An Introduction to the World of Options Trading

Options trading offers a thrilling opportunity to leverage the power of potential price movements in various financial instruments, including stocks, currencies, and commodities. At its core, an option grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This unique characteristic empowers traders to navigate market fluctuations strategically, potentially maximizing their returns.

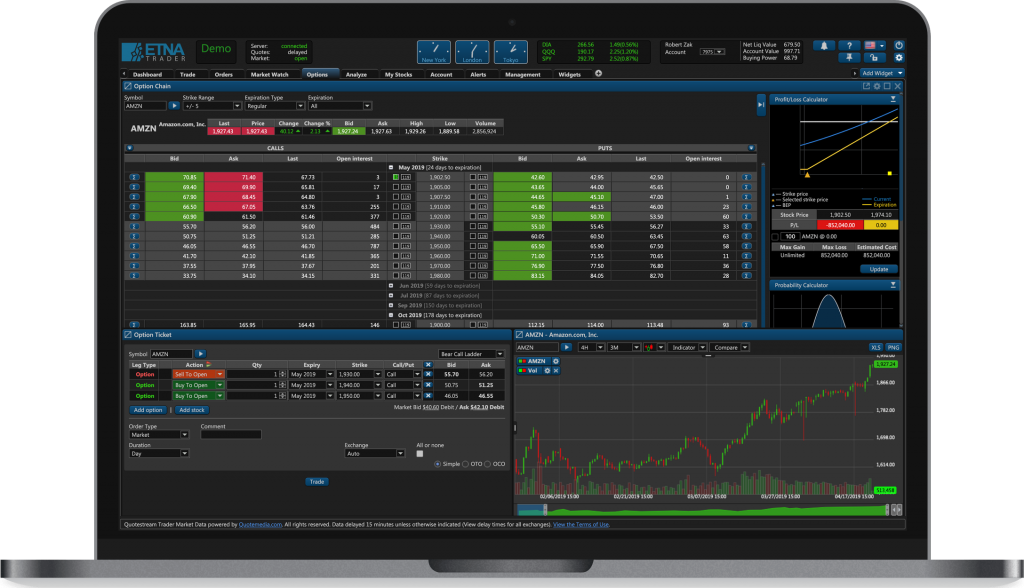

Image: www.etnasoft.com

Embarking on an options trading venture requires a solid understanding of options trading core concepts, market dynamics, and risk management strategies. This comprehensive guide, crafted with meticulous attention to detail, will equip you with the knowledge and insights you need to create an options trading platform in C++—empowering you to take control of your financial destiny.

Unveiling the Intricacies of an Options Trading Platform

Before delving into the technical intricacies of building an options trading platform, let’s first explore its fundamental components:

-

Data Feed: Real-time market data powers your trading decisions. An efficient data feed provides up-to-date information on price movements, bid-ask spreads, and market depth, enabling you to make informed trades.

-

Order Management System: This system orchestrates the seamless execution of your trades. It accepts, modifies, and cancels orders, ensuring that your trading intentions are translated into actual market orders with precision.

-

Trading Interface: This is the user interface that facilitates your interactions with the platform. It should be intuitive, customizable, and designed to enhance your trading experience.

-

Risk Management Module: Options trading carries inherent risks. This module monitors your positions, calculates Greeks (measures of risk and sensitivity), and provides insights to help you manage potential losses.

A Step-by-Step Blueprint for Building Your C++ Options Trading Platform

With a clear understanding of the platform components, let’s embark on the journey of building it in C++.

-

Prerequisites: Ensure you have a solid grasp of C++, object-oriented programming, and data structures. Familiarity with financial concepts and trading strategies is also beneficial.

-

Design the Data Model: Define the data structures that will represent market data, orders, and positions. Consider factors like efficiency, flexibility, and scalability.

-

Implement Data Feed Integration: Establish a connection to a reliable data feed provider and develop a module to ingest and parse real-time market data into your platform.

-

Create the Order Management System: Build a robust order management system that can handle different order types, including market orders, limit orders, and stop orders. Ensure robust error handling and order status tracking.

-

Develop the Trading Interface: Design a user-friendly trading interface that allows traders to view market data, place orders, and monitor their positions. Consider features like customizable charts, trade alerts, and position summaries.

-

Integrate Risk Management: Implement a risk management module that calculates Greeks and provides insights into potential risks associated with different trading strategies.

-

Test and Refine: Thoroughly test your platform to ensure its accuracy, stability, and performance under varying market conditions. Seek feedback from traders and continuously refine the platform based on their experiences.

Harnessing the Power of C++ for Options Trading

C++, a powerful and versatile language known for its speed and efficiency, offers numerous advantages for options trading platform development:

-

High Performance: C++ code executes exceptionally fast, enabling real-time processing of market data and lightning-fast order execution.

-

Object-Oriented Design: C++’s object-oriented nature promotes code reusability, maintainability, and extensibility.

-

Cross-Platform Compatibility: C++ code can be compiled for various operating systems, providing flexibility in deployment options.

-

Community Support: A vast and active C++ developer community provides valuable resources, support, and libraries specifically tailored for financial applications.

Image: www.eoption.com

Options Trading Platform C++ Project

Image: technode.global

Conclusion

Creating an options trading platform in C++ is an ambitious yet rewarding endeavor. By following the outlined steps, leveraging the strengths of C++, and embracing continuous learning, you can build a powerful tool to navigate the dynamic world of options trading. Remember, the key to success lies in a thorough understanding of options trading, prudent risk management, and unwavering dedication to honing your skills as a trader. May your trading journey be marked by informed decisions, calculated risks, and the realization of your financial aspirations.