**Personal Anecdote**

In the realm of finance, I was drawn to the allure of options trading, captivated by its promise of amplifying profits. Sparrow options emerged as a compelling choice, offering a flexible and potentially lucrative trading strategy. Embark on this journey with me as I delve into the intricate world of sparrow options trading, unravel its complexities, and unveil its transformative potential.

Image: medium.com

**Sparrow Options: Unlocking Market Opportunities**

Sparrow options are a type of equity-based option contract that grants the holder the right, but not the obligation, to buy or sell a specific underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This unique structure empowers traders with the ability to capitalize on market fluctuations by leveraging their predictions.

**Historical Roots and Modern Significance**

Sparrow options trace their lineage back to the early days of options trading. However, their popularity has surged in recent years, driven by advancements in technology and the increasing accessibility of financial markets. Today, sparrow options are employed by a diverse spectrum of traders, ranging from experienced professionals to aspiring investors.

**Unriddling the Complexity of Sparrow Options**

Understanding the key aspects of sparrow options is crucial for successful execution.

Image: www.nsbanking.com

Call Options

Call options confer the right to buy a specific asset at the strike price. Traders typically purchase call options when they anticipate price rises, aiming to profit from upward market movements.

Put Options

Put options, on the other hand, grant the right to sell a specific asset at the strike price. Traders utilize put options when they foresee price declines, hedging against potential losses or speculating on market downturns.

Expiration Date and Strike Price

The expiration date defines the timeframe during which the option can be exercised, while the strike price determines the underlying asset’s price at which the option can be bought or sold. Traders must carefully assess these parameters to optimize their trading strategies.

Intrinsic Value and Time Value

The intrinsic value of an option represents its potential profit if exercised immediately, while the time value measures the premium paid for the option’s remaining time until expiration.

**Navigating the Nuances of Market Trends**

Staying abreast of market trends is vital for informed sparrow options trading decisions. By monitoring economic indicators, tracking price movements, and interpreting market sentiment, traders can enhance their predictive abilities and maximize their chances of success.

Keep an eye on News and Updates

Staying informed about market-moving events, including economic reports, earnings announcements, and geopolitical shifts, is paramount for making timely and strategic trading decisions.

Utilize Technical Analysis

Technical analysis involves studying price charts and patterns to identify potential trading opportunities. Tools like moving averages, support and resistance levels, and candlestick patterns can provide insights into market momentum and potential reversal points.

**Tips and Expert Advice for Empowered Trading**

Start Small and Gradually Increase Exposure: Begin with modest trades until you gain a feel for the market and develop confidence. As you acquire knowledge and experience, gradually increase the size of your positions.

Understand Risk Management Techniques: Risk management is a cornerstone of successful options trading. Employ strategies like stop-loss orders, protective puts, and hedging to safeguard your capital and minimize losses.

Seek Guidance from Experienced Traders: Engage with mentors or join trading communities to learn from seasoned professionals and gain valuable insights into market dynamics and successful trading practices.

**FAQs for Enhanced Clarity**

Q: What is the difference between a call and a put option?

A: Call options grant the right to buy, while put options convey the right to sell an underlying asset at a specified price.

Q: How do I choose the appropriate strike price?

A: The strike price should align with your profit targets and market expectations. Consider the underlying asset’s historical price movements and future projections.

Q: What factors influence option premiums?

A: Premiums are impacted by variables such as volatility, time to expiration, and the underlying asset’s price.

Q: Can I lose more than I invest in options trading?

A: Yes, options trading carries the potential for substantial losses, even exceeding your initial investment.

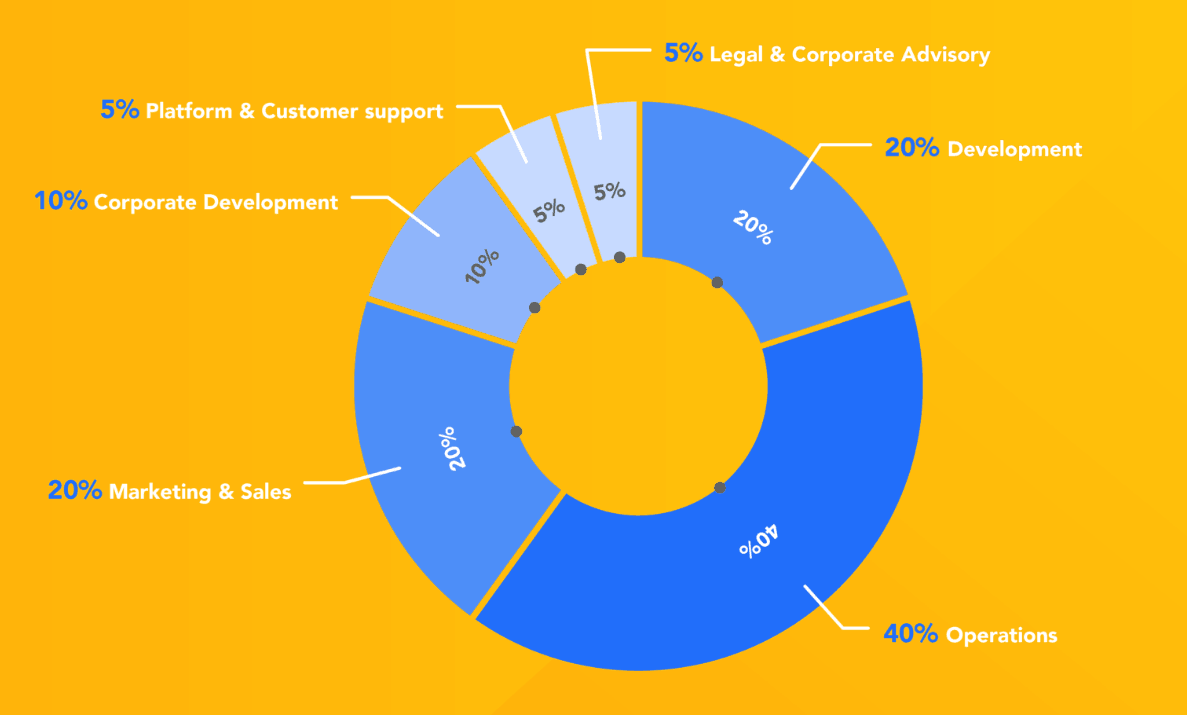

Sparrow Options Trading

Image: icodrops.com

**Conclusion: Embracing the Potential of Sparrow Options Trading**

Gentlemen, we have lifted the veil on the enigmatic realm of sparrow options trading. This article has served as a comprehensive guide, empowering you with the knowledge and insights necessary to embark on your own trading journey. By embracing the power of sparrow options, you can harness market opportunities to amplify your profits and navigate the financial markets with enhanced confidence.

Are you ready to soar with the sparrows and unleash your financial potential?