Introducing the Exciting World of Options

In the realm of finance, options trading presents an intriguing frontier for investors seeking to navigate market volatility and enhance their portfolio returns. Whether you’re a seasoned veteran or just stepping into this arena, understanding the fundamentals of options trading is crucial. In this beginner-friendly guide, we’ll delve into the intricacies of options trading, equipping you with the knowledge you need to make informed decisions and harness its potential.

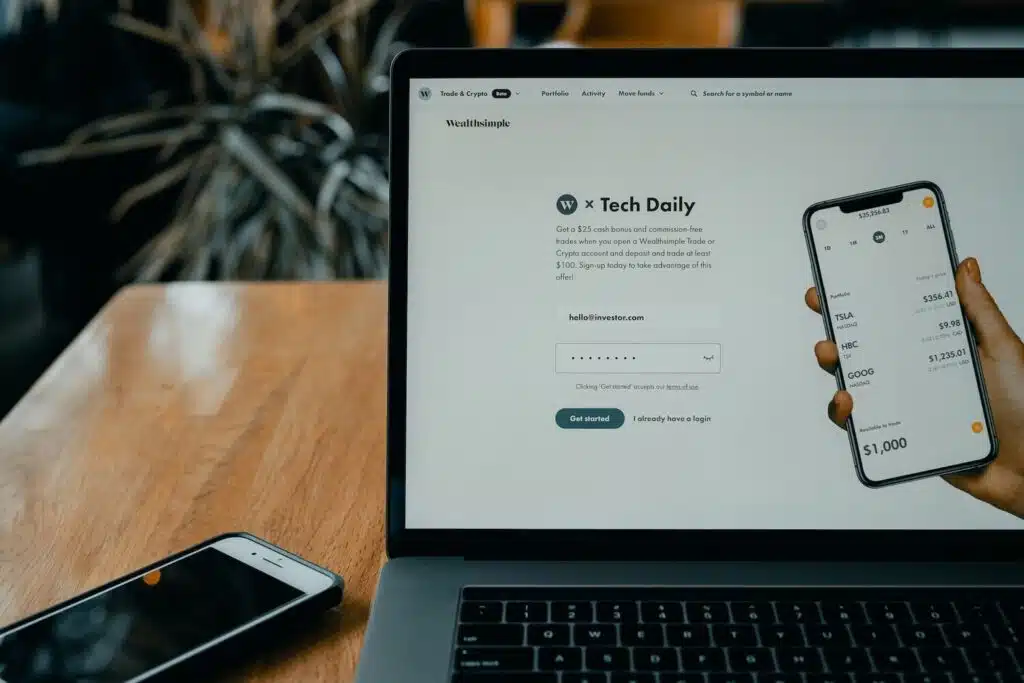

Image: www.tradingview.com

What Are Options?

Options are financial instruments that derive their value from the underlying asset, such as stocks or indices. They grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) before a specified date (expiration date). This flexibility enables investors to tailor their strategies to various market conditions, mitigating risk and maximizing returns.

A Detailed Explanation of Options

To fully grasp options trading, it’s essential to understand the following fundamental concepts:

- Option types: Call options convey the right to buy, while put options confer the right to sell.

- Strike price: This is the price at which you can exercise your option to buy or sell the underlying asset.

- Expiration date: Options have a predetermined expiration date beyond which they become worthless.

- Premium: The cost of acquiring an option, which is influenced by factors such as the underlying asset’s price, strike price, time to expiration, and volatility.

- Underlying asset: This is the security or asset that the option contract is based on, such as a stock, index, or commodity.

Current Trends in Options Trading

Staying abreast of the latest trends in options trading is vital for making informed decisions. Here are some key developments:

- Rising popularity of ETFs: Options on ETFs, such as SPY (tracking the S&P 500) and QQQ (tracking the Nasdaq 100), have gained traction due to their diversification and reduced volatility compared to individual stocks.

- Increasing use of options in income strategies: Investors are employing options strategies to generate regular income, such as selling covered calls or writing cash-secured puts.

- Technological advancements: Online platforms and mobile apps have simplified options trading, making it more accessible to retail investors.

Image: www.youtube.com

Tips and Expert Advice for Beginners

To navigate the world of options trading effectively, consider these tips from seasoned experts:

- Start with a paper trading account: Practice trading options risk-free before committing real capital.

- Educate yourself: Thoroughly research options strategies and their potential risks and rewards.

- Manage your risk: Use stop-loss orders and position sizing to mitigate potential losses.

- Focus on quality over quantity: Select a few suitable options strategies and master them rather than spreading yourself too thin.

- Seek professional guidance: Consult with a licensed broker or financial advisor to tailor your options strategy to your specific goals and risk tolerance.

Frequently Asked Questions (FAQs)

Q: What are the advantages of options trading?

A: Options trading offers flexibility, allows for both bullish and bearish strategies, and can be used to enhance portfolio returns.

Q: What are the risks of options trading?

A: Options trading carries inherent risks, including potential for loss of capital, time decay, and the complexities of various strategies.

Q: Is options trading suitable for all investors?

A: Options trading is appropriate for experienced investors with a strong understanding of the markets and a willingness to manage risk.

Site Thebalance.Com Options Trading How To Begin

Image: kellysthoughtsonthings.com

Conclusion

Options trading can be a powerful tool for enhancing portfolio returns, but it demands a thorough understanding of the underlying concepts, latest trends, risks involved, and best practices. By embracing the strategies outlined in this guide and seeking professional guidance as needed, you can unlock the potential of options trading while mitigating risks and pursuing your financial goals.

Call to Action: Are you intrigued by the possibilities of options trading? Join the conversation and explore the opportunities it holds by diving deeper into this captivating domain.