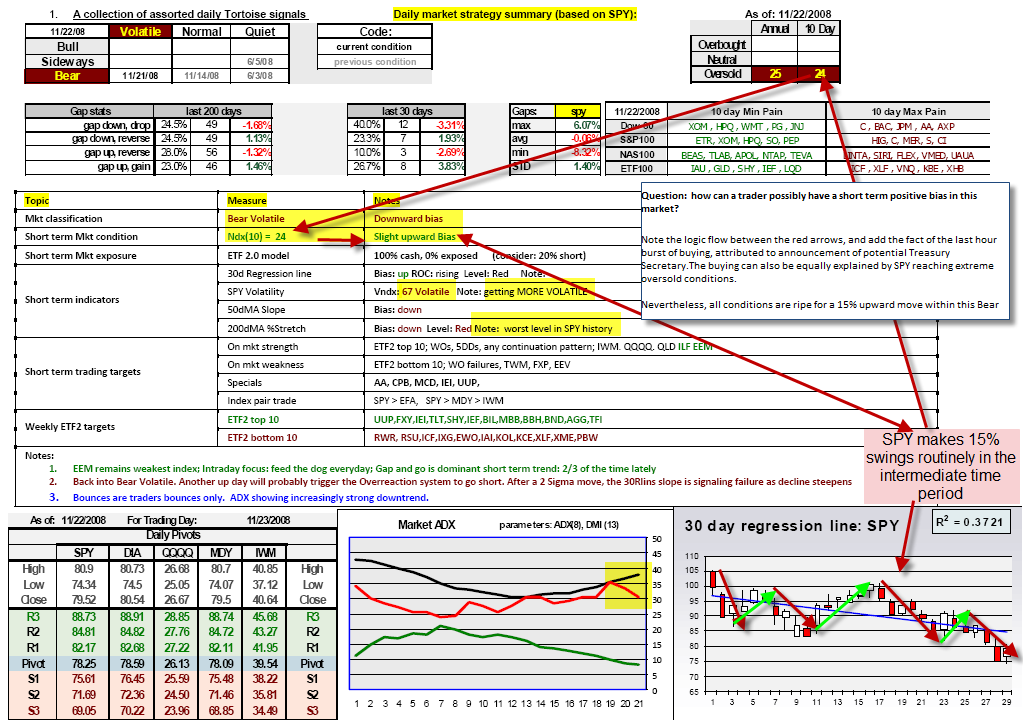

Image: investpost.org

1. Trading Strategy

Articulate the specific trading strategies that will be employed, such as buying/selling calls or puts, or using options spreads. Define the underlying assets, expiration dates, and target profit/loss levels.

2. Risk Management

Specify maximum loss tolerance, position sizing guidelines, and stop-loss triggers. Detailed risk parameters help traders mitigate potential losses and avoid emotional decision-making.

3. Position Management

Outline strategies for entry and exit points, trade adjustments, and profit targets. Defining specific price levels for these actions provides a clear framework for executing trades with precision.

4. Risk-Reward Analysis

Quantify the potential risk and reward ratios associated with each trade. By evaluating the potential return on investment (ROI) relative to the defined risk, traders can make informed decisions about their trade selection.

5. Emotional Management

Acknowledge the inevitable influence of emotions on trading and establish strategies to manage emotional bias. This could include setting trading session limits, reviewing trades objectively, or seeking external support.

6. Market Analysis

Specify the technical and fundamental analysis techniques used to determine market conditions and identify trading opportunities. Define the key indicators, chart patterns, and news events that will guide trading decisions.

7. Trading Journal

Maintain a detailed record of all trades, including entry and exit prices, profit/loss, and any relevant notes. This journal serves as a valuable reference for evaluating performance and identifying areas for improvement.

Options Trading Plan Sample

Image: www.tradersmastermind.com

Conclusion

An options trading plan sample is an indispensable tool for successful navigation of the complex and volatile world of financial markets. By incorporating the elements described in this guide, traders can establish a disciplined framework for making informed trading decisions, managing risk, and optimizing potential returns. Remember, the effectiveness of an options trading plan lies not only in its creation but also in its consistent implementation and regular evaluation.