In the ever-evolving world of finance, future and options trading have emerged as powerful tools for investors seeking to maximize returns and mitigate risks. ICICIDirect, one of India’s leading financial institutions, offers a comprehensive platform for these sophisticated investment strategies, empowering traders to capitalize on market fluctuations.

Image: www.setindiabiz.com

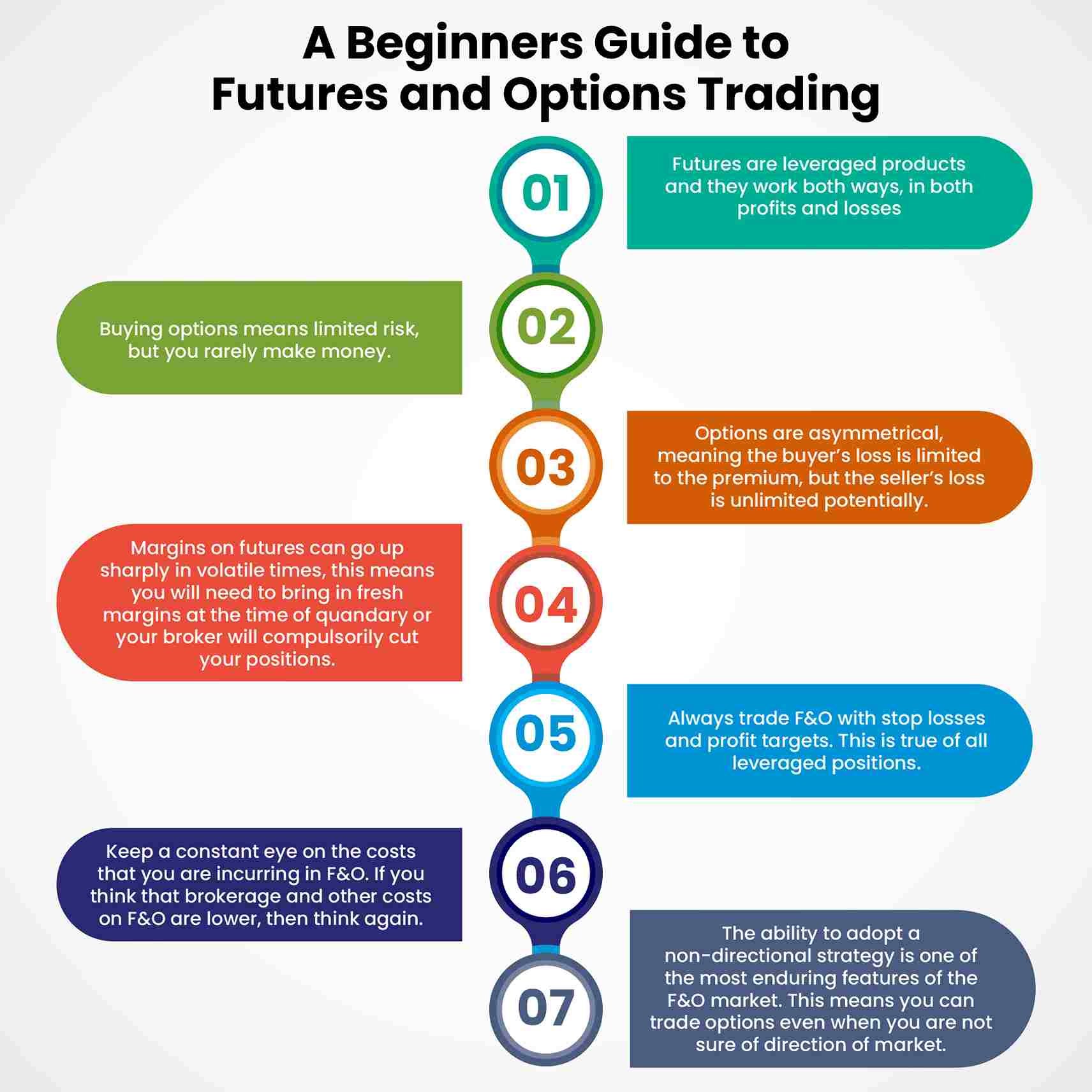

Venturing into the realm of future and options trading requires a clear understanding of the concepts, strategies, and potential risks involved. This article serves as an extensive guide, providing investors with all the essential knowledge they need to navigate these markets confidently and effectively.

Understanding Future and Options Trading

Futures are standardized contracts that obligate the buyer and seller to trade an underlying asset at a predetermined price on a specific future date. On the other hand, options provide the buyer with the right but not the obligation to purchase or sell an underlying asset at a specified price within a defined time frame.

Types of Future and Options Contracts

ICICIDirect offers a wide range of future and options contracts covering various asset classes, including:

- Stock Futures: Contracts based on the underlying prices of individual stocks.

- Index Futures: Contracts based on the underlying prices of market indices, such as Nifty or Bank Nifty.

- Currency Futures: Contracts based on the underlying exchange rates of different currencies.

- Commodity Futures: Contracts based on the underlying prices of commodities, such as gold or crude oil.

- Call Options: Grants the buyer the right to buy the underlying asset at a specified price.

- Put Options: Grants the buyer the right to sell the underlying asset at a specified price.

The Importance of Risk Management

Risk management is paramount in futures and options trading. Investors must carefully evaluate their risk tolerance and develop appropriate trading strategies that align with their financial goals. Proper risk management techniques include:

- Setting Stop-Loss Orders: Predetermined orders to limit potential losses if the market moves against the trader’s position.

- Hedging: Using opposing positions in different markets to offset potential risks.

- Diversification: Spreading investments across multiple assets to reduce the impact of adverse market movements.

Image: filmspksmo.blogspot.com

Latest Trends in Future and Options Trading

The future of future and options trading is shaped by several key trends:

- Growing Popularity of Algo Trading: Algorithmic trading uses automated algorithms to execute trades based on predefined parameters.

- Emergence of New Trading Platforms: Advanced trading platforms provide real-time data, sophisticated charting tools, and risk management features.

- Integration of Artificial Intelligence: AI-powered tools assist traders with market analysis, trade execution, and risk assessment.

Tips for Successful Trading

ICICIDirect offers a wealth of resources and expert advice to enhance your trading journey. Here are some valuable tips:

- Educate Yourself: Continuously acquire knowledge and stay abreast of market trends through webinars, articles, and industry research.

- Practice with Virtual Trading: Utilize simulated trading environments to test strategies and gain experience without risking real capital.

- Start Small: Initially, trade with limited capital to manage risks and build confidence.

- Respect the Market: Avoid excessive leverage and emotional trading. Discipline and a systematic approach are crucial.

Frequently Asked Questions (FAQs)

Q: What are the benefits of trading futures and options?

A: Future and options trading offers opportunities for higher returns, risk management, and portfolio diversification.

Q: What types of traders are suitable for future and options trading?

A: Traders with a high-risk tolerance, solid market knowledge, and a disciplined approach are best suited for these strategies.

Q: What are the risks associated with future and options trading?

A: Future and options trading involve inherent risks, including price volatility, margin calls, and potential loss of capital.

Future And Options Trading In Icicidirect

Image: times.software

Conclusion

Future and options trading offer a powerful means to navigate market fluctuations and achieve financial objectives. ICICIDirect’s comprehensive platform and expert guidance empower traders to explore these sophisticated strategies with confidence. By embracing risk management, staying updated on industry trends, and seeking continuous education, traders can unlock the full potential of future and options trading and achieve their investment goals.

Are you ready to embark on the exhilarating journey of future and options trading? Explore the opportunities and join ICICIDirect’s vibrant trading community today!