In the realm of finance, options trading emerges as a potent instrument for harnessing market volatility to generate profit. By understanding the intricacies of options and implementing a well-structured trading plan, traders can amplify their chances of success in this dynamic market. This comprehensive guide will lead you through the essential components of a sample option trading plan, empowering you to navigate the complexities of this lucrative domain.

Image: tujogim.web.fc2.com

Unveiling Options Trading: A Path to Market Triumph

Options, financial contracts that grant the right but not the obligation to buy or sell an underlying asset at a predetermined price, provide unparalleled flexibility in managing risk and leveraging market movements. As an options trader, you have the power to tailor your trading strategies to align with your risk tolerance, market expectations, and investment goals. Mastering the art of options trading requires a thorough understanding of option types, pricing factors, and trading mechanics.

Pillars of a Sample Option Trading Plan: A Framework for Success

A well-defined sample option trading plan serves as the cornerstone of successful trading decisions. This comprehensive blueprint encompasses essential elements that guide your every move in the market, ensuring both clarity and discipline. Let us delve into the building blocks of a robust trading plan:

-

Market Analysis: Laying the Foundation for Informed Decisions

Before venturing into the trading arena, a thorough analysis of the market landscape is paramount. Identify key market trends, conduct technical and fundamental analysis, and stay abreast of economic indicators and global events that may impact your trading strategies. This holistic approach empowers you with the insights necessary to make informed decisions and capitalize on market opportunities.

-

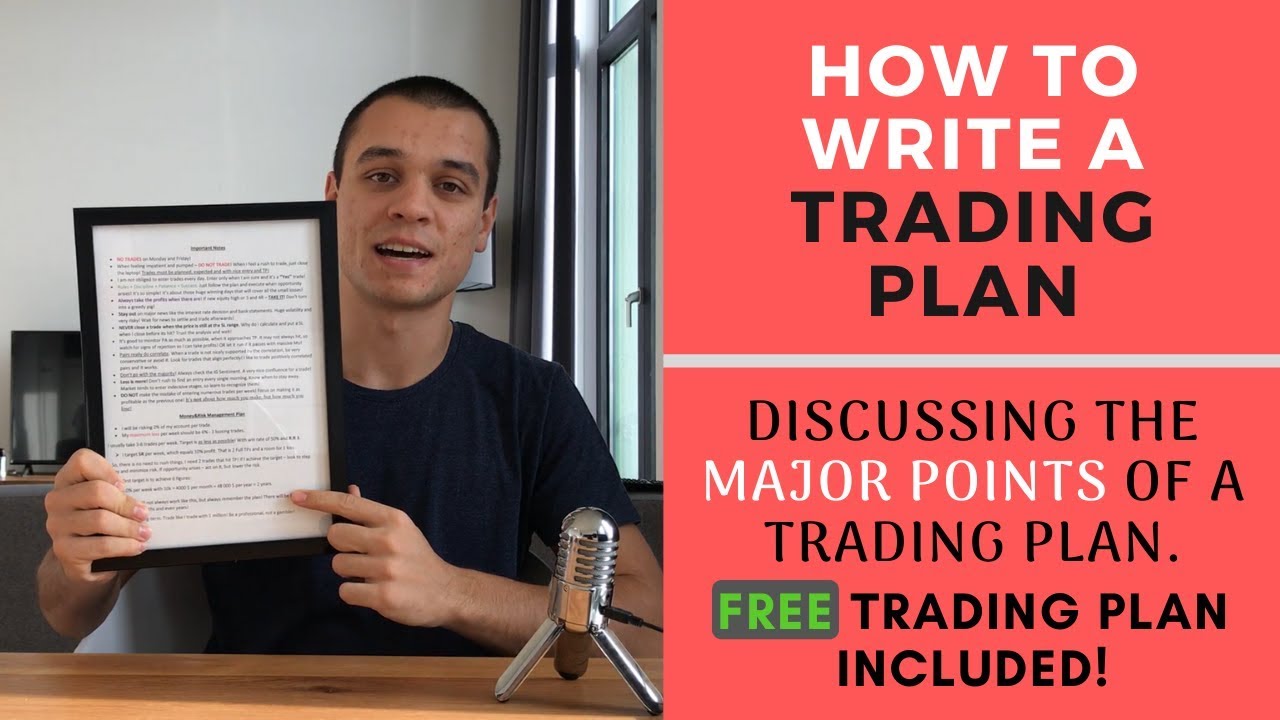

Image: www.youtube.comRisk Management: Navigating the Market’s Unpredictability

Risk management lies at the heart of successful options trading. Define your risk tolerance, establish clear entry and exit points, and determine the maximum amount you are willing to lose on any given trade. Employ stop-loss orders and position sizing techniques to mitigate risk and protect your capital.

-

Option Selection: Matching Strategy to Market Conditions

The choice of options contracts plays a pivotal role in determining the potential rewards and risks associated with your trading plan. Understand the different types of options available, including calls, puts, and spreads, and align your selection with your trading goals and market outlook.

-

Trade Execution: Precision and Discipline in Action

Execute your trades with precision and discipline to maximize your chances of success. Adhere to your pre-defined trading plan, manage your orders effectively, and monitor market conditions closely. Maintain a trading journal to track your performance, identify areas for improvement, and refine your strategies over time.

-

Performance Evaluation: Refining Your Trading Edge

Regularly evaluate your trading performance to identify strengths and weaknesses. Analyze your win rate, profit-to-loss ratio, and risk-adjusted returns. This self-assessment process empowers you to refine your trading strategies, improve your decision-making abilities, and continuously enhance your trading proficiency.

Expanding Your Trading Prowess: Advanced Strategies and Techniques

As your experience and confidence grow, consider incorporating advanced strategies and techniques into your sample option trading plan. These include:

-

Options Trading Strategies: Maximizing Profit Potential

Explore a diverse range of options trading strategies, such as covered calls, cash-secured puts, and iron condors, to diversify your portfolio and increase your profit-generating opportunities.

-

Options Greeks: Quantifying Market Sensitivity

Master the concept of options Greeks, such as delta, gamma, and vega, to gain a deeper understanding of how options behave in response to changes in underlying asset price, time decay, and volatility.

-

Volatility Trading: Harnessing Market Fluctuations

Incorporate volatility trading into your plan to capitalize on market fluctuations. Understand how implied volatility impacts option prices and employ strategies that benefit from changing volatility levels.

Sample Option Trading Plan

Image: db-excel.com

Conclusion: Empowering Yourself for Trading Success

By embracing the principles outlined in this guide, you can craft a robust sample option trading plan that empowers you to navigate the markets with confidence and maximize your trading potential. Remember to continuously refine your strategies, adapt to market conditions, and never cease the pursuit of knowledge. The path to trading success lies in thoughtful preparation, disciplined execution, and an unwavering commitment to personal growth. Embrace this journey with enthusiasm and become a master of the options trading arena.