Introduction

Imagine stepping into the vibrant world of finance, where opportunities abound and strategies unfold to unlock your financial potential. Among the various avenues lies options trading, a universe of possibilities waiting to be explored. But before you embark on this exciting journey, let’s delve into a comprehensive exploration of options trading, unraveling its nuances and empowering you to make informed decisions.

Image: jeka-vagan.blogspot.com

Options trading, in its essence, is a contract between two parties that grants the buyer the option, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This unique financial instrument empowers investors with flexibility, allowing them to speculate on the future direction of assets without the commitment of ownership.

Understanding the Core Concepts

At the heart of options trading lies the underlying asset, which can range from stocks and bonds to commodities and currencies. The buyer of an option, known as the option holder, pays a premium to the seller, known as the option writer, in exchange for the right to exercise the option at a future date.

Options contracts are classified into two primary types: calls and puts. A call option grants the holder the right to buy the underlying asset, while a put option otorga the right to sell. Each option specifies a strike price, which is the predetermined price at which the underlying asset can be bought or sold.

Exploring Option Strategies

The true power of options trading lies in the diverse strategies it offers. These strategies can range from simple to complex, catering to varying risk appetites and investment objectives. Some of the most common strategies include:

-

Buying Calls: This strategy is employed when the investor expects the underlying asset’s price to rise. By purchasing a call option, the holder gains the right to buy the asset at the strike price, potentially profiting from future appreciation.

-

Selling Calls: In this scenario, the investor anticipates a decline in the underlying asset’s price. By selling a call option, the holder grants the buyer the right to buy the asset at the strike price, profiting if the asset’s price remains below or falls further.

-

Buying Puts: When an investor anticipates a decline in the underlying asset’s price, buying a put option becomes a viable strategy. This option grants the holder the right to sell the asset at the strike price, potentially profiting from the asset’s price depreciation.

-

Selling Puts: Selling puts involves the anticipation of a rise in the underlying asset’s price. The investor sells a put option, granting the buyer the right to sell the asset at the strike price, profiting if the asset’s price rises or remains above the strike price.

Expert Insights and Practical Tips

“Options trading can be a powerful tool, but it’s crucial to approach it with a solid trading plan and risk management strategies,” advises renowned financial strategist, Emily Jones. “Understanding the potential rewards and risks is essential to making informed decisions.”

To enhance your understanding further, here are some practical tips:

-

Start with Paper Trading: Before venturing into live trading, paper trading provides a valuable opportunity to practice and refine your strategies in a simulated environment.

-

Research Thoroughly: Conduct extensive research on the underlying assets and market trends to make educated investment decisions.

-

Manage Risk: Implement proper risk management techniques, including position sizing, stop-loss orders, and hedging strategies.

Image: latinforex.org

Options Trading Explicacion

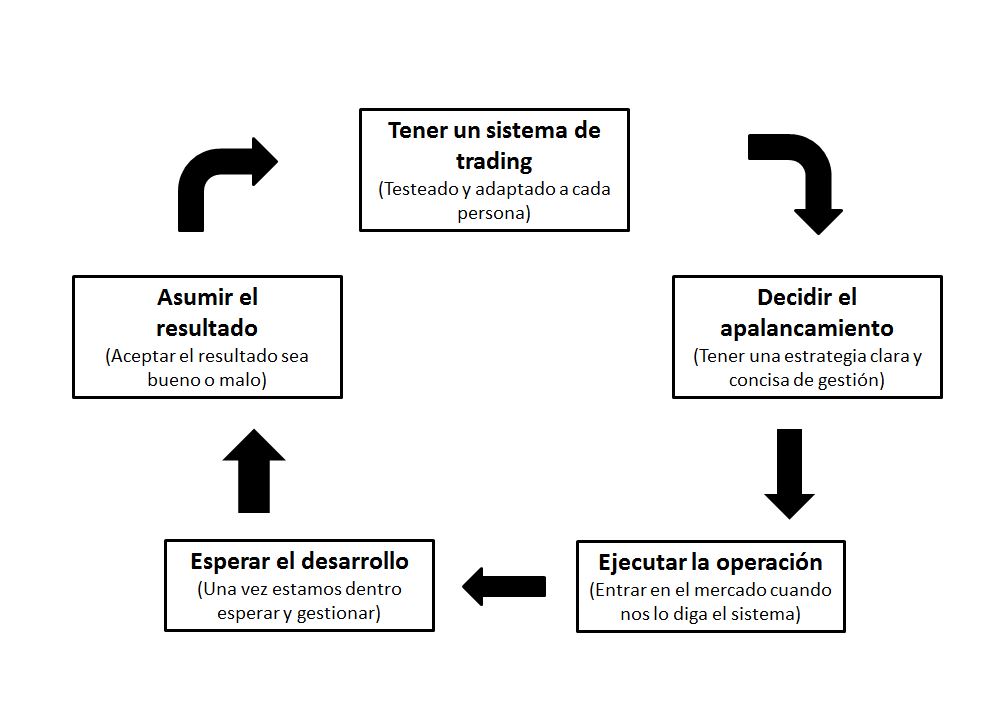

Image: bolsaytrading.com

Conclusion

Options trading offers a dynamic landscape for investors to navigate, unlocking a world of financial possibilities. By educating yourself, memahami the core concepts, exploring various strategies, and seeking guidance from experts, you can harness the power of options to enhance your investment portfolio and pursue financial success.